Question: Calculate ratios for Problems E-J e. Return on stockholdens' equity f. Return on assets g. Debt-to-equity ratio h. Days of inventory i. Inventory turnover ratio

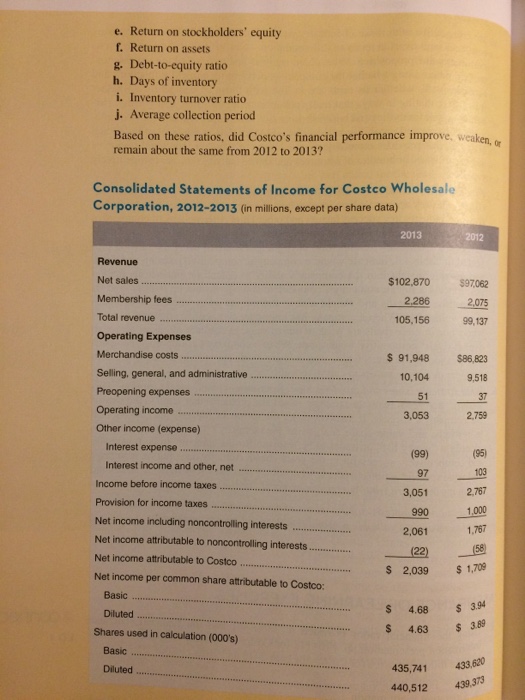

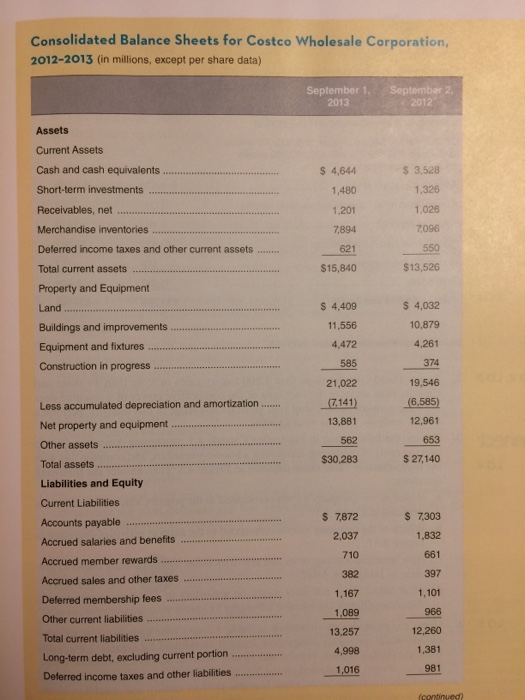

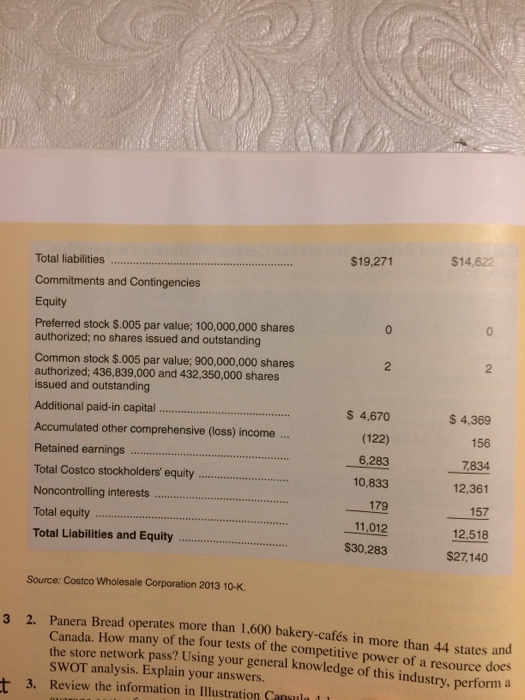

e. Return on stockholdens' equity f. Return on assets g. Debt-to-equity ratio h. Days of inventory i. Inventory turnover ratio i. Average collection period Based on these ratios, did Costco's financial performance improve, weaken, remain about the same from 2012 to 2013? Consolidated Statements of Income for Costco Wholesale Corporation, 2012-2013 (in millions, except per share data) 2013 2012 Revenue Net sales Membership fees. Total revenue Operating Expenses Merchandise costs. Selling, general, and administrative Preopening expenses . Operating income Other income (expense) $102,870 $97062 2.286 2,075 105,156 99,137 91,948 $86,823 9,518 51 3 2.759 10,104 3,053 Interest expense (95) 103 3,051 2.767 1,000 1,767 (99) Interest income and other, net.... Income before income taxes. Provision for income taxes Net income including noncontrolling interests. Net income attributable to noncontrolling interests. Net income attributable to Costco Net income per common share attributable to Costco: 97 990 2,061 2039$ 1,709 2,039 Basic $ 4.68 3.94 s 4.63 3.89 Diluted Shares used in calculation (000's) Basic 435,741 433,620 440,512 439 373 Diluted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts