Question: Calculate the adjusted (1.10) Use an IF function with nested VLOOKUP functions to calculate the Federal Income Tax Rate. a. The federal tax rate is

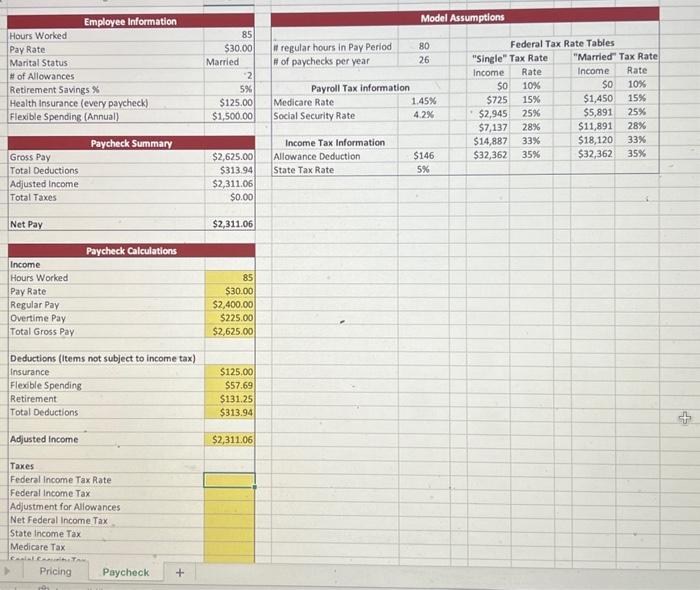

Calculate the adjusted (1.10) Use an IF function with nested VLOOKUP functions to calculate the Federal Income Tax Rate. a. The federal tax rate is a function of the adjusted income and the employee's marital status. b. Reference the tax tables in the Model Assumptions and the marital status in the Employee Information section to construct a formula (set of nested formulas) to calculate the tax rate. c. For example, a single employee who earned $15,000 would pay a 33% marginal tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts