Question: Calculate the APV for Hi-Tech using the assumptions in Table 4.6 and assuming the firm takes on $100 Million debt at the time of the

Calculate the APV for Hi-Tech using the assumptions in Table 4.6 and assuming the firm takes on $100 Million debt at the time of the sale. At the end of each subsequent year to the sale, $25 Million of this debt is retired.

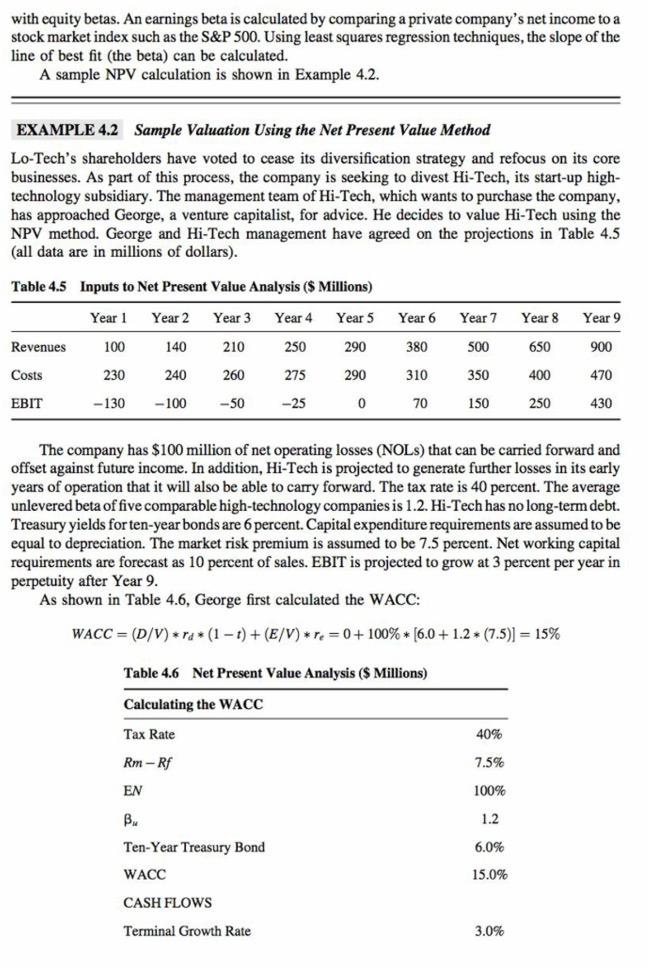

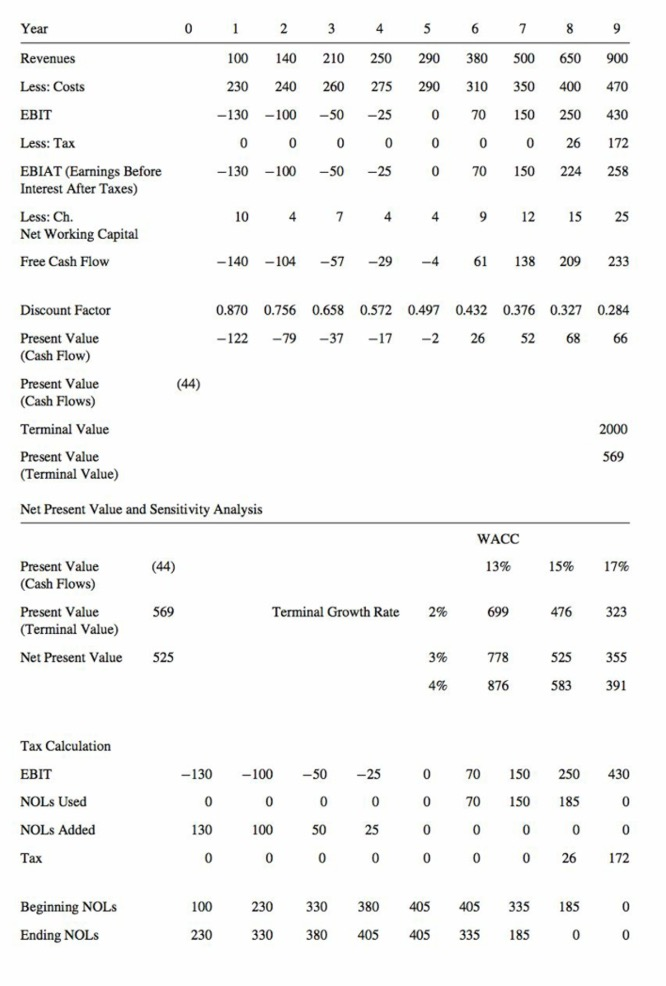

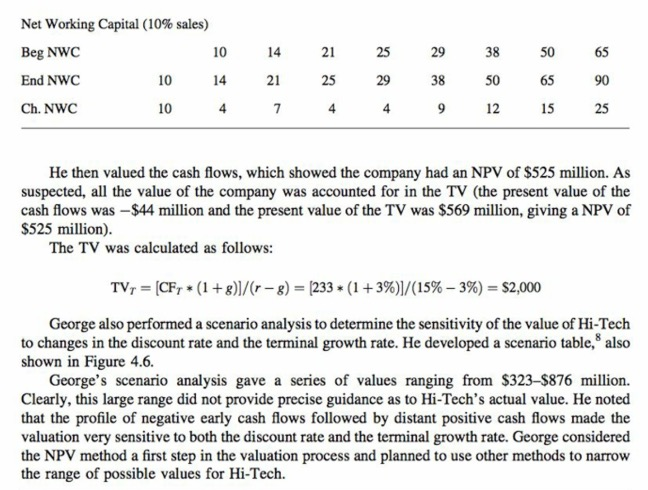

with equity betas. An earnings beta is calculated by comparing a private company's net income to a stock market index such as the S&P 500. Using least squares regression techniques, the slope of the line of best fit (the beta) can be calculated A sample NPV calculation is shown in Example 4.2. EXAMPLE 4.2 Sample Valuation Using the Net Present Value Method Lo-Tech's shareholders have voted to cease its diversification strategy and refocus on its core businesses. As part of this process, the company is seeking to divest Hi-Tech, its start-up high technology subsidiary. The management team of Hi-Tech, which wants to purchase the company, has approached George, a venture capitalist, for advice. He decides to value Hi-Tech using the NPV method. George and Hi-Tech management have agreed on the projections in Table 4.5 (all data are in millions of dollars) Table 4.5 Inputs to Net Present Value Analysis (S Millions) Year Year2 Year 3 Year 4 Year 5 Year 6 Year7 Yer Year9 900 470 430 Revenues Costs EBIT 100 230 130 140 240 100 380 260 275 310 350 150 250 The company has $100 million of net operating losses (NOLs) that can be carried forward and offset against future income. In addition, Hi-Tech is projected to generate further losses in its early years of operation that it will also be able to carry forward. The tax rate is 40 percent. The average unlevered beta of five comparable high-technology companies is 1.2. Hi-Tech has no long-term debt. Treasury yields for ten-year bonds are 6 percent. Capital expenditure requirements are assumed to be equal to depreciation. The market risk premium is assumed to be 7.5 percent. Net working capital requirements are forecast as 10 percent of sales. EBIT is projected to grow at 3 percent per year in perpetuity after Year9 As shown in Table 4.6, George first calculated the WACC: WACC = (D/V) * rd * (1-1) + (EW) * = 0+100% * [6.0 + 1.2 * (7.5)] = 15% Table 4.6 Net Present Value Analysis (S Millions) Calculating the WACC Tax Rate Rm-Rf EN Bu Ten-Year Treasury Bond WACC CASH FLowS Terminal Growth Rate 40% 7.5% 100% 1.2 6.0% 15.0% 3.0% Year Revenues Less: Costs EBIT Less: Tax EBIAT (Earnings Before Interest After Taxes) Less: Ch Net Working Capital Free Cash Flow 4 100 140 210 250 290 380 500 650 900 230 240 260 275 290 310 350 400 470 0 70 50 250 430 0 26 172 0 70 150 224 258 130-100 50 25 130-100 -50-25 12 15 25 10 4 7-29-4 61 138 209 233 140-104 Discount Factor Present Value (Cash Flow) Present Value (Cash Flows) Terminal Value Present Value Terminal Value) 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 122 -79 37-17 -2 26 52 68 66 (44) Net Present Value and Sensitivity Analysis WACC 13% 17% Present Value (Cash Flows) Present Value (Terminal Value) Net Present Value (44) 15% 476 323 569 Terminal Growth Rate 2% 778 525 3% 525 355 876 4% 583 391 Tax Calculation EBIT NOLs Used NOLs Added 130 25 0 70 150 250 430 -100 70 150 185 130 100 25 0 26 172 100 Beginning NOLs 230 330 380 405 405 335 185 Ending NOLs 230 330 380 405 405 335 185 Net Working Capital (10% sales) Beg NWC End NWC Ch. NWC 10 21 25 10 21 25 90 10 12 15 4 He then valued the cash flows, which showed the company had an NPV of $525 million. As suspected, all the value of the company was accounted for in the TV (the present value of the cash flows was -$44 million and the present value of the TV was $569 million, giving a NPV of $525 million) The TV was calculated as follows: TV,-[CFr * (1 + g))/(r-g)-[233 * (1 + 3%)/(15%-3%)-S2,000 George also performed a scenario analysis to determine the sensitivity of the value of Hi-Tech to changes in the discount rate and the terminal growth rate. He developed a scenario table, also shown in Figure 4.6. George's scenario analysis gave a series of values ranging from $323-$876 million. Clearly, this large range did not provide precise guidance as to Hi-Tech's actual value. He noted that the profile of negative early cash flows followed by distant positive cash flows made the valuation very sensitive to both the discount rate and the terminal growth rate. George considered the NPV method a first step in the valuation process and planned to use other methods to narrow the range of possible values for Hi-Tech. with equity betas. An earnings beta is calculated by comparing a private company's net income to a stock market index such as the S&P 500. Using least squares regression techniques, the slope of the line of best fit (the beta) can be calculated A sample NPV calculation is shown in Example 4.2. EXAMPLE 4.2 Sample Valuation Using the Net Present Value Method Lo-Tech's shareholders have voted to cease its diversification strategy and refocus on its core businesses. As part of this process, the company is seeking to divest Hi-Tech, its start-up high technology subsidiary. The management team of Hi-Tech, which wants to purchase the company, has approached George, a venture capitalist, for advice. He decides to value Hi-Tech using the NPV method. George and Hi-Tech management have agreed on the projections in Table 4.5 (all data are in millions of dollars) Table 4.5 Inputs to Net Present Value Analysis (S Millions) Year Year2 Year 3 Year 4 Year 5 Year 6 Year7 Yer Year9 900 470 430 Revenues Costs EBIT 100 230 130 140 240 100 380 260 275 310 350 150 250 The company has $100 million of net operating losses (NOLs) that can be carried forward and offset against future income. In addition, Hi-Tech is projected to generate further losses in its early years of operation that it will also be able to carry forward. The tax rate is 40 percent. The average unlevered beta of five comparable high-technology companies is 1.2. Hi-Tech has no long-term debt. Treasury yields for ten-year bonds are 6 percent. Capital expenditure requirements are assumed to be equal to depreciation. The market risk premium is assumed to be 7.5 percent. Net working capital requirements are forecast as 10 percent of sales. EBIT is projected to grow at 3 percent per year in perpetuity after Year9 As shown in Table 4.6, George first calculated the WACC: WACC = (D/V) * rd * (1-1) + (EW) * = 0+100% * [6.0 + 1.2 * (7.5)] = 15% Table 4.6 Net Present Value Analysis (S Millions) Calculating the WACC Tax Rate Rm-Rf EN Bu Ten-Year Treasury Bond WACC CASH FLowS Terminal Growth Rate 40% 7.5% 100% 1.2 6.0% 15.0% 3.0% Year Revenues Less: Costs EBIT Less: Tax EBIAT (Earnings Before Interest After Taxes) Less: Ch Net Working Capital Free Cash Flow 4 100 140 210 250 290 380 500 650 900 230 240 260 275 290 310 350 400 470 0 70 50 250 430 0 26 172 0 70 150 224 258 130-100 50 25 130-100 -50-25 12 15 25 10 4 7-29-4 61 138 209 233 140-104 Discount Factor Present Value (Cash Flow) Present Value (Cash Flows) Terminal Value Present Value Terminal Value) 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 122 -79 37-17 -2 26 52 68 66 (44) Net Present Value and Sensitivity Analysis WACC 13% 17% Present Value (Cash Flows) Present Value (Terminal Value) Net Present Value (44) 15% 476 323 569 Terminal Growth Rate 2% 778 525 3% 525 355 876 4% 583 391 Tax Calculation EBIT NOLs Used NOLs Added 130 25 0 70 150 250 430 -100 70 150 185 130 100 25 0 26 172 100 Beginning NOLs 230 330 380 405 405 335 185 Ending NOLs 230 330 380 405 405 335 185 Net Working Capital (10% sales) Beg NWC End NWC Ch. NWC 10 21 25 10 21 25 90 10 12 15 4 He then valued the cash flows, which showed the company had an NPV of $525 million. As suspected, all the value of the company was accounted for in the TV (the present value of the cash flows was -$44 million and the present value of the TV was $569 million, giving a NPV of $525 million) The TV was calculated as follows: TV,-[CFr * (1 + g))/(r-g)-[233 * (1 + 3%)/(15%-3%)-S2,000 George also performed a scenario analysis to determine the sensitivity of the value of Hi-Tech to changes in the discount rate and the terminal growth rate. He developed a scenario table, also shown in Figure 4.6. George's scenario analysis gave a series of values ranging from $323-$876 million. Clearly, this large range did not provide precise guidance as to Hi-Tech's actual value. He noted that the profile of negative early cash flows followed by distant positive cash flows made the valuation very sensitive to both the discount rate and the terminal growth rate. George considered the NPV method a first step in the valuation process and planned to use other methods to narrow the range of possible values for Hi-Tech

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts