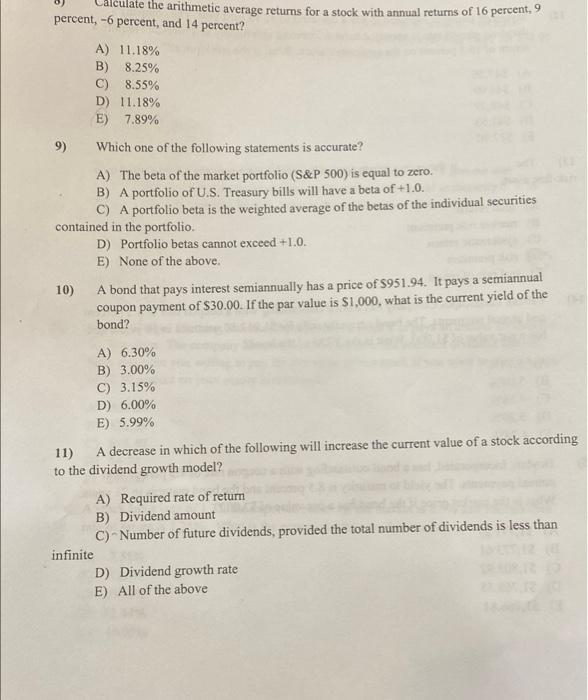

Question: calculate the arithmetic average returns for a stock with annual returns of 16 percent, 9 percent, -6 percent, and 14 percent? A) 11.18% B) 8.25%

calculate the arithmetic average returns for a stock with annual returns of 16 percent, 9 percent, -6 percent, and 14 percent? A) 11.18% B) 8.25% C) 8.55% D) 11.18% E) 7.89% 9) Which one of the following statements is accurate? A) The beta of the market portfolio (S&P 500) is equal to zero. B) A portfolio of U.S. Treasury bills will have a beta of +1.0. C) A portfolio beta is the weighted average of the betas of the individual securities contained in the portfolio. D) Portfolio betas cannot exceed +1.0. E) None of the above. A bond that pays interest semiannually has a price of $951.94. It pays a semiannual coupon payment of $30.00. If the par value is $1,000, what is the current yield of the bond? 10) A) 6.30% B) 3.00% C) 3.15% D) 6.00% E) 5.99% 11) A decrease in which of the following will increase the current value of a stock according to the dividend growth model? A) Required rate of return B) Dividend amount C) Number of future dividends, provided the total number of dividends is less than infinite D) Dividend growth rate E) All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts