Question: Calculate the Cash Conversion Cycle, breaking it down to three components. Apple Inventory 4,061,000,000 Cost of Goods Sold 169,559,000,000 Accounts Recievable 16,120,000,000 Sales 274,515,000,000

![]()

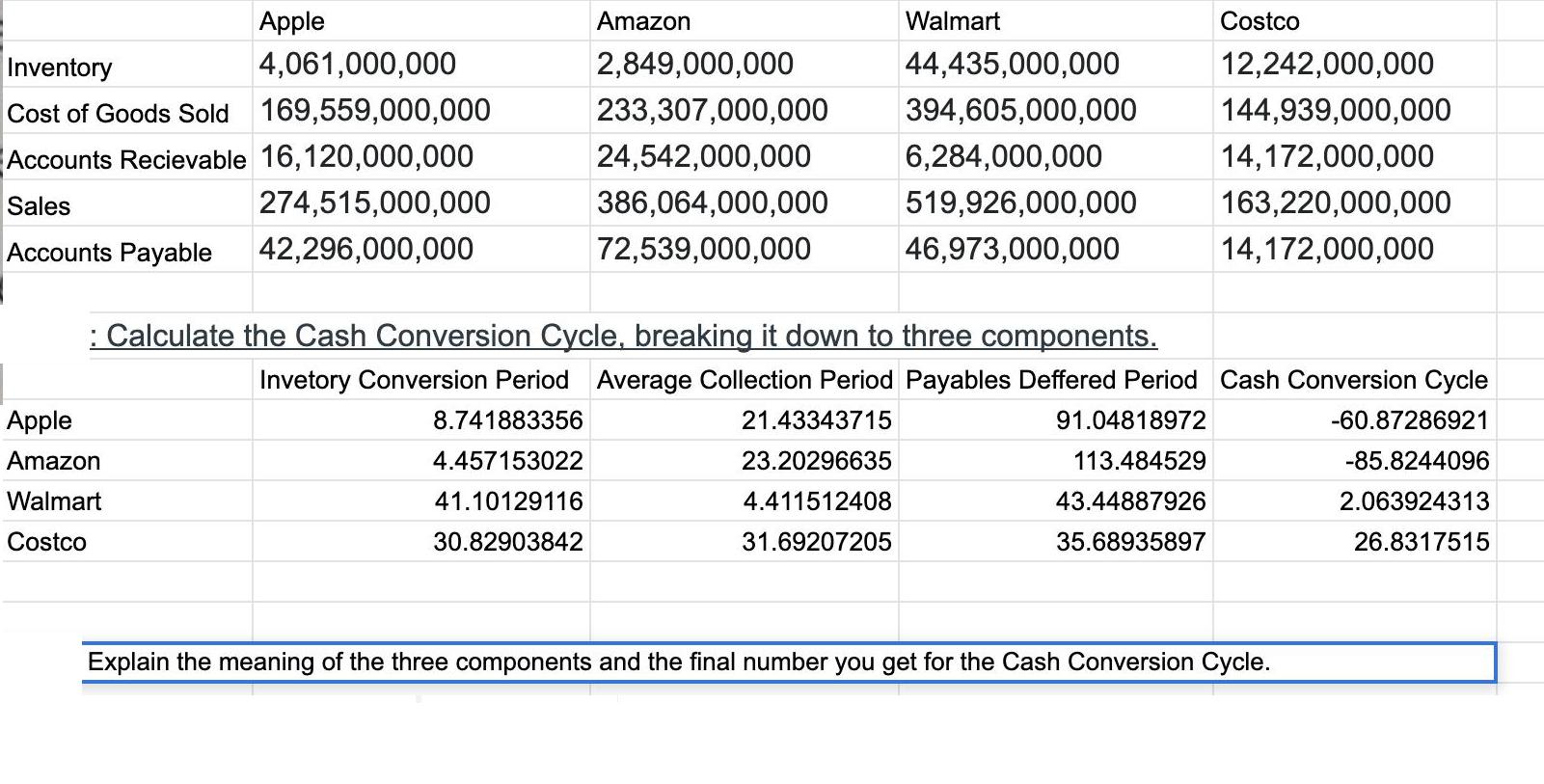

Calculate the Cash Conversion Cycle, breaking it down to three components. Apple Inventory 4,061,000,000 Cost of Goods Sold 169,559,000,000 Accounts Recievable 16,120,000,000 Sales 274,515,000,000 Accounts Payable 42,296,000,000 Apple Amazon Walmart Costco Amazon 2,849,000,000 233,307,000,000 24,542,000,000 386,064,000,000 72,539,000,000 Walmart : Calculate the Cash Conversion Cycle, breaking it down to three components. 44,435,000,000 394,605,000,000 6,284,000,000 519,926,000,000 46,973,000,000 21.43343715 23.20296635 4.411512408 31.69207205 Costco Invetory Conversion Period Average Collection Period Payables Deffered Period Cash Conversion Cycle 8.741883356 4.457153022 41.10129116 30.82903842 91.04818972 113.484529 43.44887926 35.68935897 12,242,000,000 144,939,000,000 14,172,000,000 163,220,000,000 14,172,000,000 Explain the meaning of the three components and the final number you get for the Cash Conversion Cycle. -60.87286921 -85.8244096 2.063924313 26.8317515

Step by Step Solution

There are 3 Steps involved in it

The Cash Conversion Cycle CCC is a financial metric that shows how long it takes for a company to convert its investments in inventory and other resou... View full answer

Get step-by-step solutions from verified subject matter experts