Question: Calculate the cash flows for the following CMO with sequential pay tranches. Consider that the payments into the pool from mortgage borrower occur annually

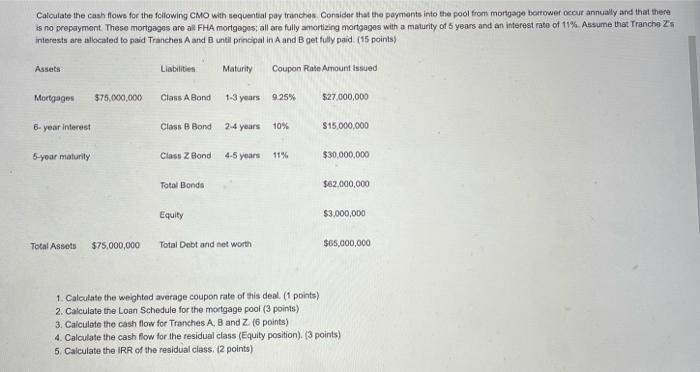

Calculate the cash flows for the following CMO with sequential pay tranches. Consider that the payments into the pool from mortgage borrower occur annually and that there is no prepayment. These mortgages are all FHA mortgages; all are fully amortizing mortgages with a maturity of 5 years and an interest rate of 11%. Assume that Tranche Zs interests are allocated to paid Tranches A and B until principal in A and B get fully paid. (15 points) Coupon Rate Amount Issued Assets Mortgages 6- year interest 5-year maturity $75,000,000 Total Assets $75,000,000 Liabilities Class A Bond Class 2 Bond Class B Bond 2-4 years Total Bonds Maturity Equity 1-3 years 9.25% 4-5 years Total Debt and net worth 10% 11% 1. Calculate the weighted average coupon rate of this deal. (1 points) 2. Calculate the Loan Schedule for the mortgage pool (3 points) 3. Calculate the cash flow for Tranches A, B and Z. (6 points) $27,000,000 $15,000,000 $30,000,000 $62,000,000 $3,000,000 $65,000,000 4. Calculate the cash flow for the residual class (Equity position). (3 points) 5. Calculate the IRR of the residual class. (2 points)

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

1 Calculate the weighted average coupon rate of this deal The weighted average coupon rate is calculated by taking the sum of the products of the amounts of each bond and its coupon rate and then divi... View full answer

Get step-by-step solutions from verified subject matter experts