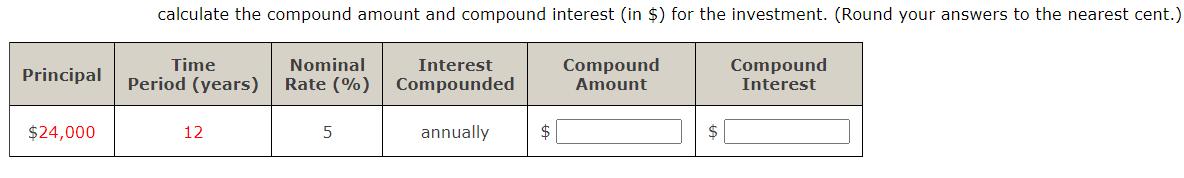

Question: calculate the compound amount and compound interest (in $) for the investment. (Round your answers to the nearest cent.) Time Principal Period (years) $24,000

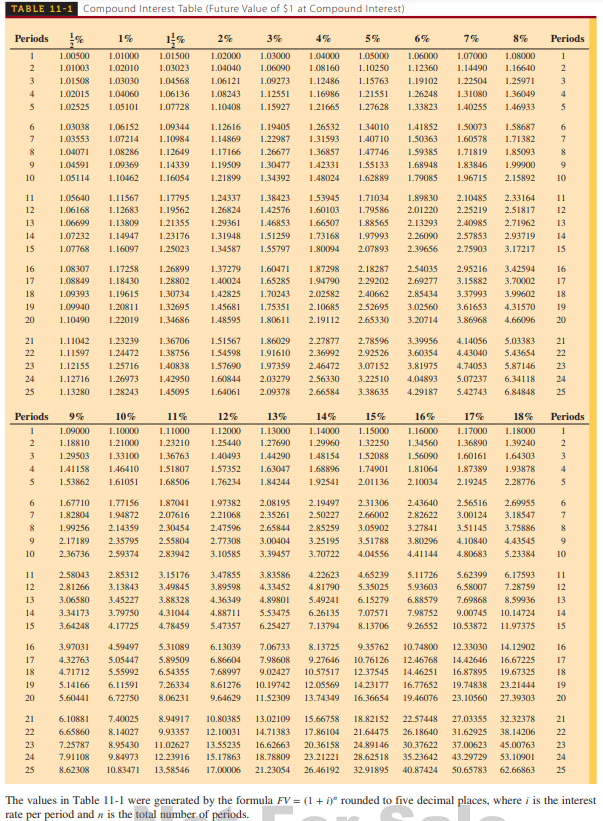

calculate the compound amount and compound interest (in $) for the investment. (Round your answers to the nearest cent.) Time Principal Period (years) $24,000 12 Nominal Rate (%) 5 Interest Compounded annually $ Compound Amount $ Compound Interest TABLE 11-1 Compound Interest Table (Future Value of $1 at Compound Interest) Periods 1 2 1% 1.00500 1.01000 1.01500 1.01003 1.02010 1.03023 1.01508 1.03030 1.04568 1.02015 1.04060 5 1.02525 1.05101 4 1.06136 1.07728 3 6 7 8 9 10 11 12 13 15 16 17 18 19 20 21 22 23 24 25 10 11 12 1.03038 1.06152 1.03553 1.07214 1.04071 1.08286 1.04591 1.09369 1.05114 Periods 9% 1 1.09000 2 1.18810 3 1.29503 4 1.41158 5 1.53862 16 17 18 6 1.67710 7 8 9 19 20 1.07232 1.07768 21 22 23 24 25 1.05640 1.11567 1.17795 1.06168 1.12683 1.19562 1.06699 1.13809 1.12649 1.14339 1.10462 1.16054 1.08307 1.17258 1.26899 1.08849 1.18430 1.28802 1.09393 1.19615 1.30734 1.09940 1.10490 1.22019 1.20811 1.32695 1.34686 1.09344 1.10984 1.11042 1.23239 1.36706 1.11597 1.24472 1.38756 1.12155 1.25716 1.40838 1.12716 1.26973 1.42950 1.13280 1.28243 1.45095 10% 1.10000 1.21000 1.33100 1.46410 1.61051 13 3.06580 3.45227 14 15 1.24337 1.26824 1.21355 1.29361 1.14947 1.23176 1.31948 1.34587 1.16097 1.25023 1.77156 1.87041 1.82804 1.94872 2.07616 1.99256 2.14359 2.30454 2.17189 2.35795 2.55804 2.83942 2.36736 2.59374 11% 1.11000 1.23210 1.36763 1.51807 1.68506 3.15176 2.58043 2.85312 2.81266 3.13843 3.49845 3.88328 3.34173 3.79750 4.31044 3.64248 4.17725 4.78459 3.97031 4.59497 5.31089 4.32763 5.05447 5.89509 4.71712 5.55992 6.54355 5.14166 6.11591 7.26334 5.60441 6.72750 8.06231 2% 3% 1.02000 1.03000 1.04040 1.06090 1.06121 1.09273 6.10881 7.40025 8.94917 6.65860 8.14027 9.93357 7.25787 8.95430 11.02627 7.91108 9.84973 12.23916 8.62308 10.83471 13.58546 1.08243 1.10408 1.12616 1.14869 7% 8% 4% 5% 6% 1.04000 1.05000 1.06000 1.07000 1.08000 1.08160 1.10250 1.12360 1.14490 1.16640 1.12486 1.15763 1.19102 1.22504 1.25971 1.12551 1.16986 1.21551 1.26248 1.31080 1.36049 1.15927 1.21665 1.27628 1.33823 1.40255 1.46933 1.19405 1.22987 1.31593 1.26677 1.36857 1.17166 1.19509 1.30477 1.42331 1.21899 1.34392 1.48024 1.38423 1.53945 1.42576 1.60103 1.46853 1.66507 1.37279 1.60471 1.40024 1.65285 1.42825 1.70243 1.45681 1.48595 1.51259 1.73168 1.55797 1.75351 1.80611 1.51567 1.86029 1.54598 1.91610 3.47855 3.89598 1.57690 1.97359 1.60844 1.64061 1.26532 1.34010 1.41852 1.50073 1.40710 1.50363 1.60578 1.71819 1.47746 1.59385 1.55133 1.68948 1.83846 1.62889 1.79085 1.96715 2.03279 2.09378 12% 13% 1.12000 1.13000 1.25440 1.27690 1.40493 1.44290 1.57352 1.63047 1.76234 1.84244 1.71034 1.89830 2.10485 2.33164 1.79586 2.01220 2.25219 2.51817 1.88565 2.13293 2.40985 2.71962 1.97993 2.26090 2.57853 2.93719 1.80094 2.07893 2.39656 2.75903 3.17217 14% 15% 16% 17% 1.17000 1.18000 1.14000 1.15000 1.16000 1.29960 1.32250 1.34560 1.36890 1.39240 1.48154 1.52088 1.56090 1.60161 1.64303 1.68896 1.74901 1.81064 1.87389 1.93878 1.92541 2.01136 2.10034 2.19245 2.28776 2.31306 2.43640 2.19497 2.56516 2.69955 2.50227 2.66002 2.82622 3.00124 3.18547 2.65844 2.85259 3.05902 3.27841 3.51145 3.75886 2.77308 3.00404 3.25195 3.51788 3.80296 4.10840 4.43545 3.10585 3.39457 3.70722 4.04556 4.41144 4.80683 5.23384 1.97382 2.08195 2.21068 2.35261 2.47596 1.58687 1.71382 1.85093 8 1.99900 9 2.15892 10 11 12 13 14 15 3.83586 4.22623 4.33452 4.81790 4.89801 5.49241 4.88711 5.53475 6.26135 5.47357 6.25427 7.13794 4.36349 Periods 1 2 3 4 5 1.87298 1.94790 2.18287 2.54035 2.95216 3.42594 16 2.29202 2.69277 3.15882 3.70002 17 2.02582 2.40662 2.85434 3.37993 3.99602 18 3.02560 3.61653 4.31570 19 3.20714 3.86968 2.10685 2.52695 2.19112 2.65330 4.66096 20 2.27877 2.78596 3.39956 5.03383 4.14056 21 2.36992 2.92526 3.60354 4.43040 5.43654 22 2.46472 3.07152 3.81975 4.74053 5.87146 23 2.56330 5.07237 6.34118 24 5.42743 6.84848 25 3.22510 4.04893 3.38635 4.29187 2.66584 4.65239 5.11726 5.35025 5.93603 6.15279 6.88579 7.07571 7.98752 8.13706 9.26552 6 7 18% Periods 1 2 3 4 5 6 7 8 9 10 5.62399 6.17593 11 6.58007 7.28759 12 7.69868 8.59936 13 9.00745 10.14724 14 10.53872 11.97375 15 6.13039 7.06733 8.13725 9.35762 10.74800 12.33030 14.12902 16 6.86604 7.98608 9.27646 10.76126 12.46768 14.42646 16.67225 17 7.68997 9.02427 10.57517 12.37545 14.46251 16.87895 19.67325 18 8.61276 10.19742 12.05569 14.23177 16.77652 19.74838 23.21444 19 9.64629 11.52309 13.74349 16.36654 19.46076 23.10560 27.39303 20 10.80385 12.10031 13.55235 15.17863 17.00006 21.23054 26.46192 32.91895 40.87424 50.65783 62.66863 25 13.02109 15.66758 18.82152 22.57448 27.03355 32.32378 21 14.71383 17.86104 21.64475 26.18640 31.62925 38.14206 22 16.62663 20.36158 24.89146 30.37622 37.00623 45.00763 23 18.78809 23.21221 28.62518 35.23642 43.29729 53.10901 24 The values in Table 11-1 were generated by the formula FV = (1 + i)" rounded to five decimal places, where i is the interest rate per period and n is the total number of periods.

Step by Step Solution

There are 3 Steps involved in it

To calculate the compound amount and compound interest for the investment we will use the formula fo... View full answer

Get step-by-step solutions from verified subject matter experts