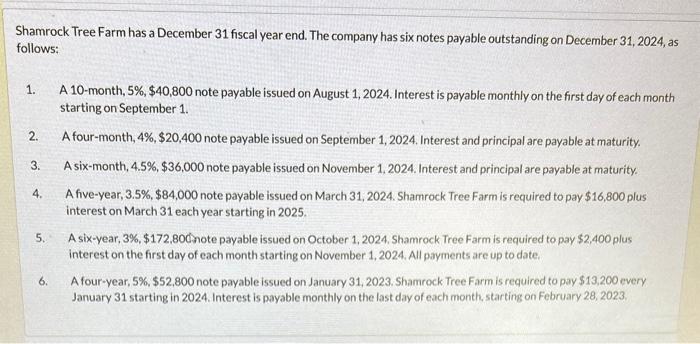

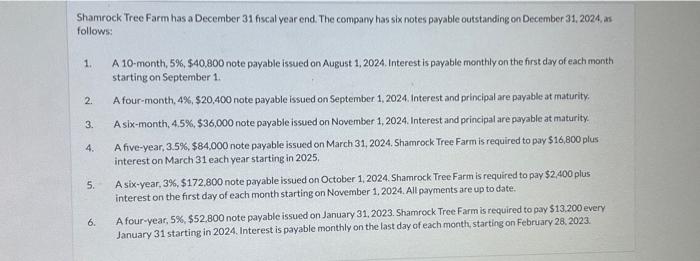

Question: calculate the current portion of each note payable Shamrock Tree Farm has a December 31 fiscal year end. The company has six notes payable outstanding

Shamrock Tree Farm has a December 31 fiscal year end. The company has six notes payable outstanding on December 31,2024 , as follows: 1. A 10-month, 5%,$40,800 note payable issued on August 1, 2024. Interest is payable monthly on the first day of each month starting on September 1. 2. A four-month, 4%,$20,400 note payable issued on September 1,2024 , Interest and principal are payable at maturity. 3. A six-month, 4.5%,$36,000 note payable issued on November 1, 2024. Interest and principal are payable at maturity. 4. A five-year, 3.5%,$84,000 note payable issued on March 31,2024 . Shamrock Tree Farm is required to pay $16,800 plus interest on March 31 each year starting in 2025. 5. A six-year, 3\%, $172,800 note payable issued on October 1, 2024, Shamrock Tree Farm is required to pay $2,400 plus interest on the first day of each month starting on November 1, 2024. All payments are up to date. 6. A four-year, 5%,$52,800 note payable issued on January 31,2023 . Shamrock Tree Farm is required to pay $13,200 every January 31 starting in 2024. Interest is payable monthly on the last day of each month, starting on February 28, 2023, Shamrock Tree Farm has a December 31 fiscal year end. The company has six notes payable outstanding on December 31 , 2024, as follows: 1. A 10-month, 5%,$40.800 note payable issued on August 1, 2024. Interest is payable monthly on the first day of each month starting on September 1. 2. A four-month, 4%,$20,400 note payable issued on September 1,2024 . Interest and principal are payable at maturity. 3. A six-month, 4,5\%, $36,000 note payable issued on November 1, 2024. Interest and principal are payable at maturity. 4. A five-year, 3.5%,$84,000 note payable issued on March 31,2024 . Shamrock Tree Farm is required to pay $16,800 plus interest on March 31 each year starting in 2025. 5. A six-year, 3%,$172,800 note payable issued on October 1, 2024. Shamrock Tree Farm is required to pay $2,400 plus interest on the first day of each month starting on November 1, 2024. All payments are up to date. 6. A four-year, 5%,$52,800 note payable issued on January 31,2023 . Shamrock Tree. Farm is required to pay $13.200 every January 31 starting in 2024. Interest is payable monthly on the last day of each month, starting on February 28,2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts