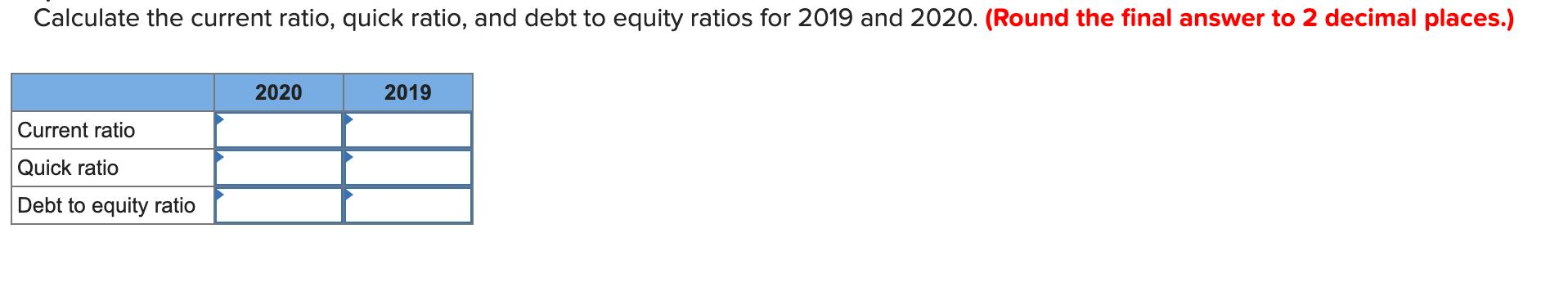

Question: Calculate the current ratio, quick ratio, and debt to equity ratios for 2019 and 2020. (Round the final answer to 2 decimal places.) Current

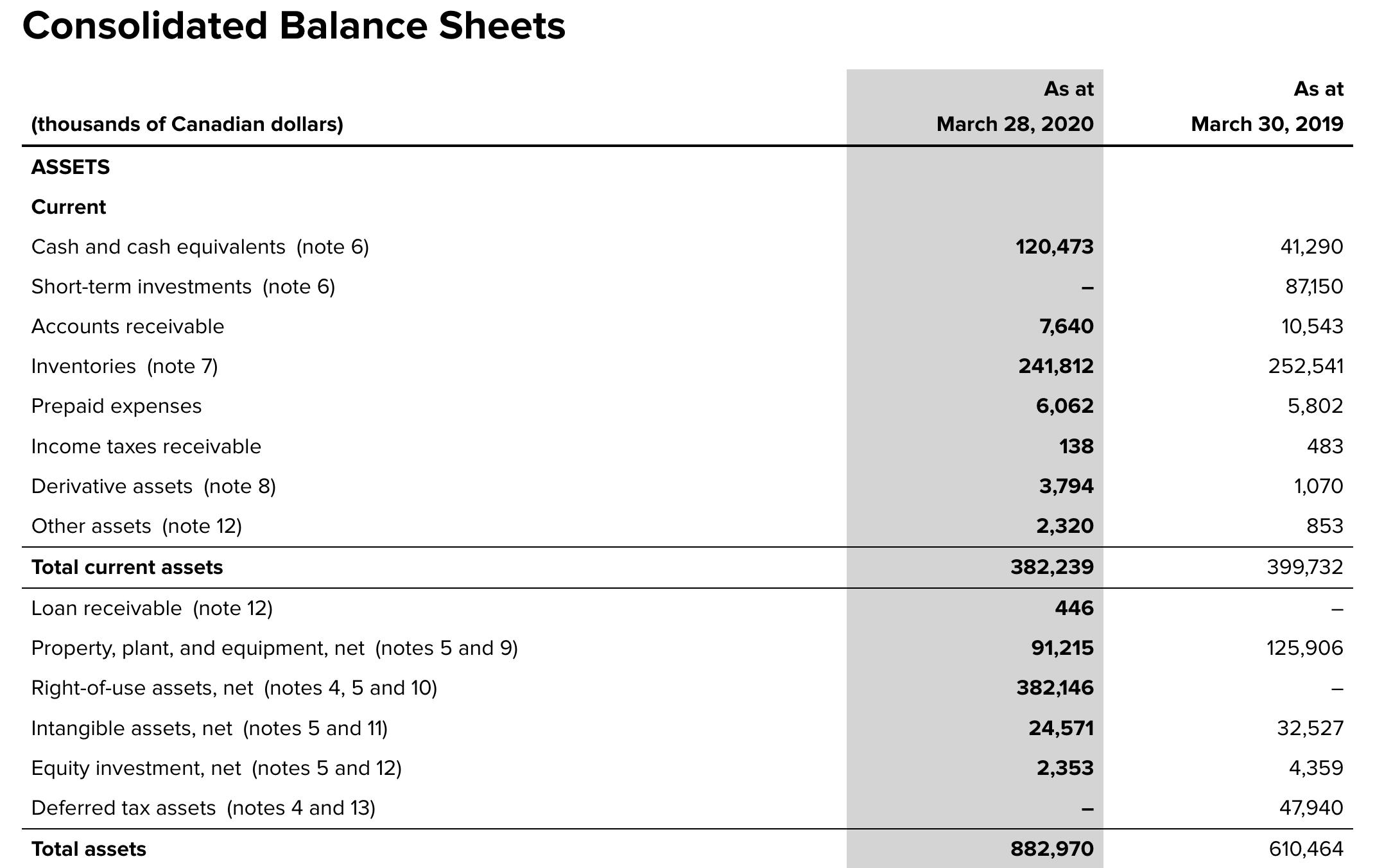

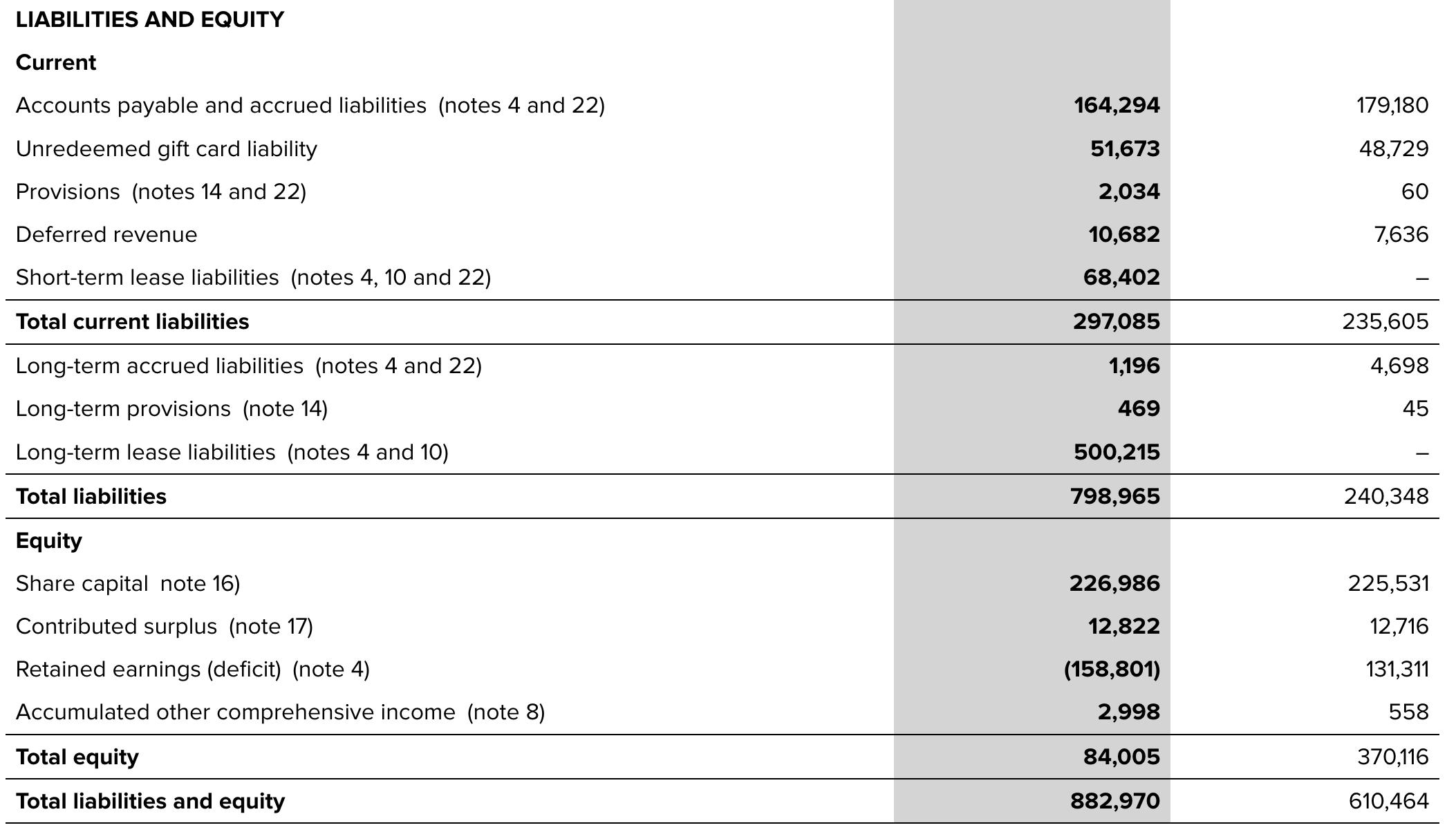

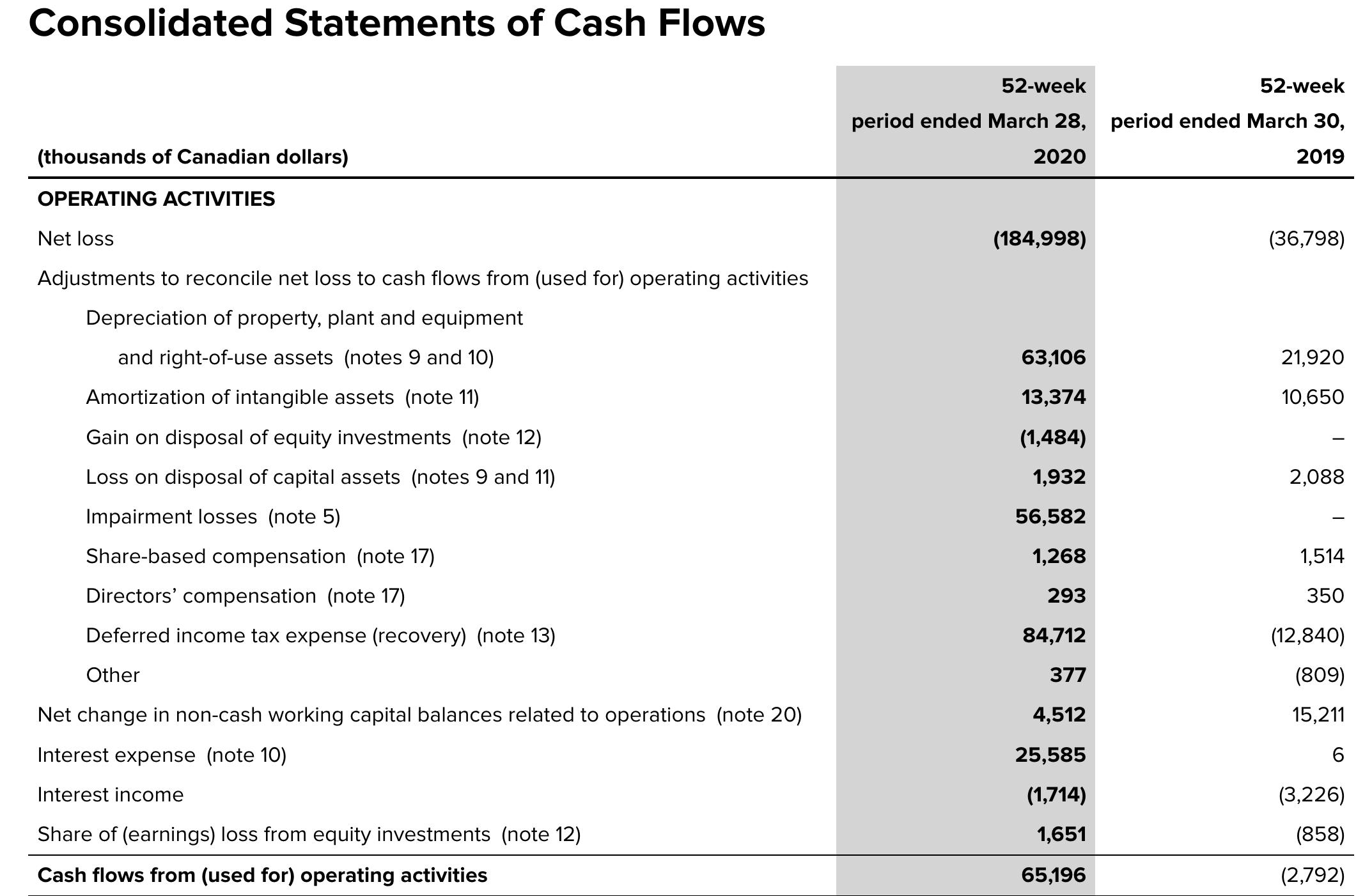

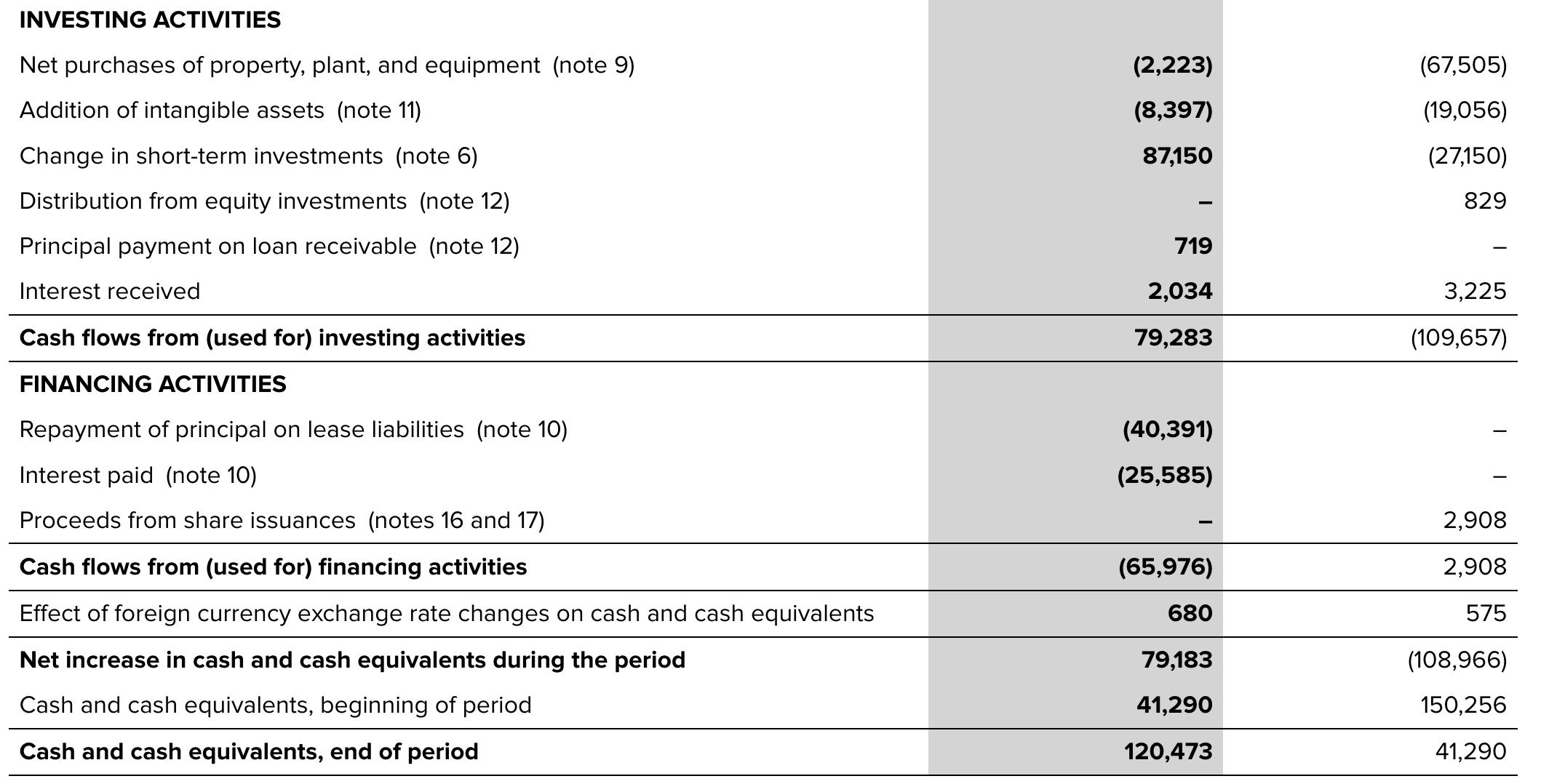

Calculate the current ratio, quick ratio, and debt to equity ratios for 2019 and 2020. (Round the final answer to 2 decimal places.) Current ratio Quick ratio Debt to equity ratio 2020 2019 Consolidated Balance Sheets (thousands of Canadian dollars) ASSETS Current Cash and cash equivalents (note 6) Short-term investments (note 6) Accounts receivable Inventories (note 7) Prepaid expenses Income taxes receivable Derivative assets (note 8) Other assets (note 12) Total current assets Loan receivable (note 12) Property, plant, and equipment, net (notes 5 and 9) Right-of-use assets, net (notes 4, 5 and 10) Intangible assets, net (notes 5 and 11) Equity investment, net (notes 5 and 12) Deferred tax assets (notes 4 and 13) Total assets As at March 28, 2020 120,473 7,640 241,812 6,062 138 3,794 2,320 382,239 446 91,215 382,146 24,571 2,353 882,970 As at March 30, 2019 41,290 87,150 10,543 252,541 5,802 483 1,070 853 399,732 125,906 32,527 4,359 47,940 610,464 LIABILITIES AND EQUITY Current Accounts payable and accrued liabilities (notes 4 and 22) Unredeemed gift card liability Provisions (notes 14 and 22) Deferred revenue Short-term lease liabilities (notes 4, 10 and 22) Total current liabilities Long-term accrued liabilities (notes 4 and 22) Long-term provisions (note 14) Long-term lease liabilities (notes 4 and 10) Total liabilities Equity Share capital note 16) Contributed surplus (note 17) Retained earnings (deficit) (note 4) Accumulated other comprehensive income (note 8) Total equity Total liabilities and equity 164,294 51,673 2,034 10,682 68,402 297,085 1,196 469 500,215 798,965 226,986 12,822 (158,801) 2,998 84,005 882,970 179,180 48,729 60 7,636 235,605 4,698 45 240,348 225,531 12,716 131,311 558 370,116 610,464 Foreign currency translation adjustment [net of taxes of 43; 2019 - (6)] Other comprehensive income (loss) Total comprehensive loss Net loss per common share (note 19) Basic Diluted See accompanying notes 445 2,440 (182,558) ($6.72) ($6.72) (225) (257) (37,055) ($1.35) ($1.35) Consolidated Statements of Cash Flows (thousands of Canadian dollars) OPERATING ACTIVITIES Net loss Adjustments to reconcile net loss to cash flows from (used for) operating activities Depreciation of property, plant and equipment and right-of-use assets (notes 9 and 10) Amortization of intangible assets (note 11) Gain on disposal of equity investments (note 12) Loss on disposal of capital assets (notes 9 and 11) Impairment losses (note 5) Share-based compensation (note 17) Directors' compensation (note 17) Deferred income tax expense (recovery) (note 13) Other Net change in non-cash working capital balances related to operations (note 20) Interest expense (note 10) Interest income Share of (earnings) loss from equity investments (note 12) Cash flows from (used for) operating activities 52-week 52-week period ended March 28, period ended March 30, 2020 2019 (184,998) 63,106 13,374 (1,484) 1,932 56,582 1,268 293 84,712 377 4,512 25,585 (1,714) 1,651 65,196 (36,798) 21,920 10,650 - 2,088 1,514 350 (12,840) (809) 15,211 6 (3,226) (858) (2,792) INVESTING ACTIVITIES Net purchases of property, plant, and equipment (note 9) Addition of intangible assets (note 11) Change in short-term investments (note 6) Distribution from equity investments (note 12) Principal payment on loan receivable (note 12) Interest received Cash flows from (used for) investing activities FINANCING ACTIVITIES Repayment of principal on lease liabilities (note 10) Interest paid (note 10) Proceeds from share issuances (notes 16 and 17) Cash flows from (used for) financing activities Effect of foreign currency exchange rate changes on cash and cash equivalents Net increase in cash and cash equivalents during the period Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period (2,223) (8,397) 87,150 719 2,034 79,283 (40,391) (25,585) (65,976) 680 79,183 41,290 120,473 (67,505) (19,056) (27,150) 829 3,225 (109,657) 2,908 2,908 575 (108,966) 150,256 41,290

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

It seems you have uploaded multiple files but I cant s... View full answer

Get step-by-step solutions from verified subject matter experts