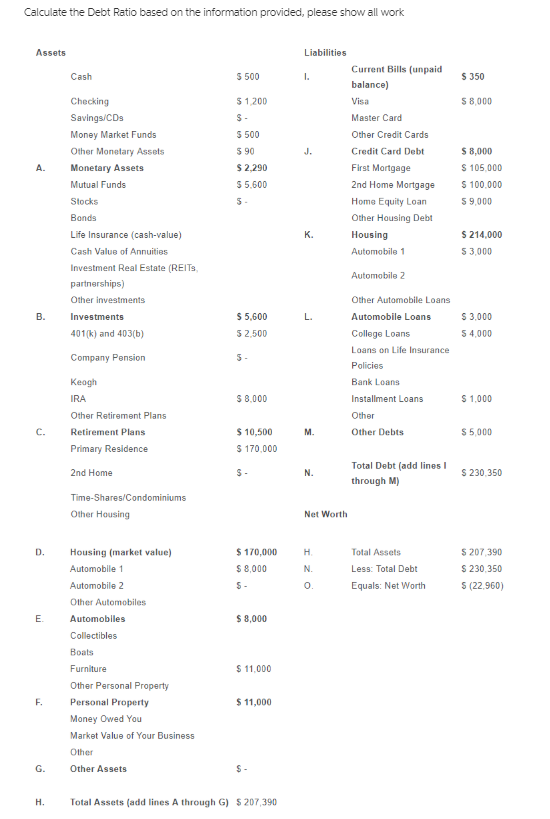

Question: Calculate the Debt Ratio based on the information provided, please show all work Assets Cash $ 500 S 350 $ 1.200 S 8.000 $ 500

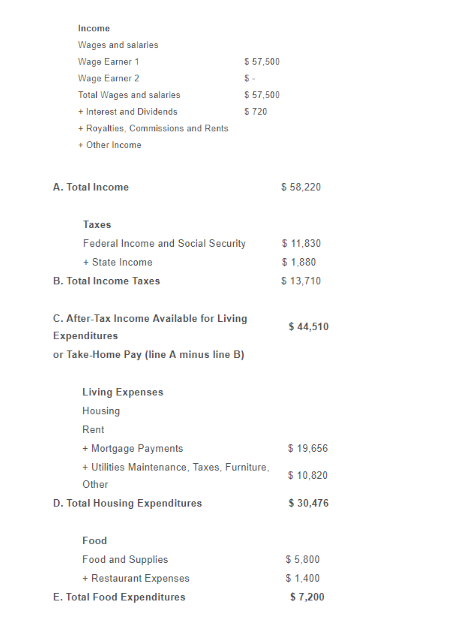

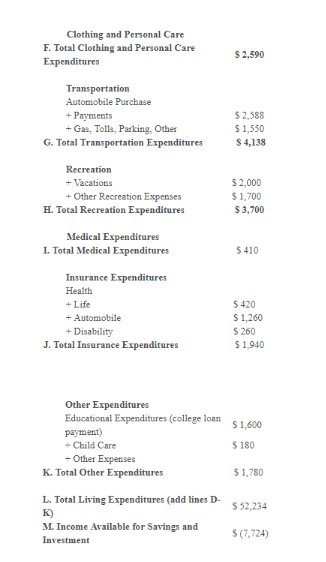

Calculate the Debt Ratio based on the information provided, please show all work Assets Cash $ 500 S 350 $ 1.200 S 8.000 $ 500 5 90 $ 2.290 $ 5,600 Checking Savings/CDs Money Market Funds Other Monetary Assets Monetary Assets Mutual Funds Stocks Bonds Life Insurance (cash-value) Cash Value of Annuities Investment Real Estate (REITS partnerships) Other investments Liabilities Current Bills (unpaid balance) Visa Master Card Other Credit Cards Credit Card Debt First Mortgage 2nd Home Mortgage Home Equity Loan Other Housing Debt Housing Automobile 1 $ 8,000 S 105,000 S 100.000 59,000 $ 214.000 53,000 Automobile 2 Investments . $ 5,600L 5 2.500 S3,000 54,000 401(k) and 403(b) Other Automobile Loans Automobile Loans College Loans Loans Loans on Life Insurance Policies Bank Loans Company Pension $ 8.000 $1,000 Keogh IRA Other Retirement Plans Retirement Plans Primary Residence Installment Loans Other Other Debts M. S 5000 $ 10,500 $ 170.000 2nd Home N. Total Debt (add lines through M) S 230,350 Time-Shares/Condominiums Other Housing Net Worth $ 170,000 $ 8,000 Total Assets Less: Total Debt Equals: Net Worth $ 207390 $ 230,350 S (22.960) Housing (market value) Automobile 1 Automobile 2 Other Automobiles Automobiles Collectibles Boats $ 8,000 Furniture $ 11,000 $ 11,000 Other Personal Property Personal Property Money Owed You Market Value of Your Business Other Other Assets H. Total Assets (add lines A through G) $ 207,390 $57,500 Income Wages and salaries Wage Earner 1 Wage Earner 2 Total Wages and salaries + Interest and Dividends + Royalties Commissions and Rents + Other Income $ 57,500 $ 720 A. Total Income $ 58,220 Taxes Federal Income and Social Security + State Income B. Total Income Taxes $ 11,830 $ 1.880 $ 13,710 $ 44,510 C. After-Tax Income Available for Living Expenditures or Take-Home Pay (line A minus line B) Living Expenses Housing Rent + Mortgage Payments + Utilities Maintenance, Taxes, Furniture, Other D. Total Housing Expenditures $ 19,656 $ 10,820 $ 30,476 Food Food and Supplies + Restaurant Expenses E. Total Food Expenditures $ 5,800 $ 1,400 $ 7,200 Clothing and Personal Care F. Total Clothing and Personal Care Expenditures $ 2.590 Transportation Automobile Purchase + Payments + Gas, Tolls, Parking. Other G. Total Transportation Expenditures $ 2,588 $1,550 $ 4,138 Recreation + Vacations + Other Recreation Expenses H. Total Recreation Expenditures $ 2,000 $ 1,700 $ 3,700 Medical Expenditures I. Total Medical Expenditures S 410 Insurance Expenditures Health + Life + Automobile + Disability J. Total Insurance Expenditures $ 420 $ 1.260 $ 260 $ 1.940 $ 1.600 Other Expenditures Educational Expenditures (college loan payment) + Child Care - Other Expenses K. Total Other Expenditures $ 180 $ 1,780 L. Total Living Expenditures (add lines D- $ 52,234 M. Income Available for Savings and Investment 5(7,724)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts