Question: Calculate the European and American values for a knock-out put option where the put option is knocked out if the stock price rises to

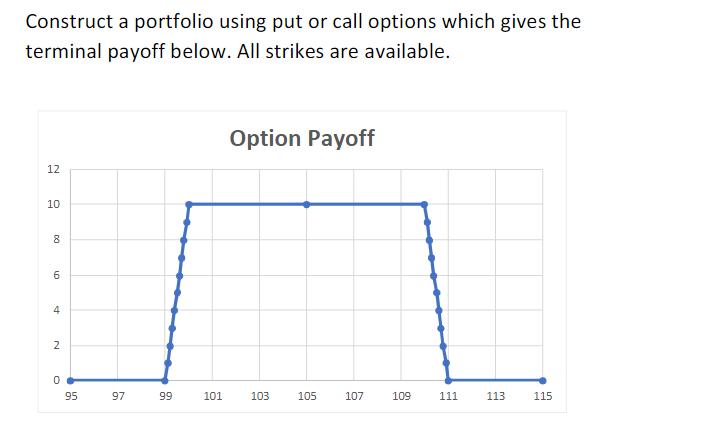

Calculate the European and American values for a knock-out put option where the put option is knocked out if the stock price rises to 130 or if the stock falls to 70. Use the binomial model with the following values, S = 100; K=100; Rf = 3% T= 1 Year 12 time steps O = 20%; 2% Dividend Yield Construct a portfolio using put or call options which gives the terminal payoff below. All strikes are available. Option Payoff 12 10 6. 4 2 95 97 99 101 103 105 107 109 111 113 115 DO

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts