Question: Calculate the expected cash flows (and standard deviation, where appropriate) for all hedging possibilities. You need to identify the best possible hedging technique. You will

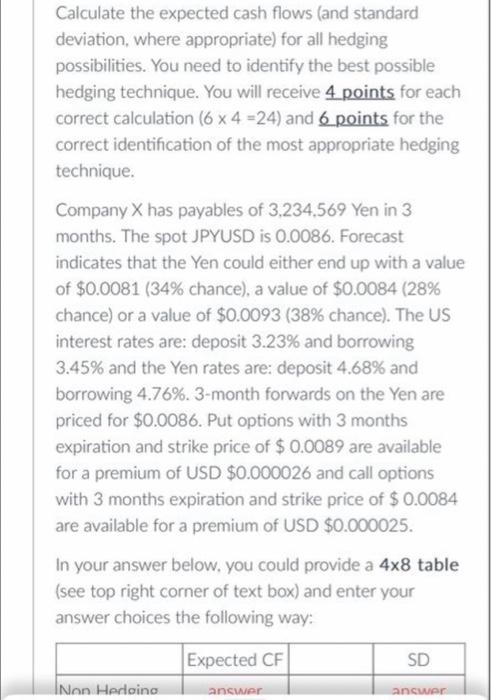

Calculate the expected cash flows (and standard deviation, where appropriate) for all hedging possibilities. You need to identify the best possible hedging technique. You will receive 4 points for each correct calculation ( 64=24 ) and 6 points for the correct identification of the most appropriate hedging technique. Company X has payables of 3,234,569 Yen in 3 months. The spot JPYUSD is 0.0086 . Forecast indicates that the Yen could either end up with a value of $0.0081 (34\% chance), a value of $0.0084 (28\% chance) or a value of $0.0093 (38\% chance). The US interest rates are: deposit 3.23% and borrowing 3.45% and the Yen rates are: deposit 4.68% and borrowing 4.76\%. 3-month forwards on the Yen are priced for $0.0086. Put options with 3 months expiration and strike price of $0.0089 are available for a premium of USD $0.000026 and call options with 3 months expiration and strike price of $0.0084 are available for a premium of USD $0.000025. In your answer below. you could provide a 48 table (see top right corner of text box) and enter your answer choices the following way

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts