Question: Calculate the expected portfolio return using the CAPM ( beta ) model. Clearly note what risk - free rate you used. Accurately discuss the other

Calculate the expected portfolio return using the CAPM beta model. Clearly note what riskfree rate you used. Accurately discuss the other clients risk tolerance and return objective. Would you design an investment portfolio that has a higher or lower expected portfolio return? Why? Instructions:

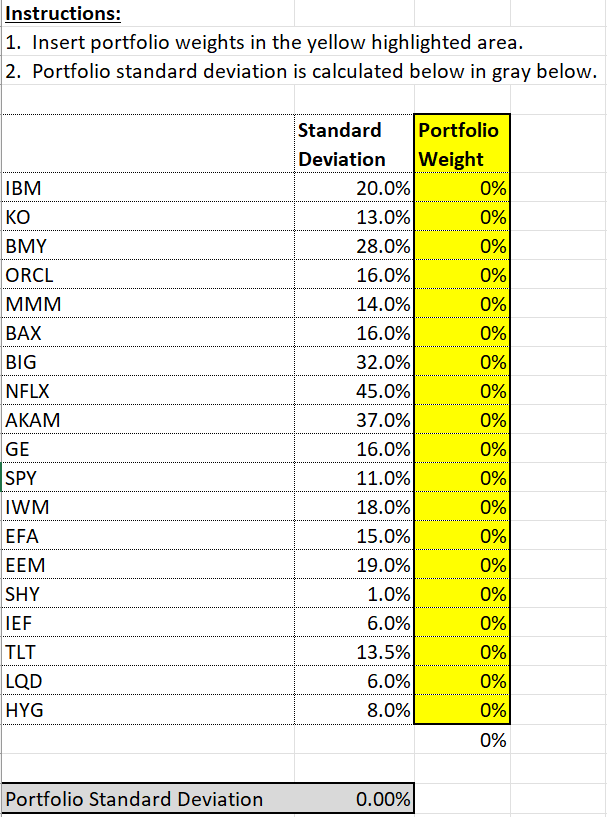

Insert portfolio weights in the yellow highlighted area.

Portfolio standard deviation is calculated below in gray below. Available Assets Table: Stocks Listed in Analysis Table and These Additional Assets

ExPost Return Statistics tableSymboltableHolding PeriodReturntableStandardDeviationBenchmarks,tableHolding PeriodReturntableStandardDeviationTLTLQDHYG

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock