Question: Calculate the expected portfolio return using the CAPM (beta) model. 4 5 6 IBM 7 KO 8 BMY 9 ORCL 10 MMM 11 BAX 12

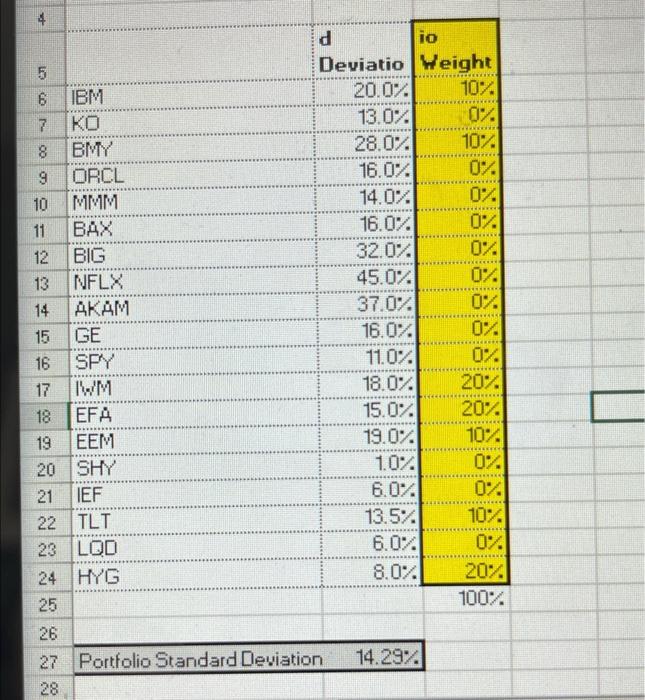

4 5 6 IBM 7 KO 8 BMY 9 ORCL 10 MMM 11 BAX 12 BIG 13 NFLX 14 AKAM 15 GE 16 SPY 17 IWM 18 EFA 19 EEM 20 SHY 21 IEF 22 TLT 23 LQD 24 HYG 25 26 27 Portfolio Standard Deviation 28 d io Deviatio Weight 20.0% 10% 13.0% 0% 28.0% 10% 16.0% 0% 14.0% 0% 16.0% 0% 32.0% 0% 45.0% 0% 37.0% 0% 16.0% 0% 11.0% 0% 18.0% 20% 15.0% 20% 19.0% 10% 1.0% 0% 6.0% 0% 13.5% 10% 6.0% 0% 8.0% 20% 100% 14.29%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts