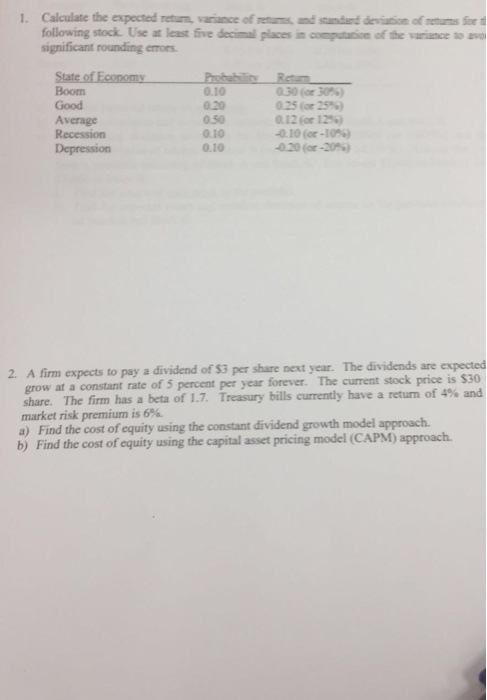

Question: Calculate the expected return, variance of returns, and standard deviation of returns for the following stock. Use at least five decimal places in computation of

Calculate the expected return, variance of returns, and standard deviation of returns for the following stock. Use at least five decimal places in computation of the variance to significant rounding errors. A firm expects to pay a dividend of exist3 per share next year. The dividends are expected at a constant rate of 5 percent per year forever. The current stock price is exist30 share. The firm has a beta of 1.7. Treasury bills currently have a return of 4% and market risk premium is 6%. a) Find the cost of equity using the constant dividend growth model approach. b) Find the cost of equity using the capital asset pricing model (CAPM) approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts