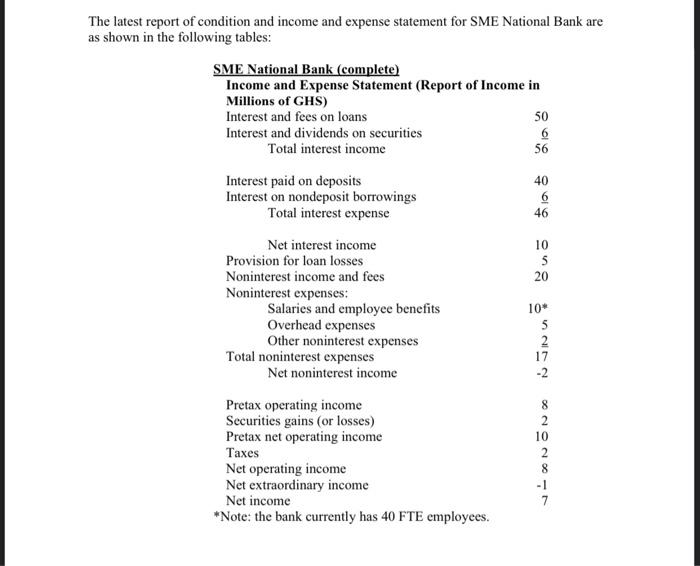

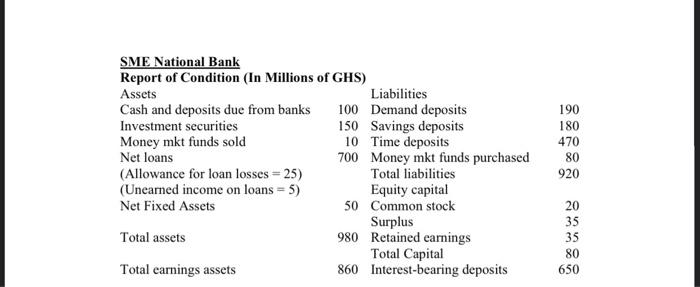

Question: calculate the following 1. Fund management efficiency 2. operating efficiency ratio The latest report of condition and income and expense statement for SME National Bank

The latest report of condition and income and expense statement for SME National Bank are as shown in the following tables: SME National Bank (complete) Income and Expense Statement (Report of Income in Millions of GHS) Interest and fees on loans 50 Interest and dividends on securities 6 Total interest income 56 Interest paid on deposits 40 Interest on nondeposit borrowings 6 Total interest expense 46 10 5 20 10* 5 2 17 -2 Net interest income Provision for loan losses Noninterest income and fees Noninterest expenses: Salaries and employee benefits Overhead expenses Other noninterest expenses Total noninterest expenses Net noninterest income Pretax operating income Securities gains (or losses) Pretax net operating income Taxes Net operating income Net extraordinary income Net income *Note: the bank currently has 40 FTE employees. 8 2 10 8 - 1 SME National Bank Report of Condition (In Millions of GHS) Assets Liabilities Cash and deposits due from banks 100 Demand deposits Investment securities 150 Savings deposits Money mkt funds sold 10 Time deposits Net loans 700 Money mkt funds purchased (Allowance for loan losses = 25) Total liabilities (Uneared income on loans = 5) Equity capital Net Fixed Assets 50 Common stock Surplus Total assets 980 Retained earnings Total Capital Total earnings assets 860 Interest-bearing deposits 190 180 470 80 920 20 35 35 80 650

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts