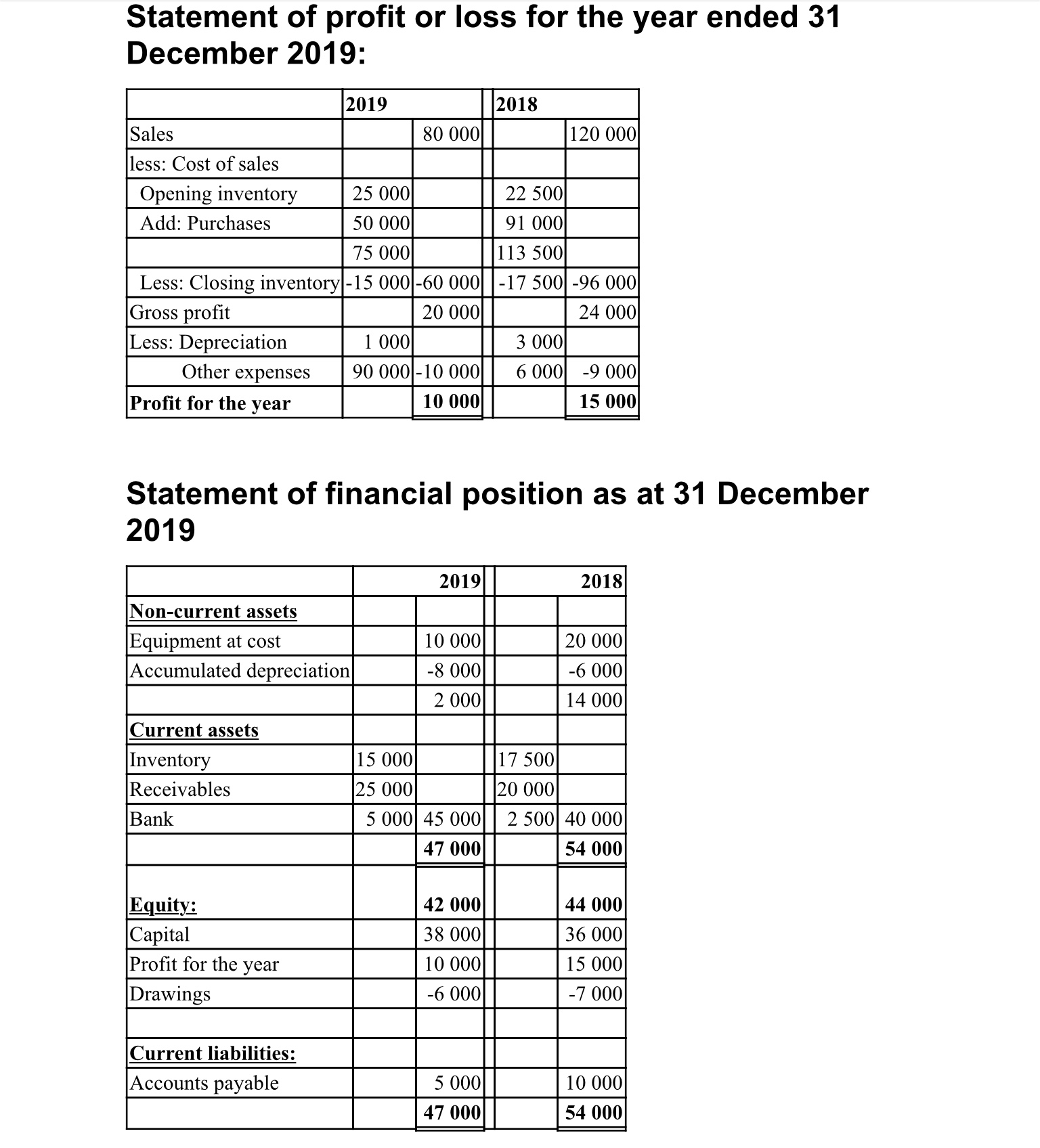

Question: Calculate the following based the information that will be provided below: ProfitabilityRatios Calculations (two ratios) 4marks ?LiquidityRatios Calculations (Two ratios) 4marks ?Long term solvency/Debt ratios

Calculate the following based the information that will be provided below:

ProfitabilityRatios Calculations (two ratios)

4marks

?LiquidityRatios Calculations (Two ratios)

4marks

?Long term solvency/Debt ratios (Two ratios)

4marks

?Discussion of profitability, liquidity and leverage

10marks

?Suggestions on how the company may improveits profitability

4marks

?Cost of equity capitalcalculation

3marks

?Cost of debtcalculation

3marks

?Cost of preference sharescalculation

3marks

?WACCcalculation

3marks

?Discussion of WACC: (why the companyshould calculate WACC,andlimitations of the models used to calculate it)

Deep YellowLtd issued corporate bonds with a coupon rate of 8.0%. The face value is N$100 and the bondisstated on the statement of financial position at its total par value of N$80m. The bonds are currently trading at a price of N$94. Interest is payable annually in arrears. The maturity date is in five years' time. The company has also issued variable loan finance of N$10m at a current interest rate of 9.0% per year.

The company has 200 000preference shares at its N$95 - per - share par value.The cost of issuing and selling the preference share is expected to be N$5 per share.Preference dividends are payable annually in arrears. The non-redeemable preference shares are currently priced at N$106. The dividend rate is 7.8% and the company has recently paid the preference dividends for the current year.

The company's equity beta is 1.15 and the risk-free rate is 6%. The company uses a market premium of 6.5% as this is the average between 5-8 which is the range of the market risk premium recommended by some analysts. The current share price is N$3.20 and the company has 30 million ordinary shares in issue.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts