Question: Calculate the following problems using Microsoft Excel. The calculations must be done in Excel. You must show your work. If you submit these in Word,

Calculate the following problems using Microsoft Excel. The calculations must be done in Excel. You must show your work. If you submit these in Word, you will not receive credit. If you do not show your work, you will not receive credit. Examples are provided above for review prior to starting this assignment. FOLLOW MY EXAMPLES! 1. Stock Valuation: A stock has an initial price of $125 per share, paid a dividend of $2.00 per share during the year, and had an ending share price of $180. Compute the percentage total return, capital gains yield, and dividend yield. 2. Total Return: You bought a share of 10% preferred stock for $100 last year. The market price for your stock is now $120. What was your total return for last year? 3. CAPM: A stock has a beta of 1.20, the expected market rate of return is 20%, and a risk-free rate of 5 percent. What is the expected rate of return of the stock? 4. WACC: The Corporation has a targeted capital structure of 80% common stock and 20% debt. The cost of equity is 10% and the cost of debt is 5%. The tax rate is 30%. What is the company's weighted average cost of capital (WACC)? 5. Flotation Costs: Medina Corp. has a debt-equity ratio of .75. The company is considering a new plant that will cost $525 million to build. When the company issues new equity, it incurs a flotation cost of 15%. The flotation cost on new debt is 8%. What is the initial cost of the plant if the company raises all equity externally? EXAMPLES.. Calculate the following problems using Microsoft Excel. The calculations must be done in Excel. You must show your work. If you submit these in Word, you will not receive credit. If you do not show your work, you will not receive credit. Examples are provided above for review prior to starting this assignment. FOLLOW MY

EXAMPLES! 1. Stock Valuation: A stock has an initial price of $125 per share, paid a dividend of $2.00 per share during the year, and had an ending share price of $180. Compute the percentage total return, capital gains yield, and dividend yield. 2. Total Return: You bought a share of 10% preferred stock for $100 last year. The market price for your stock is now $120. What was your total return for last year? 3. CAPM: A stock has a beta of 1.20, the expected market rate of return is 20%, and a risk-free rate of 5 percent. What is the expected rate of return of the stock? 4. WACC: The Corporation has a targeted capital structure of 80% common stock and 20% debt. The cost of equity is 10% and the cost of debt is 5%. The tax rate is 30%. What is the company's weighted average cost of capital (WACC)? 5. Flotation Costs: Medina Corp. has a debt-equity ratio of .75. The company is considering a new plant that will cost $525 million to build. When the company issues new equity, it incurs a flotation cost of 15%. The flotation cost on new debt is 8%. What is the initial cost of the plant if the company raises all equity externally?Calculate the following problems using Microsoft Excel. The calculations must be done in Excel. You must show your work. If you submit these in Word, you will not receive credit. If you do not show your work, you will not receive credit. Examples are provided above for review prior to starting this assignment. FOLLOW MY EXAMPLES! 1. Stock Valuation: A stock has an initial price of $125 per share, paid a dividend of $2.00 per share during the year, and had an ending share price of $180. Compute the percentage total return, capital gains yield, and dividend yield. 2. Total Return: You bought a share of 10% preferred stock for $100 last year. The market price for your stock is now $120. What was your total return for last year? 3. CAPM: A stock has a beta of 1.20, the expected market rate of return is 20%, and a risk-free rate of 5 percent. What is the expected rate of return of the stock? 4. WACC: The Corporation has a targeted capital structure of 80% common stock and 20% debt. The cost of equity is 10% and the cost of debt is 5%. The tax rate is 30%. What is the company's weighted average cost of capital (WACC)? 5. Flotation Costs: Medina Corp. has a debt-equity ratio of .75. The company is considering a new plant that will cost $525 million to build. When the company issues new equity, it incurs a flotation cost of 15%. The flotation cost on new debt is 8%. What is the initial cost of the plant if the company raises all equity externally? Calculate the following problems using Microsoft Excel. The calculations must be done in Excel. You must show your work. If you submit these in Word, you will not receive credit. If you do not show your work, you will not receive credit. Examples are provided above for review prior to starting this assignment. FOLLOW MY EXAMPLES! 1. Stock Valuation: A stock has an initial price of $125 per share, paid a dividend of $2.00 per share during the year, and had an ending share price of $180. Compute the percentage total return, capital gains yield, and dividend yield. 2. Total Return: You bought a share of 10% preferred stock for $100 last year. The market price for your stock is now $120. What was your total return for last year? 3. CAPM: A stock has a beta of 1.20, the expected market rate of return is 20%, and a risk-free rate of 5 percent. What is the expected rate of return of the stock? 4. WACC: The Corporation has a targeted capital structure of 80% common stock and 20% debt. The cost of equity is 10% and the cost of debt is 5%. The tax rate is 30%. What is the company's weighted average cost of capital (WACC)? 5. Flotation Costs: Medina Corp. has a debt-equity ratio of .75. The company is considering a new plant that will cost $525 million to build. When the company issues new equity, it incurs a flotation cost of 15%. The flotation cost on new debt is 8%. What is the initial cost of the plant if the company raises all equity externally? Calculate the following problems using Microsoft Excel. The calculations must be done in Excel. You must show your work. If you submit these in Word, you will not receive credit. If you do not show your work, you will not receive credit. Examples are provided above for review prior to starting this assignment. FOLLOW MY please see EXAMPLES!

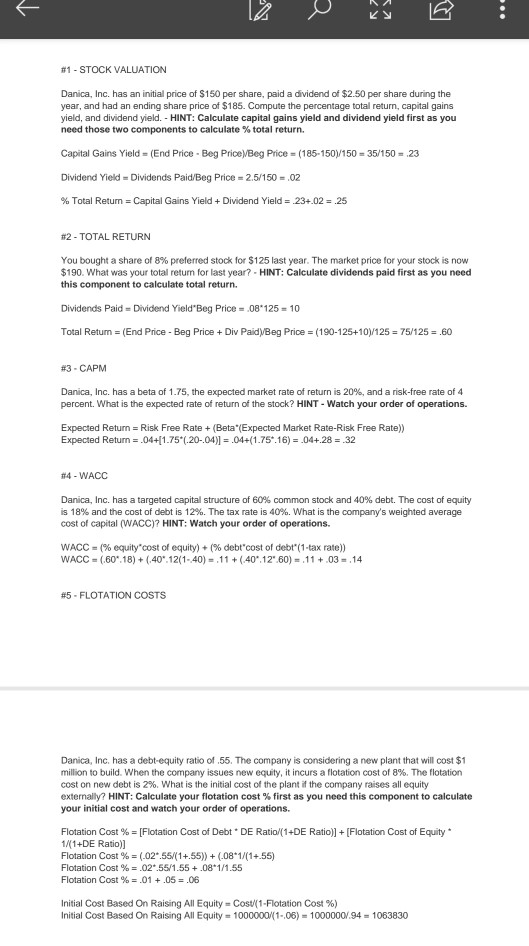

#1 - STOCK VALUATION Danica, Inc. has an initial price of $150 per share, paid a dividend of $2.50 per share during the year, and had an ending share price of $185. Compute the percentage total return, capital gains yield, and dividend yield. - HINT: Calculate capital gains yield and dividend yield first as you need those two components to calculate % total return. Capital Gains Yield = (End Price - Beg Price)Beg Price = (185-150)/150 = 35/150 = 23 Dividend Yield - Dividends Paid/Beg Price = 2.5/150 = .02 % Total Retum = Capital Gains Yield + Dividend Yield = 23+.02 = .25 #2 - TOTAL RETURN You bought a share of 8% preferred stock for $125 last year. The market price for your stock is now $190. What was your total return for last year? - HINT: Calculate dividends paid first as you need this component to calculate total return. Dividends Paid - Dividend Yield"Beg Price = .08*125 = 10 Total Return = (End Price - Beg Price + Div PaidyBeg Price = (190-125+10)/125 = 75/125 = 60 #3 - CAPM Danica, Inc. has a beta of 1.75, the expected market rate of return is 20%, and a risk-free rate of 4 percent. What is the expected rate of return of the stock? HINT - Watch your order of operations. Expected Return = Risk Free Rate +(Beta"(Expected Market Rate-Risk Free Rate)) Expected Return = .04+[1.75.20-04)] = .04+(1.75*16) = .04+.28 = .32 #4 - WACC Danica, Inc. has a targeted capital structure of 60% common stock and 40% debt. The cost of equity is 18% and the cost of debt is 12%. The tax rate is 40%. What is the company's weighted average cost of capital ( WACC)? HINT: Watch your order of operations. WACC = (% equity cost of equity) + (% debt cost of debt" (1-tax rate)) WACC = (.60.18) + (-40.12(1-40) = .11 + (404.12.60) = 11 +.03.14 #5 - FLOTATION COSTS Danica, Inc. has a debt-equity ratio of 55. The company is considering a new plant that will cost $1 million to build. When the company issues new equity, it incurs a flotation cost of 8%. The flotation cost on new debt is 2%. What is the initial cost of the plant if the company raises all equity externally? HINT: Calculate your flotation cost % first as you need this component to calculate your initial cost and watch your order of operations. Flotation Cost % = [Flotation Cost of Debt DE Ratio/(1+DE Ratio)] + [Flotation Cost of Equity * 1/(1+DE Ratio)] Flotation Cost % = (.02.55/(1+.55)) + .081/(1+.55) Flotation Cost % = .02*.55/1.55 +.08*1/1.55 Flotation Cost % = .01 +.05 = .06 Initial Cost Based On Raising All Equity - Cost(1-Flotation Cost %) Initial Cost Based On Raising All Equity = 1000000/(1-.06) - 10000001.94 1063830

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts