Calculate the fringe benefits tax liability in respect of each benefit provided to Sau Fuk. QUESTION...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

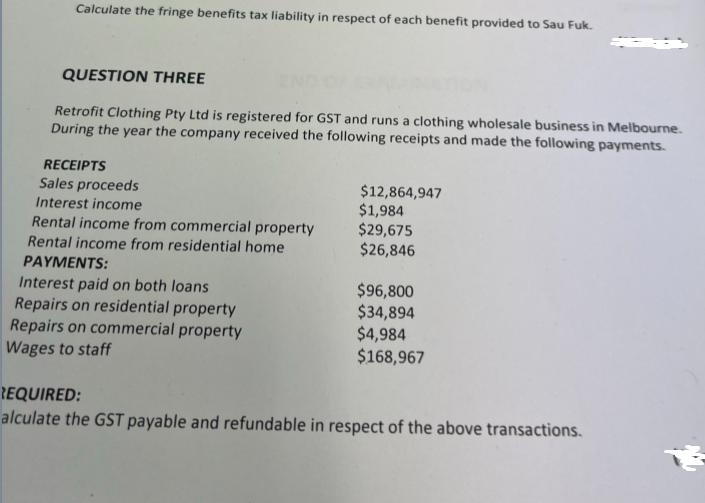

Calculate the fringe benefits tax liability in respect of each benefit provided to Sau Fuk. QUESTION THREE Retrofit Clothing Pty Ltd is registered for GST and runs a clothing wholesale business in Melbourne. During the year the company received the following receipts and made the following payments. RECEIPTS Sales proceeds Interest income Rental income from commercial property Rental income from residential home PAYMENTS: Interest paid on both loans Repairs on residential property Repairs on commercial property Wages to staff $12,864,947 $1,984 $29,675 $26,846 $96,800 $34,894 $4,984 $168,967 REQUIRED: alculate the GST payable and refundable in respect of the above transactions. Calculate the fringe benefits tax liability in respect of each benefit provided to Sau Fuk. QUESTION THREE Retrofit Clothing Pty Ltd is registered for GST and runs a clothing wholesale business in Melbourne. During the year the company received the following receipts and made the following payments. RECEIPTS Sales proceeds Interest income Rental income from commercial property Rental income from residential home PAYMENTS: Interest paid on both loans Repairs on residential property Repairs on commercial property Wages to staff $12,864,947 $1,984 $29,675 $26,846 $96,800 $34,894 $4,984 $168,967 REQUIRED: alculate the GST payable and refundable in respect of the above transactions.

Expert Answer:

Answer rating: 100% (QA)

To calculate the GST payable and refundable for Retrofit Clothing Pty Ltd we need to determine the G... View the full answer

Related Book For

Management Accounting Information for Decision-Making and Strategy Execution

ISBN: 978-0137024971

6th Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, S. Mark Young

Posted Date:

Students also viewed these law questions

-

The effective duration of the pool was reported by the state auditor as 7.4 years in December 1994. Suppose the Orange county did not liquidate the portfolio worth $7.5 billon. In 1995, interest...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Betty is a sole trader and owns the business Cake Magic. Bettys business sells baking goods and equipment to wholesale and retail customers. Cake Magic also has a small manufacturing function that...

-

Explain how you solve problems during the implementation of your projects. Does this operate as a formal approach and/or use specific supportive techniques?

-

Explain how economic transactions between household savers of funds and corporate users of funds would occur in a world without financial institutions.

-

In Exercises 1324, find the mass and center of mass of the lamina bounded by the graphs of the equations for the given density. y = 36 - x, 0 y x p = k

-

(1) What might be the TA life positions of Bella the soprano, Jeremy the artistic director and Simon the conductor?

-

On January 1, 2011, S&S Corporation invested in LLB Industries' negotiable two-year, 10% notes, with interest receivable quarterly. The company classified the investment as available-for-sale. S&S...

-

Sandhill Limited purchased a machine on account on April 2, 2018, at an invoice price of $332,220. On April 4, it paid $2,170 for delivery of the machine. A one-year, $3,960 insurance policy on the...

-

The financial statements of Columbia Sportswear Company are presented in Appendix B. Financial statements of Under Armour, Inc. are presented in Appendix C. The complete annual reports, including the...

-

Action Required: In the organization where you work or take an example of your choice to answer the question given below. 5.3 Test your Knowledge (Question): List the common methods used in selecting...

-

1. create a concept map for 0D, 1D, 2D and 3D crystals 2. write down the formulas for quantifying numbers of defects

-

\fNOTES TO CONSOLIDATED FINANCIAL STATEMENTS OF AMERICAN AIRLINES GROUP INC . Commitments , Contingencies and Guarantees ( 2 ) Aircraft and Engine Purchase Commitment Under all of our aircraft and...

-

Critical Values. In Exercises 41-44, find the indicated critical value. Round results to two decimal places. 41. Z0.25 42. Z0.90 43. Z0.02 44. 20.05

-

Use the following information for questions 1 and 2. Caterpillar Financial Services Corp. (a subsidiary of Caterpillar) and Sterling Construction sign a lease agreement dated January 1, 2020, that...

-

In todays social and business environments, some organizations only talk the talk regarding ethics and ethical conduct rather than walk the ethical organizational path. In what ways can ethical and...

-

I need help preparing this statement Instructions Linsenmeyer Company produces a common machine component for industrial equipment in three departments: molding, grinding, and finishing. The...

-

Determine the values of the given trigonometric functions directly on a calculator. The angles are approximate. tan 0.8035

-

From a behavioral point of view, what potential problems can occur when implementing a target costing system?

-

Budget slack Mike Shields was having dinner with one of his friends at a restaurant in Memphis. His friend, Woody Brooks, a local manager of an express mail service, told Mike that he consistently...

-

In the mid-1990s, Mobil Corporation??s Marketing and Refining (M&R) division underwent a major reorganization and developed new strategic directions. In conjunction with these changes, M&R developed...

-

The efficient market hypothesis suggests that it is difficult to outperform the market on a consistent basis. Are there possible exceptions to the hypothesis that concern the valuation of common...

-

How might a Daily Spending Diary result in wiser consumer buying and more saving for the future?

-

Jamie Lee sat down with a salesperson to discuss a new vehicle and its $24,000 purchase price. Jamie Lee has heard that no one really pays the vehicle sticker price. What guidelines may be suggested...

Study smarter with the SolutionInn App