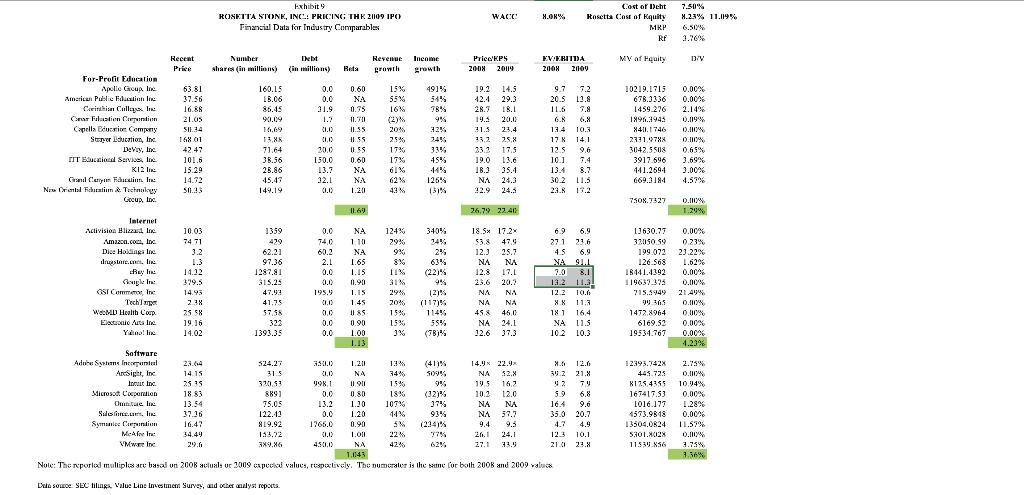

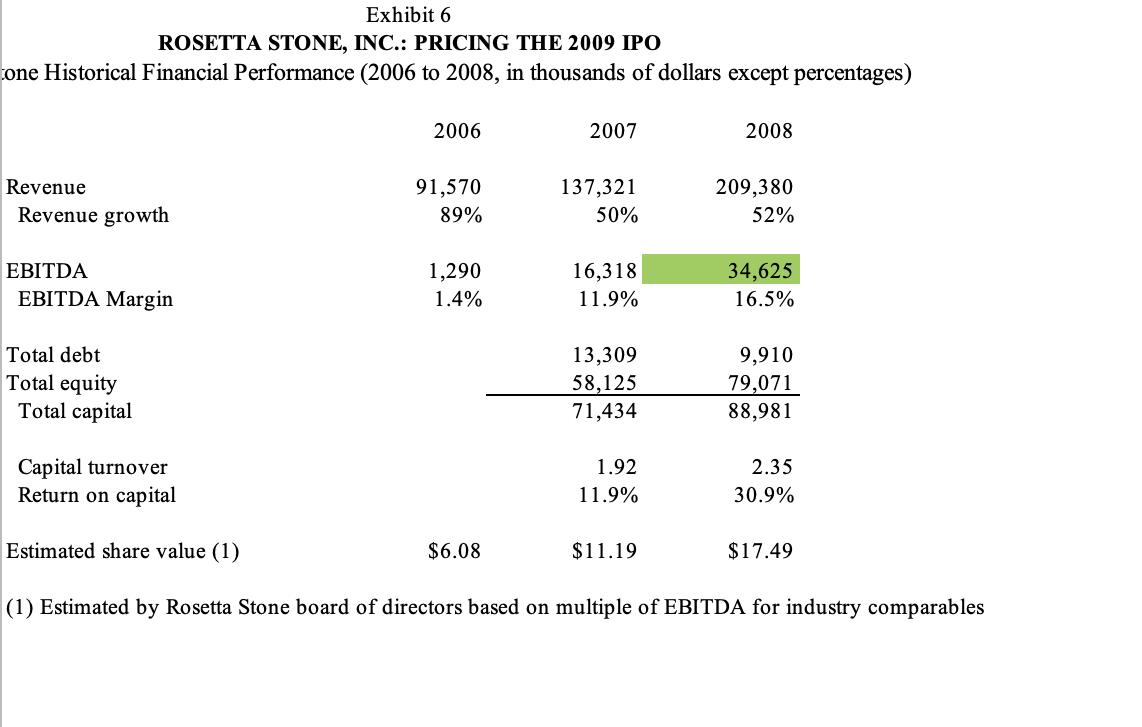

Question: Calculate the implied enterprise value of Rosetta Stone using the average EV/EBITDA multiple for all three categories of comparable firms provided in Exhibit 9 and

Calculate the implied enterprise value of Rosetta Stone using the average EV/EBITDA multiple for all three categories of comparable firms provided in Exhibit 9 and Rosetta Stone EBITDA provided in Exhibit 6, a total of three multiples. Interpret what these numbers suggest regarding the value of Rosetta Stone. The market-multiples approach seems easy. What are the some pros and cons of using a market-multiples approach in valuation?

Recent ROSETTA STONE, INC: PRICING THE 2009 IPO Financial Data for Industry Com 9222222

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Exhibit 9 Industry Comparables Company Category Revenue 2008 EBITDA 2008 EVEBITDA Multiple Pearson E... View full answer

Get step-by-step solutions from verified subject matter experts