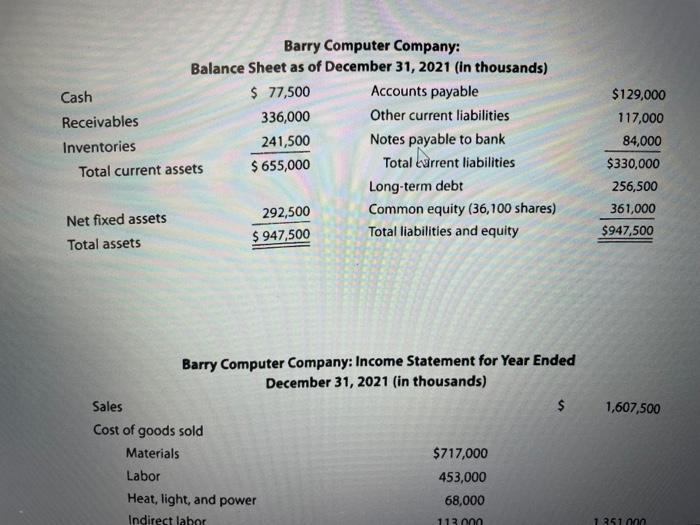

Question: Calculate the market/book ratios from the given data and interpret the ratios. Cash Receivables Inventories Barry Computer Company: Balance Sheet as of December 31, 2021

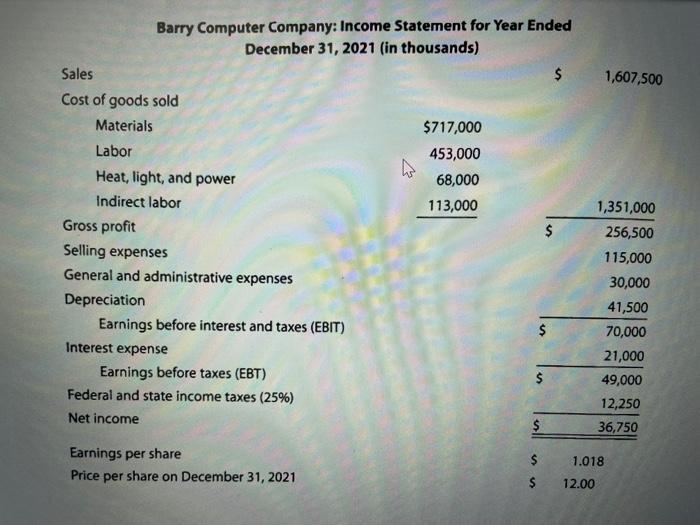

Cash Receivables Inventories Barry Computer Company: Balance Sheet as of December 31, 2021 (in thousands) $ 77,500 Accounts payable Total current assets Net fixed assets Total assets 336,000 241,500 $ 655,000 292,500 $947,500 Other current liabilities Notes payable to bank Total current liabilities Sales Cost of goods sold Materials Labor Heat, light, and power Indirect labor Long-term debt Common equity (36,100 shares) Total liabilities and equity Barry Computer Company: Income Statement for Year Ended December 31, 2021 (in thousands) $717,000 453,000 68,000 113.000 $ $129,000 117,000 84,000 $330,000 256,500 361,000 $947,500 1,607,500 1.351.000

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

To calculate the marketbook ratio we need to know the market value and book value M... View full answer

Get step-by-step solutions from verified subject matter experts