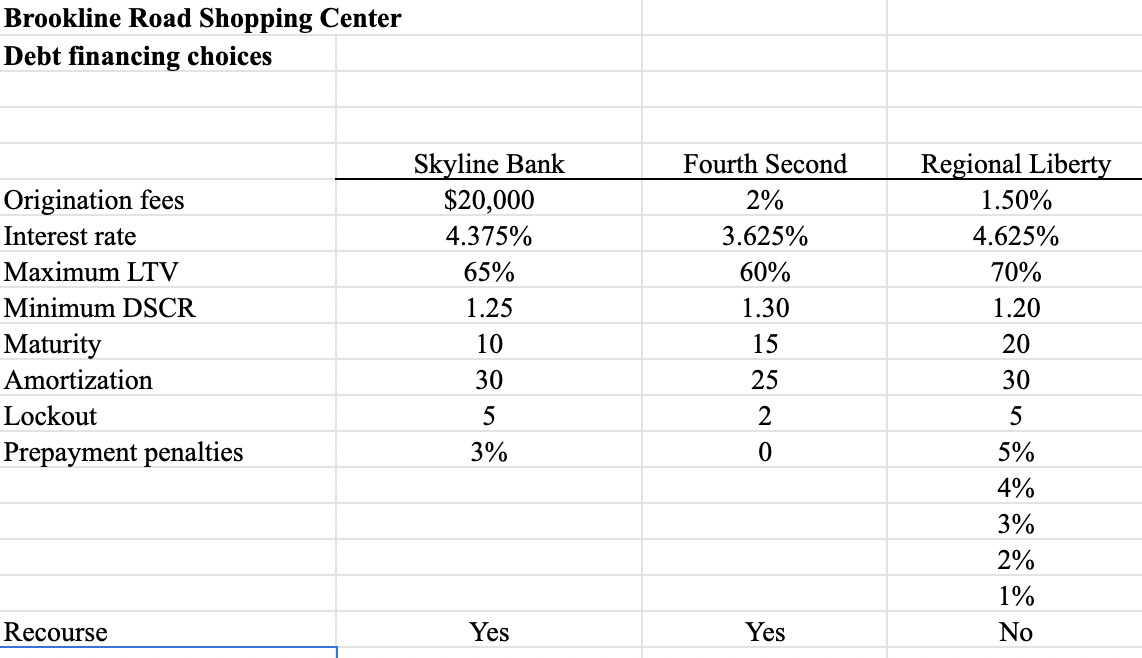

Question: Calculate the maximum amount Cirano can currently borrow for each debt option, making sure to satisfy the LTV and DSCR constraints. For the Brookline property,

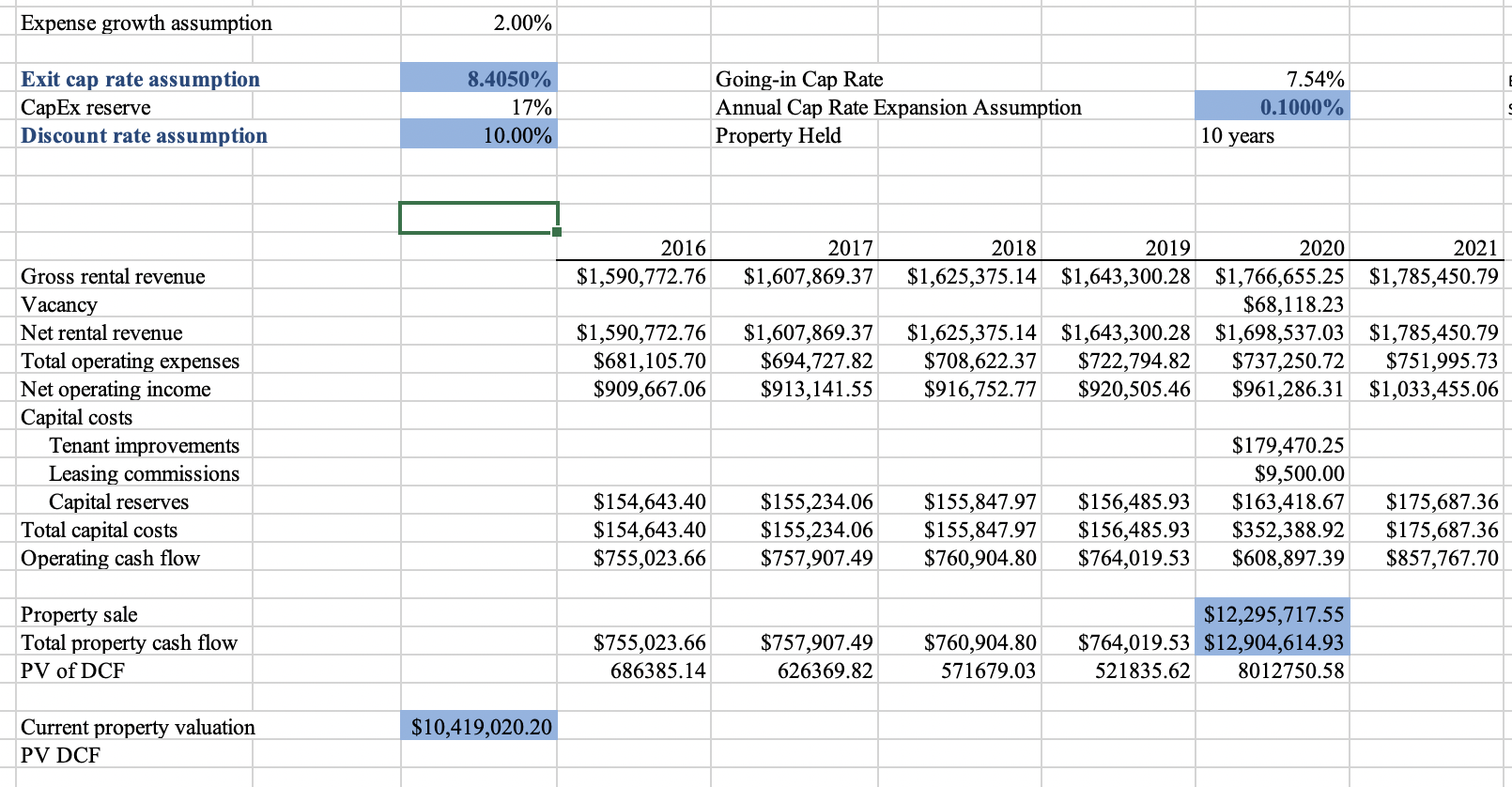

Calculate the maximum amount Cirano can currently borrow for each debt option, making sure to satisfy the LTV and DSCR constraints. For the Brookline property, all lenders agree on the cash flow forecasts. Current Property Valuation is $10,419,020.20

Use the image below, please show all work and formulas for the calculations. Thank you!

Brookline Road Shopping Center Debt financing choices Fourth Second 2% Origination fees Interest rate Maximum LTV Minimum DSCR Maturity Amortization Lockout Prepayment penalties Skyline Bank $20,000 4.375% 65% 1.25 10 30 3.625% 60% 1.30 15 25 Regional Liberty 1.50% 4.625% 70% 1.20 20 30 5 5% 4% 3% 2% 1% No 5 3% 2 0 Recourse Yes Yes Expense growth assumption 2.00% Exit cap rate assumption CapEx reserve Discount rate assumption 8.4050% 17% 10.00% Going-in Cap Rate Annual Cap Rate Expansion Assumption Property Held 7.54% 0.1000% 10 years 2016 $1,590,772.76 2017 $1,607,869.37 2018 2019 2020 2021 $1,625,375.14 $1,643,300.28 $1,766,655.25 $1,785,450.79 $68,118.23 $1,625,375.14 $1,643,300.28 $1,698,537.03 $1,785,450.79 $708,622.37 $722,794.82 $737,250.72 $751,995.73 $916,752.77 $920,505.46 $961,286.31 $1,033,455.06 $1,590,772.76 $681,105.70 $909,667.06 $1,607,869.37 $694,727.82 $913,141.55 Gross rental revenue Vacancy Net rental revenue Total operating expenses Net operating income Capital costs Tenant improvements Leasing commissions Capital reserves Total capital costs Operating cash flow $154,643.40 $154,643.40 $755,023.66 $155,234.06 $155,234.06 $757,907.49 $155,847.97 $155,847.97 $760,904.80 $156,485.93 $156,485.93 $764,019.53 $179,470.25 $9,500.00 $163,418.67 $352,388.92 $608,897.39 $175,687.36 $175,687.36 $857,767.70 Property sale Total property cash flow PV of DCF $755,023.66 686385.14 $757,907.49 626369.82 $760,904.80 571679.03 $12,295,717.55 $764,019.53 $12,904,614.93 521835.62 8012750.58 Current property valuation PV DCF $10,419,020.20 Brookline Road Shopping Center Debt financing choices Fourth Second 2% Origination fees Interest rate Maximum LTV Minimum DSCR Maturity Amortization Lockout Prepayment penalties Skyline Bank $20,000 4.375% 65% 1.25 10 30 3.625% 60% 1.30 15 25 Regional Liberty 1.50% 4.625% 70% 1.20 20 30 5 5% 4% 3% 2% 1% No 5 3% 2 0 Recourse Yes Yes Expense growth assumption 2.00% Exit cap rate assumption CapEx reserve Discount rate assumption 8.4050% 17% 10.00% Going-in Cap Rate Annual Cap Rate Expansion Assumption Property Held 7.54% 0.1000% 10 years 2016 $1,590,772.76 2017 $1,607,869.37 2018 2019 2020 2021 $1,625,375.14 $1,643,300.28 $1,766,655.25 $1,785,450.79 $68,118.23 $1,625,375.14 $1,643,300.28 $1,698,537.03 $1,785,450.79 $708,622.37 $722,794.82 $737,250.72 $751,995.73 $916,752.77 $920,505.46 $961,286.31 $1,033,455.06 $1,590,772.76 $681,105.70 $909,667.06 $1,607,869.37 $694,727.82 $913,141.55 Gross rental revenue Vacancy Net rental revenue Total operating expenses Net operating income Capital costs Tenant improvements Leasing commissions Capital reserves Total capital costs Operating cash flow $154,643.40 $154,643.40 $755,023.66 $155,234.06 $155,234.06 $757,907.49 $155,847.97 $155,847.97 $760,904.80 $156,485.93 $156,485.93 $764,019.53 $179,470.25 $9,500.00 $163,418.67 $352,388.92 $608,897.39 $175,687.36 $175,687.36 $857,767.70 Property sale Total property cash flow PV of DCF $755,023.66 686385.14 $757,907.49 626369.82 $760,904.80 571679.03 $12,295,717.55 $764,019.53 $12,904,614.93 521835.62 8012750.58 Current property valuation PV DCF $10,419,020.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts