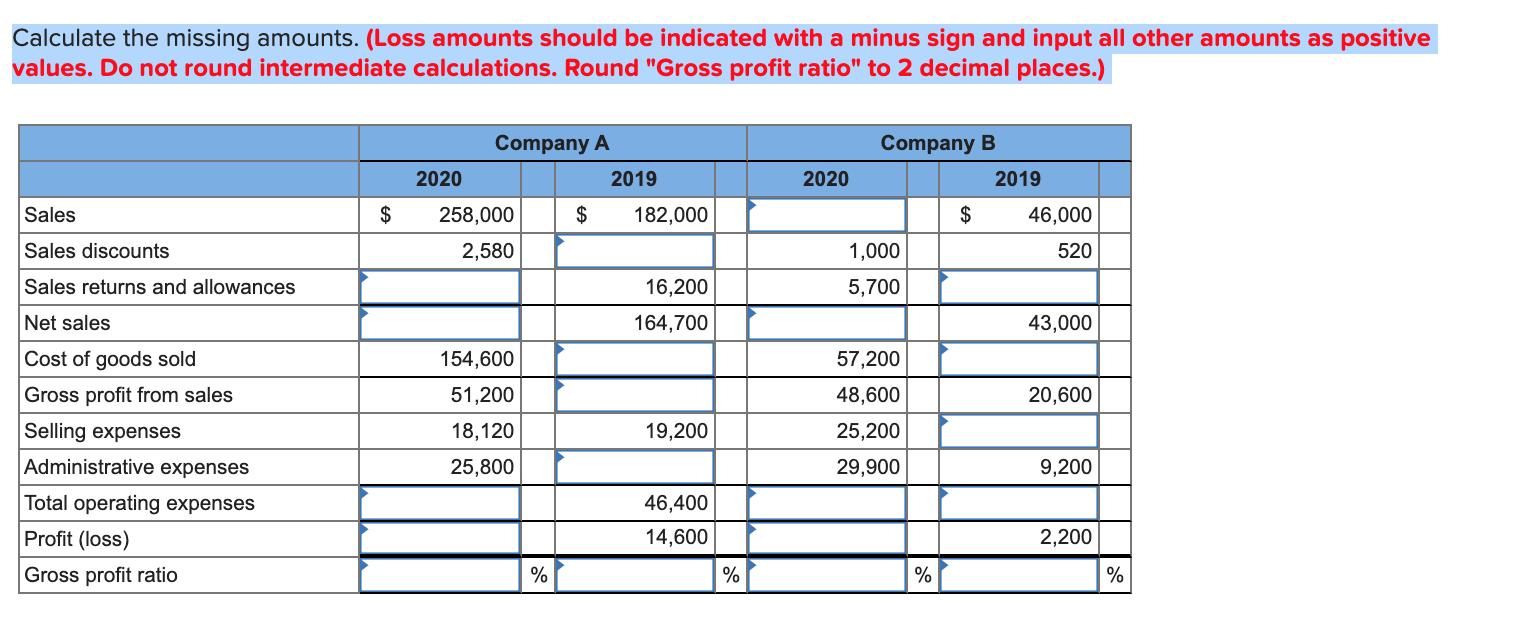

Question: Calculate the missing amounts. (Loss amounts should be indicated with a minus sign and input all other amounts as positive values. Do not round

Calculate the missing amounts. (Loss amounts should be indicated with a minus sign and input all other amounts as positive values. Do not round intermediate calculations. Round "Gross profit ratio" to 2 decimal places.) Company A Company B 2020 2019 2020 2019 Sales $ 258,000 $ 182,000 $ 46,000 Sales discounts 2,580 1,000 520 Sales returns and allowances 16,200 5,700 Net sales 164,700 43,000 Cost of goods sold 154,600 57,200 Gross profit from sales 51,200 48,600 20,600 Selling expenses 18,120 19,200 25,200 Administrative expenses 25,800 29,900 9,200 Total operating expenses 46,400 Profit (loss) 14,600 2,200 Gross profit ratio % % %

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Company A Company B 2020 2019 2020 2019 Sales 258000 182000 112500 46000 Sales Discounts 2580 1100 1... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

6093be4e668e5_210111.pdf

180 KBs PDF File

6093be4e668e5_210111.docx

120 KBs Word File