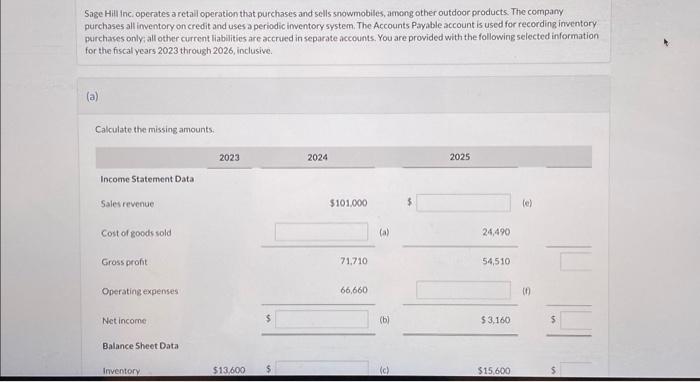

Question: calculate the missing amounts Sage Hill inc operates a retall operation that purchases and sells snowmobiles, among other outdoor products. The company purchases all inventory

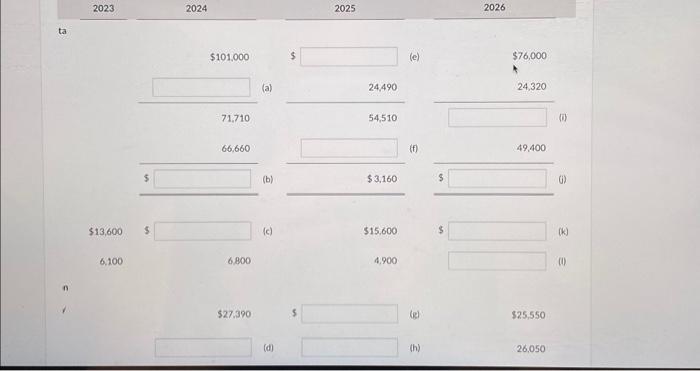

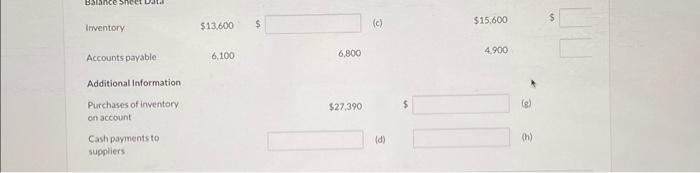

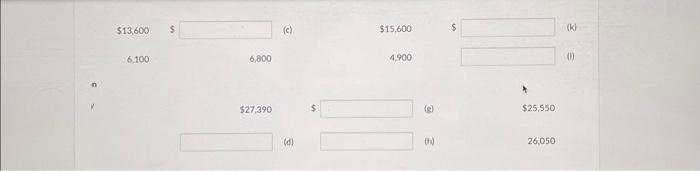

Sage Hill inc operates a retall operation that purchases and sells snowmobiles, among other outdoor products. The company purchases all inventory on credit and uses a periodic inventory systern. The Accounts. Payable account is used for recording inwentory purchases only all other current liabilitios are accrued in separate accounts. You are provided with the following selected information for the fiscal years 2023 through 2026 , inclusive. (a) Calculate the missing amounts. 2023 2024 2025 2026 ta $101,000 5 (a) 71,710 66,660 5 (b) $13,600 5 (c) 6,100 (c) 24,490 54,510 (f) $3,160 $15,600 6800 4,900 $76,000 24,320 (i) 49.400 (j) (k) (i) $27.390 (g) $25,550 (d) (h) 26,050 Imventory: $13,600 Accounts payable (c) $15.600 6,100 6,800 4,900 Additional information Purchases of inventory $27,390 on account Cash payments to (d) suppliers $13,600$ 6,7006,600 n (c) $15,6004,900 (e) (i) 5 (k) (1) (d) 5 $25,550 26,050

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts