Question: Calculate the operating margin (%) for the hospital, Use the debt-to-asset ratio to evaluate the capital structure of your org. Activities & Governance Parti! Summary

Calculate the operating margin (%) for the hospital, Use the debt-to-asset ratio to evaluate the capital structure of your org.

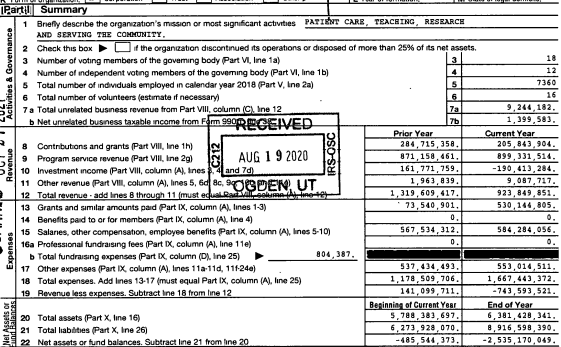

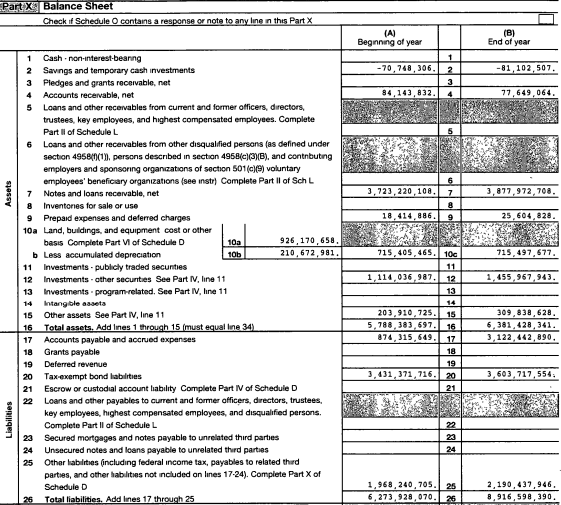

Activities & Governance Parti! Summary 1 Briefly descnbe the organization's mission or most significant activities PATIENT CARE, TEACHING, RESEARCH AND SERVING THE COMUNITY 2 Check this box of the organization discontinued its operations or disposed of more than 25% of its net assets. 3 Number of voting members of the governing Body Part VI. Ine 1a) 3 18 4 Number of independent voting members of the goveming body Part VI, line 16) 4 12 5 Total number of individuals employed in calendar year 2018 Part V. Ine 2a) 5 7360 6 Total number of volunteers (estimate if necessary) 6 16 7 a Total unrelated business revenue from Part VIII, column (C), Ine 12 7a 9,244,182. b Net unrelated business taxable income from Fam 999RECEIVED 7b 1,399,583 Prior Year Current Year 8 Contributions and grants (Part VII, Iine 1h) 284,715, 358. 205,843,904 9 Program service revenue (Part VIII, Ine 2g) AUG 1 9 2020 871,158,461. 899,331,514. 10 Investment income Part VIII, column (A), Ines and 7d) 161,771,759. -190,413,284. 11 Other revenue Part Villl, column (A), ines 5, 6 80, OGDEN, UT 990 1,963,839 9,087,717. 12 Total revenue. add lines through 11 must edul RAAMARA Tine 1,319,609,417. 923,849,851. 13 Grants and similar amounts pard Part IX, column (Al. lines 1-3) 73,540,901 530, 146,805 14 Benefits pard to or for members (Part IX, column (Al, Ine 4) 0. 15 Salanes, other compensation, employee benefits Part IX, colur (A), Ines 5-10) 567,534,312. 584,284,056. 16a Professional fundraising fees (Part IX. column (A), line 11e) 0. 0 b Total fundraising expenses Part IX, column (D), Ine 25) 804,387. 17 Other expenses Part IX. column (A), Ines 11a-110, 111-24) 537,434,493, 553,014,511. 18 Total expenses. Add Ines 13-17 (must equal Part IX, column (A), line 25) 1,178, 509,706. 1,667,443,372. 19 Revenue less expenses. Subtract Ine 18 from line 12 141,099,711. - 743,593,521 Berinning of Current Yes End of Year 20 Total assets (Part X, line 16) 5,788,383,697. 6,381, 428,341. 21 Total liabilities (Part X Ine 26) 6,273,928, 070. 8,916,599,390. 22 Net assets or fund balances. Subtract line 21 from line 20 -185,541,373. -2,535,170,049 IRS OSC Revenue Expenses Net Assets or und Balances Part Balance Sheet Check if Schedule o contains a response or note to any line n this part X (B) (A) Beginning of year End of year -70,748,306, 1 2 -81, 102,507. 84,143,832 3 4 77,649,064. Assets 3,877,972,708. 6 3,723, 220,108.7 8 18,414,886. 9 25,604,828. 715, 497,677. 1 Cash. non interest-bearng 2 Savings and temporary cash investments 3 Pledges and grants receivable, net 4 Accounts receivable, net 5 Loans and other receivables from current and former officers, directors, trustees, key employees, and highest compensated employees. Complete Part 1 of ScheduleL 6 Loans and other recervables from other disqualified persons (as defined under section 49584(1), persons described in section 495B(c)(3)(B), and contbuting employers and sponsoring organizations of section 501(c)9) voluntary employees' beneficiary organizations (see instr) Complete Part II of Sch L 7 Notes and loans receivable, net 8 Inventories for sale or use 9 Prepaid expenses and deferred charges 10a Land, buildings and equipment cost or other basis Complete Part 1 of Schedule D 10a 926,170,658 b Less accumulated depreciation 10b 210,672,981. 11 Investments - publicly traded secunties 12 Investments other securities See Part IV line 11 13 Investments program-related. See Part IV line 11 Intangible asseta 15 Other assets See Part IV, line 11 16 Total assets. Add lines 1 through 15 (must equal line 34 17 Accounts payable and accrued expenses 18 Grants payable 19 Deferred revenue 20 Tax-exempt bond liabilities 21 Escrow or custodial account liability Complete Part IV of Schedule D 22 Loans and other payables to current and former officers, directors, trustees, key employees, highest compensated employees, and disqualified persons. Complete Part II of ScheduleL 23 Secured mortgages and notes payable to unrelated third parties 24 Unsecured notes and loans payable to unrelated third parties 25 Other habilities (including federal income tax payables to related third parties, and other habilitues not included on lines 17-24). Complete Part X of Schedule D Total liabilities. Add lines 17 through 25 1,455,967,943. 715,405,465.100 11 1,114,036,987.12 13 14 203,910,725. 15 5,788,383,697. 16 874,315,649.17 18 19 3,431, 371, 716. 20 21 309,838,628. 6,381, 428,341. 3, 122, 442,890, 3,603, 717,554. Liabilities 22 23 24 1,968,240,705.25 6,273,928,070.26 2,190, 437,946. 8,916,598,390 26 Activities & Governance Parti! Summary 1 Briefly descnbe the organization's mission or most significant activities PATIENT CARE, TEACHING, RESEARCH AND SERVING THE COMUNITY 2 Check this box of the organization discontinued its operations or disposed of more than 25% of its net assets. 3 Number of voting members of the governing Body Part VI. Ine 1a) 3 18 4 Number of independent voting members of the goveming body Part VI, line 16) 4 12 5 Total number of individuals employed in calendar year 2018 Part V. Ine 2a) 5 7360 6 Total number of volunteers (estimate if necessary) 6 16 7 a Total unrelated business revenue from Part VIII, column (C), Ine 12 7a 9,244,182. b Net unrelated business taxable income from Fam 999RECEIVED 7b 1,399,583 Prior Year Current Year 8 Contributions and grants (Part VII, Iine 1h) 284,715, 358. 205,843,904 9 Program service revenue (Part VIII, Ine 2g) AUG 1 9 2020 871,158,461. 899,331,514. 10 Investment income Part VIII, column (A), Ines and 7d) 161,771,759. -190,413,284. 11 Other revenue Part Villl, column (A), ines 5, 6 80, OGDEN, UT 990 1,963,839 9,087,717. 12 Total revenue. add lines through 11 must edul RAAMARA Tine 1,319,609,417. 923,849,851. 13 Grants and similar amounts pard Part IX, column (Al. lines 1-3) 73,540,901 530, 146,805 14 Benefits pard to or for members (Part IX, column (Al, Ine 4) 0. 15 Salanes, other compensation, employee benefits Part IX, colur (A), Ines 5-10) 567,534,312. 584,284,056. 16a Professional fundraising fees (Part IX. column (A), line 11e) 0. 0 b Total fundraising expenses Part IX, column (D), Ine 25) 804,387. 17 Other expenses Part IX. column (A), Ines 11a-110, 111-24) 537,434,493, 553,014,511. 18 Total expenses. Add Ines 13-17 (must equal Part IX, column (A), line 25) 1,178, 509,706. 1,667,443,372. 19 Revenue less expenses. Subtract Ine 18 from line 12 141,099,711. - 743,593,521 Berinning of Current Yes End of Year 20 Total assets (Part X, line 16) 5,788,383,697. 6,381, 428,341. 21 Total liabilities (Part X Ine 26) 6,273,928, 070. 8,916,599,390. 22 Net assets or fund balances. Subtract line 21 from line 20 -185,541,373. -2,535,170,049 IRS OSC Revenue Expenses Net Assets or und Balances Part Balance Sheet Check if Schedule o contains a response or note to any line n this part X (B) (A) Beginning of year End of year -70,748,306, 1 2 -81, 102,507. 84,143,832 3 4 77,649,064. Assets 3,877,972,708. 6 3,723, 220,108.7 8 18,414,886. 9 25,604,828. 715, 497,677. 1 Cash. non interest-bearng 2 Savings and temporary cash investments 3 Pledges and grants receivable, net 4 Accounts receivable, net 5 Loans and other receivables from current and former officers, directors, trustees, key employees, and highest compensated employees. Complete Part 1 of ScheduleL 6 Loans and other recervables from other disqualified persons (as defined under section 49584(1), persons described in section 495B(c)(3)(B), and contbuting employers and sponsoring organizations of section 501(c)9) voluntary employees' beneficiary organizations (see instr) Complete Part II of Sch L 7 Notes and loans receivable, net 8 Inventories for sale or use 9 Prepaid expenses and deferred charges 10a Land, buildings and equipment cost or other basis Complete Part 1 of Schedule D 10a 926,170,658 b Less accumulated depreciation 10b 210,672,981. 11 Investments - publicly traded secunties 12 Investments other securities See Part IV line 11 13 Investments program-related. See Part IV line 11 Intangible asseta 15 Other assets See Part IV, line 11 16 Total assets. Add lines 1 through 15 (must equal line 34 17 Accounts payable and accrued expenses 18 Grants payable 19 Deferred revenue 20 Tax-exempt bond liabilities 21 Escrow or custodial account liability Complete Part IV of Schedule D 22 Loans and other payables to current and former officers, directors, trustees, key employees, highest compensated employees, and disqualified persons. Complete Part II of ScheduleL 23 Secured mortgages and notes payable to unrelated third parties 24 Unsecured notes and loans payable to unrelated third parties 25 Other habilities (including federal income tax payables to related third parties, and other habilitues not included on lines 17-24). Complete Part X of Schedule D Total liabilities. Add lines 17 through 25 1,455,967,943. 715,405,465.100 11 1,114,036,987.12 13 14 203,910,725. 15 5,788,383,697. 16 874,315,649.17 18 19 3,431, 371, 716. 20 21 309,838,628. 6,381, 428,341. 3, 122, 442,890, 3,603, 717,554. Liabilities 22 23 24 1,968,240,705.25 6,273,928,070.26 2,190, 437,946. 8,916,598,390 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts