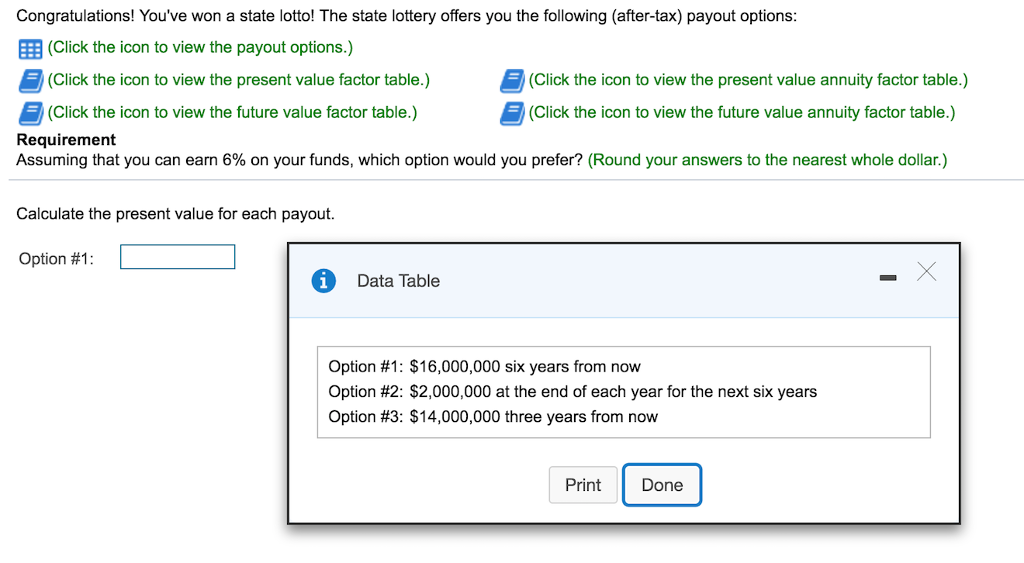

Question: Calculate the present value for each payout. Option #1: Option #2: Option #3: Congratulations! You've won a state lotto! The state lottery offers you the

Calculate the present value for each payout.

| Option #1: |

| Option #2: |

| Option #3: |

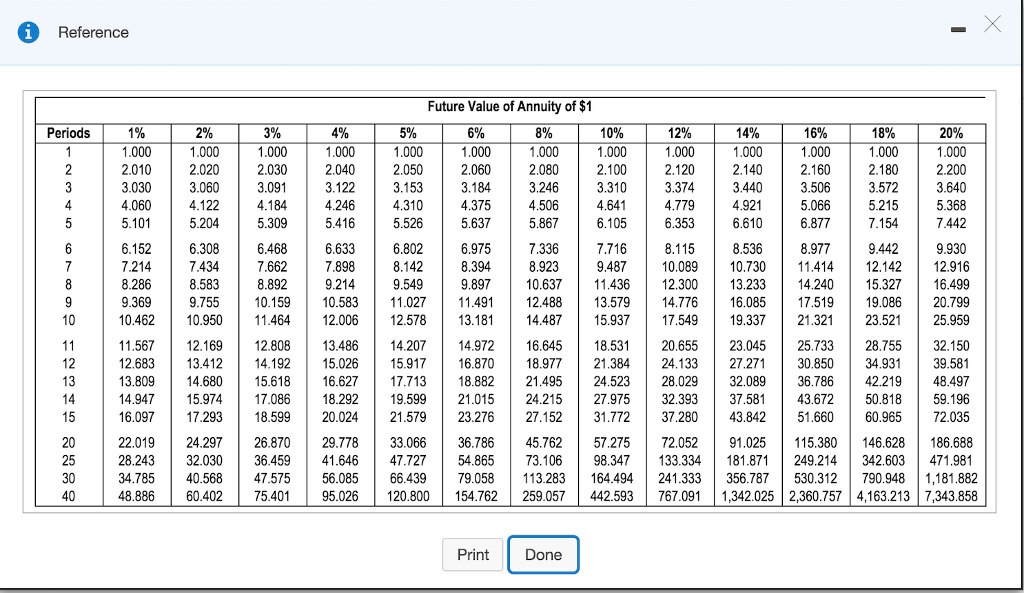

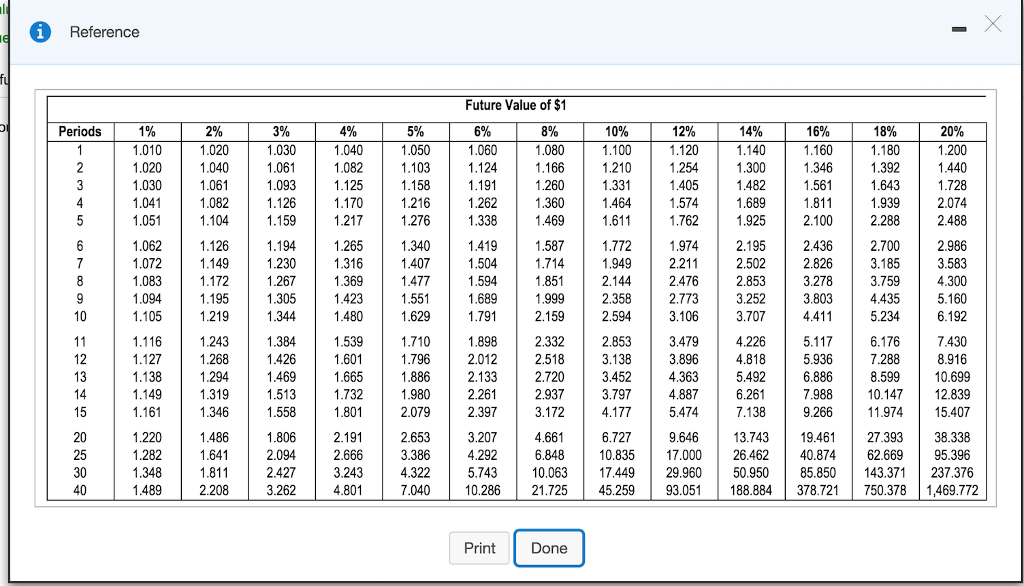

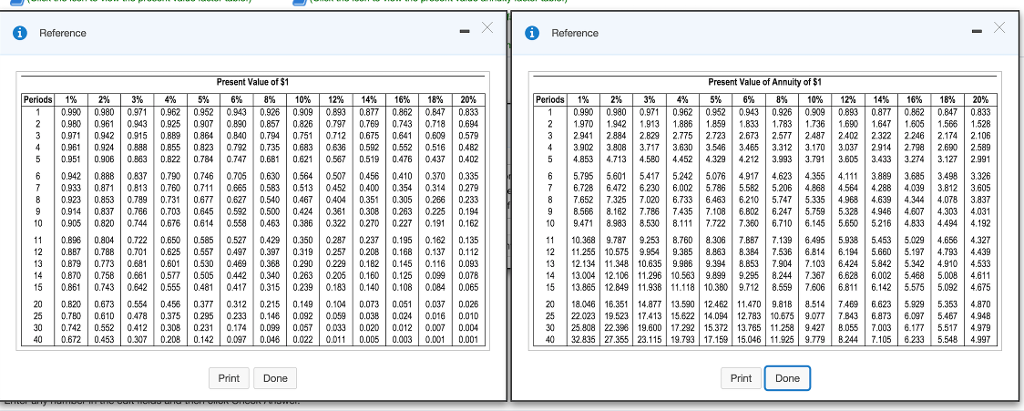

Congratulations! You've won a state lotto! The state lottery offers you the following (after-tax) payout options: EEB (Click the icon to view the payout options.) (Click the icon to view the present value factor table.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the future value factor table.) Requirement Assuming that you can earn 6% on your funds, which option would you prefer? (Round your answers to the nearest whole dollar.) (Click the icon to view the future value annuity factor table.) Calculate the present value for each payout. Option #1 : Data Table Option #1: $16,000,000 six years from now Option #2: $2,000,000 at the end of each year for the next six years Option #3: $14,000,000 three years from now PrintDone 1 Reference Future Value of Annuity of $1 3 6 9.48710.0890.730 11.414 12.1422.916 9.89710.63711.436 12.30013.233 14.240 15.327 16.499 9.75510.159 10.58311.02711.49 12.488 13.57914.776 6.085 17.5199.08620.799 10.46210.950 11.464 12.006 12.578 13.181 14.487 15.937 17.549 19.337 21.321 23.52125.959 11.56712.169 12.808 13.486 14.207 4.972 16.64518.531 20.655 23.045 25.733 28.75532.150 12.68313.412 14.192 15.02615.917 16.870 18.97721.384 24.133 27.27130.850 34.93139.581 13.80914.680 5.618 16.62717.713 18.882 21.49524.523 28.029 32.08936.786 42.219 48.497 14.94715.974 17.086 18.29219.599 21.015 24.215 27.97532.393 37.581 43.67250.81859.196 16.097 17.293 18.599 20.024 21.579 23.276 27.152 31.772 37.280 43.842 51.660 60.96572.035 22.019 24.297 26.870 29.77833.066 36.786 45.76257.275 72.052 91.025 115.380 146.628 186.688 28.24332.030 36.459 41.64647.727 54.865 73.10698.347133.334 181.871 249.214 342.603 471.981 10 14 15 25 30 3 34.78540.56847.575 56.085 66.43979.058 113.283164.494241.333 356.787530.312 790.9481,181.882 48.88660.40275.401 95.026 120.800 154.762 259.057442.593 767.091 1,342.025 2,360.757 4,163.213 7,343.858 8 997 0848 63002 9 684 33 2- 021 85 23 45 11122 23456 78 68974 39 '1 8 3 2398 47 9 5193 5 11112 23345 67811 27 62 750 %-6 6 61 11 00 36 6 7 3 1 17 3 6 8 6 IST TA 350 488 81 48284 19892 0 95 5 4-13469 15827 28421 1 22233 44567 749 6 5 2-12457 924 7 48384 1 33445 9793 3 9 012346 135 8147-7 075 114 f 01234 7891 579-6 2 17 723 69 094 69 0 1 1 2 3 45567 80123 227 222 345 2 8 66 07 01122 77890 6 02507 56930 91521 1631 3 5 2 9259 38 4791 46 96 8 |0 0 0 2345 67891 12345 20 25 30 40 Reference Present Value of Annuity of $1 Periods 1% l 2% | 3% 4% | 5% l 6% | 8% | 10% | 12% | 14% | 16% | 18% | 20% 10990 0.980 0.9710.962 0952 0.943 0.926 0.909 0893 0877 0.8620847 0.833 0.980 0.961 0.943 09250907 0890 0.857 0.826 07970.769 0.743 0.718 0.694 3 0971 0942 0915 0889 0864 0840 0.794 0.751 0712 0675 0640.609 0579 0.961 .924 | 0.388 | D.855 | 0.823 | 0.792 | 0.735 | 0.683 | 0536 | 0.592 | 0.552 | 0.516 | 0.482 0.951 0.906 0.863 0822 0.784 0.747 0.6810.621 0567 0.519 0.476 0437 0402 0942 | 0888 | 0837 0.790 0.746 0.705 0.630 | 0.564 | 0.507 | 0456 | 0410 | 0.370 0.335 0.933 0.871 0.813 0760 0711 0665 0.583 0.513 0452 0400 0.354 0.314 0.279 0923 | 0.853 | 0.789 | 0.731 | 0.677 0.627 | 0.540 | 0.467 | 0404 0.351 | 0.305 | 0.266 | 0.233 0914 | 0.837 | 0.766 | 0.703 | 0.645 0.592 | 0.500 | 0.424 | 0.361 0.308 | 0.263 | 0.225 0.194 0905 0820 0.7440.6760614 0.558 0.4630.386 0322 0270 0.227 0.1 0.162 11 | 0896 | 0.804 | 0.722 0.650 | 0.585 0.527 | 0.429 | 0.350 | 0.287 0.237 0.195 | 0.162 | 0.135 12 0.8B 0.788 0.701 0.62505570497 0.397 0.319 0257 0208 0.168 0.1370.112 13 0.879 0.773 0.681 0.601 0530 0.469 0.368 0.290 0229 0.182 0.145 0.116 0.093 14 0870 0.758 0.661 0577 0.505 04420.340 0.263 0205 0.160 0.125 0.099 0078 15 | 0.861 | 0.743 | 0.642 | 0.555 | 0481 0.417 | 0.315 | 0.239 | 0.183 | 0.140 | 0.108 | 0.084 | 0.065 20 | 0.820 | 0.673 | 0.554 | D.456 | 0.377 0.312 | 0.215 | 0.149 | 0.104 | 0.073 | 0.051 | 0.037 | 0.026 25 DTBO 0.610 0.478 D.375 02950.233 0.1480.092 O.059 0.038 0.024 0.016 0.010 30 0.742 0.552 0.412 0.3080231 0.174 0.099 0.057 0033 0.020 0.0120.007 0.004 40 0.672 0.453 0.307 0.208 0.142 0097 0.048 0.022 000.005 0.003 0.001 0.001 Periods 1% | 2% | 3% | 4% | 5% | 6% 8% | 10% | 12% | 14% | 16% | 18% | 20% 1 0.990 0980 0.9710.962 0952 0.943 0.926 0909 0893 0877 0.8620.847 0833 2 1970942 1.913 18861859 1.833 1.783 1.736 169047605156 1528 2941 | 2884 | 2.829 | 2.775 | 2.723 2.673 | 2577 | 2487 | 2402 2.322 | 2.246 | 2.174 | 2.106 3902 3808 3.717 363 3.546 3465 3.312 3.170 3037 2914 27982.690 2.589 4.853 4.713 4.580 4452 4.329 4.212 3.993 3.791 3605 3433 3.2743.127 2.991 6 5.79 5601 5417 52425076 4917 4.623 4.355 4.11 3889 3.685 3.498 3.326 7 | 6728 | 6472 | 6.230 | 6.002 | 5786 | 5.582 | 5.206 | 4368 | 4564 | 4288 | 4.009 | 3.812 | 3605 7652 7.325 7.020 6.7336463 6.210 5.74753354968 4639 4344 4.078 3.837 8.566 | 0.162 | 7.786 | 7.435 | 7.108 6.802 | 6.247 | 5.759 | 5328 | 4.946 | 4.607 4.303 | 4031 9471 8983 8.530 8.1117.722 7.380 6.710 6.145 .6505216 4.8334494 4.192 11 10.368 9.7879.2538.7608.3067887 7.139 6.4959385453 50294.6564.327 12 11.255 10.575 9.954 9.3858.8638.384 7.5366.814 6.194 5.6605.197 4.793 4.439 13 12134 11.348 10.635 9.966 9.394 8.B53 7.904 7.103 6424 5842 5.342 4910 4533 14 13004 12.106 11.296 10563 9.899 9.295 8.244 7.367 6628 6.002 5468 5.008 4611 15 13.865 12.849 11.938 11.118 10.380 9.712 8.559 7606 6811 6.142 5575 5.092 4675 18.046| 16.351 | 14.877|13.580| 12.462 11.470| 981B | 8514 | 7469 | 6623 | 5, 5.353 | 4870 25 22.023 19.523 17.413 15.822 14.09412.783 10.675 9.077 7843 6.873 6.097 5.467 4.948 30 25.808| 22.396| 19.600 | 17.292| 15.372| 13.785| 11.258| g-427 | B.055 7.003 | 6.177 | 5.517 | 4.979 40 |32835| 27.355| 23.115 | 19.793| 17.159 | 15.046| 11.925| g779 | B244 | 7.105 | 6.233 | 5.548 | 4.997

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts