Question: calculate the question below option a and cd as in the example 218 will pay ( $ 700 ) per share in fotation costs a.

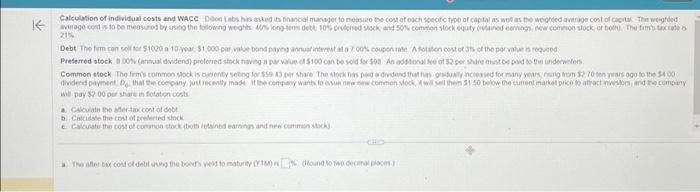

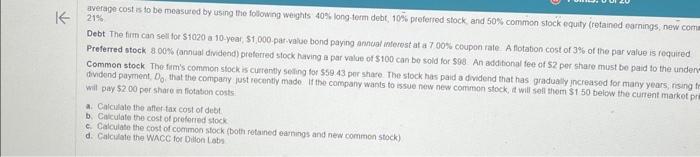

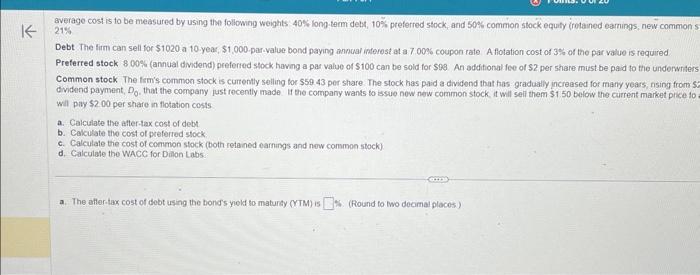

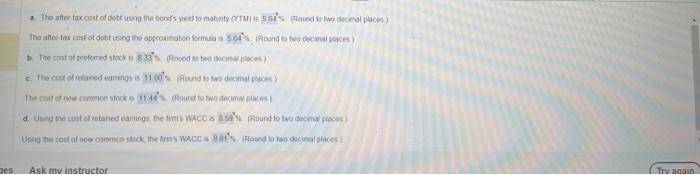

218 will pay \\( \\$ 700 \\) per share in fotation costs a. Civiale the mertax cont of debt b. Caicidale the cost of inelerind stock Thts \40 long-term debt, \10 preferred stock, and \50 common stock equity (retained earnings, new common stock, or both). The firm's tax rate is lue bond paying annual interest at a \7.00 coupon rate. A flotation cost of \3 of the par value is required having a par value of \\( \\$ 100 \\) can be sold for \\( \\$ 98 \\). An additional fee of \\( \\$ 2 \\) per share must be paid to the underwnters. ing for \\( \\$ 59.43 \\) per share. The stock has paid a dividend that has gradually increased for many years, rising from \\( \\$ 2.70 \\) ten years ago to the \\( \\$ 4.00 \\) de If the company wants to issue new new common stock, it will sell them \\( \\$ 1.50 \\) below the current market price to attract investors, and the company nings and new common stock) turity (YTM) is \\%. (Round to two decimal places) averape cost \\( z \\) to be measured by using the folowng weights \40 long term debt, \10 preferred stock and \50 common stock equity (retained earnings, new com \21 Debt The firm can sell for \\( \\$ 1020 \\) a 10-year, \\$1,000-par-value bond payng annual inferest at a \700 coupon rate A flotation cost of \3 of the par value is fequired Preferred stock \8.00 (annial dividend) prefarred stock having a par value of \\( \\$ 100 \\) can bo sold for syg. An addifional fee of 52 per share must be paid to the under Common stock The firm's common stock is currantly sefing for 559.43 por shace. The stock has paid a divdend that has pradually increased for many years, fising dividend paymeat, \\( D_{0} \\), that the compary just recently mado. If the company wants to issue new new common stock, id will sell them \\( \\$ 150 \\) beicw the current market \\( p \\) wil pay \\$200 por share a fiotaten costs. a. Calcilale the after-fax cost of debt. b. Calculate the cost of preferied slock c. Calculate the cost of coemmon stock (both retained eamings and new common stock) d. Calcilate the WAcC for Dulion Labs average cost is to be measured by using the followng weights \40 long tem debt, \10 preferred stock, and \50 common stock equify (rotained earnings, new common s \21 Debt The firm can sell for \\( \\$ 1020 \\) a 10.year, \\( \\$ 1,000 \\)-par-value bond paying annual interest at a \7.00 coupon rate A flotation cost of \3 of the par value is required Preferred stock \800 (annual divifend) preferred stock having a par value or \\( \\$ 100 \\) can be sold for \\$pS. An additional fee of \\$2 per share inust be paid to the underwnters Common stock. The firm's common stock is cumently selling for \\( \\$ 59.43 \\) per share. The stock has paid a dividend that has gradually increased for many years, nsing from \\( \\$ \\) dividend payment, \\( D_{0} \\). that the company just rocently made. If the company wants to sssue now new common stock it will seli them \\( \\$ 1,50 \\) below the current market price fo wil pay \\( \\$ 2.00 \\) per share in flotation costs. a. Calculate the after-tax cost of debt b. Calculate tho cost of preferred sfock c. Calculate the cost of common stock (both retaned earnings and now common stock) d. Calculate the WACC for Dilion Labs: a. The afler-tax cost of dobt using the bond's yeld to maturty (YTM) is 6. (Round to two decinal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts