Question: Calculate the Ratios below with the given balance sheets Current Ratio Acid Test Ratio (Quick Ratio) Net Working Capital Debt to Equtity Ratio Retun on

Calculate the Ratios below with the given balance sheets

Current Ratio Acid Test Ratio (Quick Ratio) Net Working Capital Debt to Equtity Ratio Retun on Sales Ratio (ROS) Return on Equity Ratio (ROE) Return on Assets Ratio (ROA) Earnings per Share (EPS Basic) Earnings per Share (EPS Fully Diluted) Price/ Earnings Ratio (P/E) (Market Price 178 per share) EBITDA (int exp 3,200)

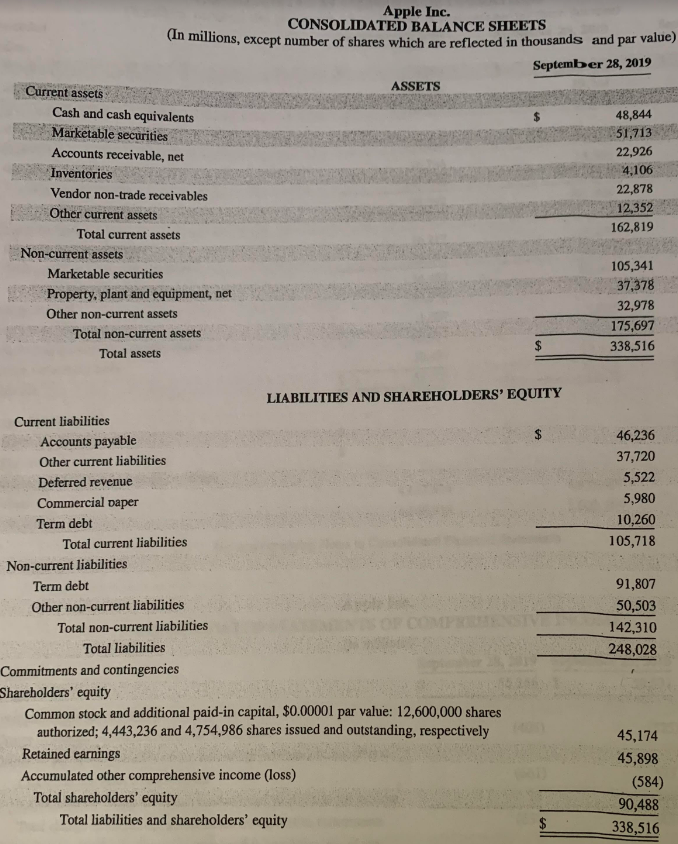

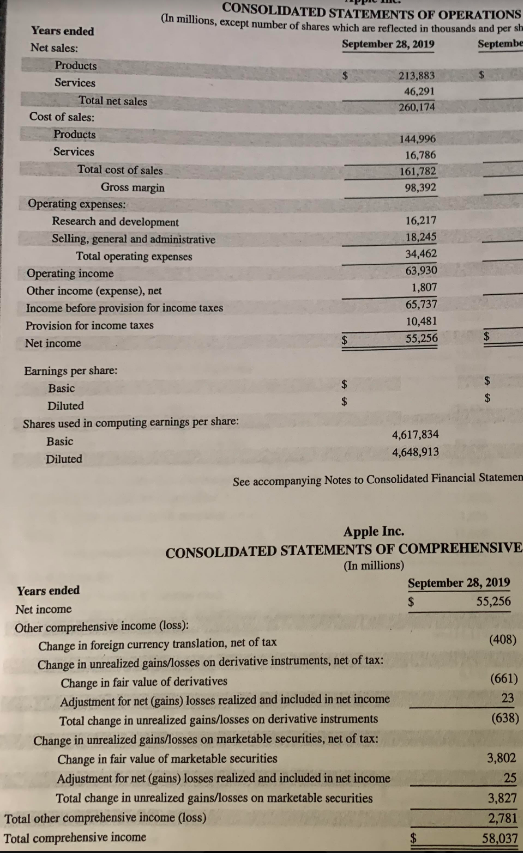

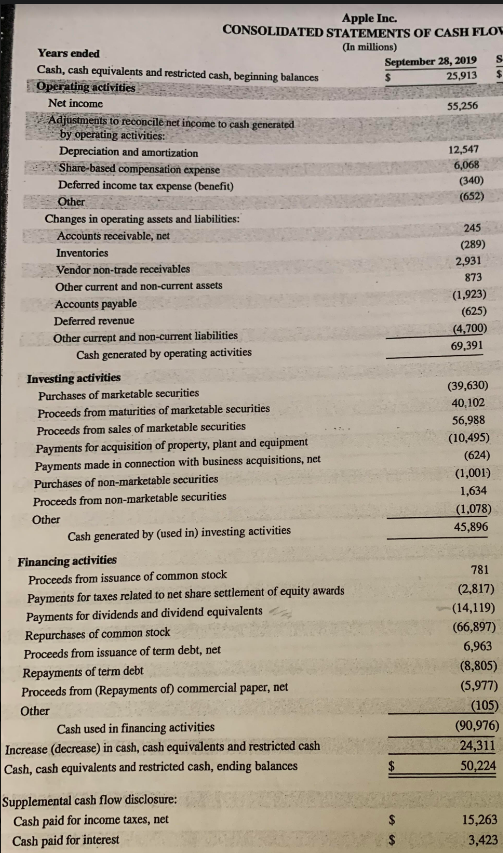

Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per sh Years ended Net sales: See accompanying Notes to Consolidated Financial Statemen Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE (In millions) Years ended Net income Other comprehensive income (loss): Change in foreign currency translation, net of tax Change in unrealized gains/losses on derivative instruments, net of tax: Change in fair value of derivatives Adjustment for net (gains) losses realized and included in net income Total change in unrealized gains/losses on derivative instruments Change in unrealized gains/losses on marketable securities, net of tax: Change in fair value of marketable securities Adjustment for net (gains) losses realized and included in net income Total change in unrealized gains/losses on marketable securities Total other comprehensive income (loss) Total comprehensive income September 28, 2019 Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOV (In millions) Years ended Cash, cash equivalents and restricted cash, beginning balances Operating activities Net income Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense (benefit) Other Changes in operating assets and liabilities: Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current liabilities Cash generated by operating activities Investing activities Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net Purchases of non-marketable securities Proceeds from non-marketable securities Other Cash generated by (used in) investing activities Financing activities Proceeds from issuance of common stock Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock Proceeds from issuance of term debt, net Repayments of term debt Proceeds from (Repayments of) commercial paper, net Other Cash used in financing activities Increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash, ending balances \begin{tabular}{l} September 28,2019 \\ \hline$25,913 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts