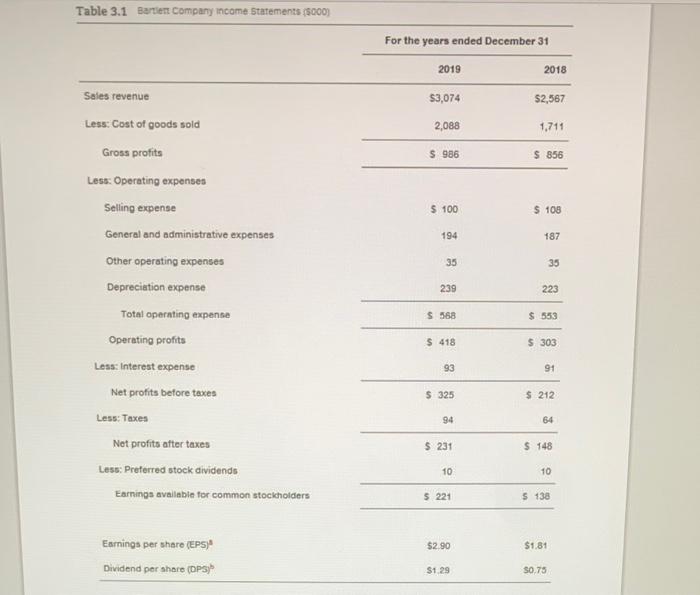

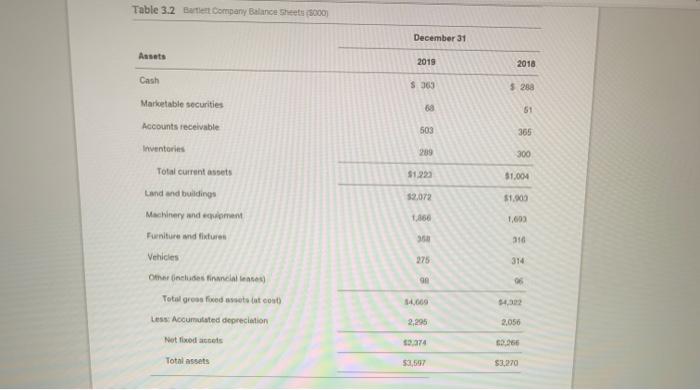

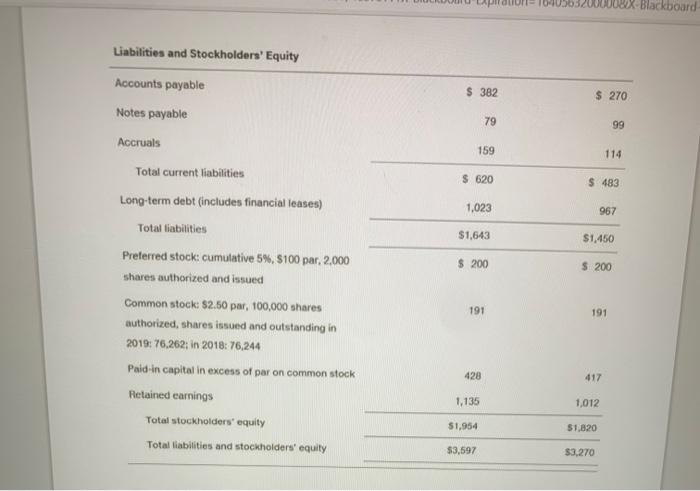

Question: CALCULATE the ratios: current ratio Quick Ratio Inventory Turnover Average age of inventory Average collection period total asset turnover debt ratio debt to equity ratio

Table 3.1 Bartent Company income Statements (5000) For the years ended December 31 2019 2018 53,074 $2,567 2,088 1,711 $ 986 $ 856 $ 100 $ 108 194 187 35 35 239 223 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses Other operating expenses Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders $ 568 $ 553 $ 418 $ 303 93 91 $ 325 $ 212 94 64 $ 231 $ 148 10 10 $ 221 $ 138 $2.90 $1.81 Earnings per share (EPS) Dividend per share (DPS)" $1.29 $0.75 Table 3.2 Brent Company Balance Sheets (5000) December 31 Assets 2019 2018 Cash S.363 $ 200 35 Marloetable securities Accounts receivable 503 365 Inventories 289 300 $1.993 51.004 $2.072 $1.000 Total current assets Land and buildings Machinery and equipment Furniture and fixtures 1860 1,603 310 275 314 Vehicles Oncludes financial aces) 90 6 Total grees for at cost $4,600 $4,302 Les Accumulated depreciation 2,295 2.056 Not fixed assets 9.374 60.966 Total assets 531.997 $3,270 Blackboard Liabilities and Stockholders' Equity $ 382 Accounts payable Notes payable $ 270 79 99 159 114 $ 620 Accruals Total current liabilities Long-term debt (includes financial leases) Total liabilities $ 483 1,023 967 $1.643 $1,450 $ 200 $ 200 191 191 Preferred stock: cumulative 5%, $100 par. 2.000 shares authorized and issued Common stock: $2.50 par, 100,000 shares authorized, shares issued and outstanding in 2018: 76,262; in 2018: 76,244 Paid-in capital in excess of per on common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 428 417 1,135 1,012 $1,954 $1,820 $3,597 $3,270

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts