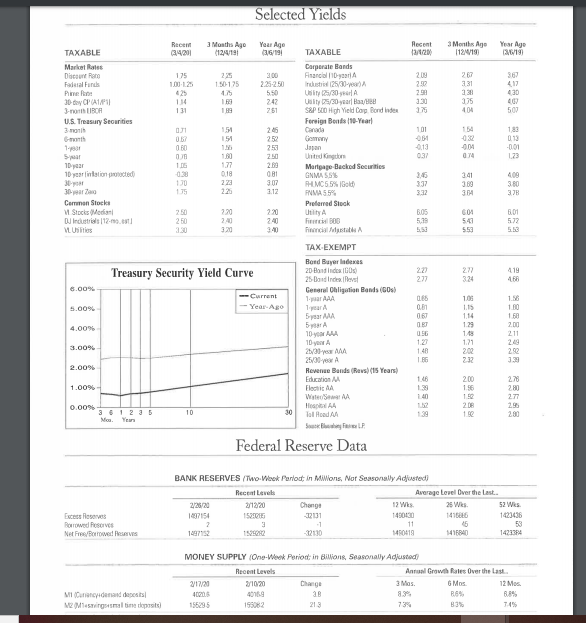

Question: Calculate the required return (k) using the capital asset pricing model to calculate the fair value based on the normal growth in earnings. Selected Yields

Calculate the required return (k) using the capital asset pricing model to calculate the fair value based on the normal growth in earnings.

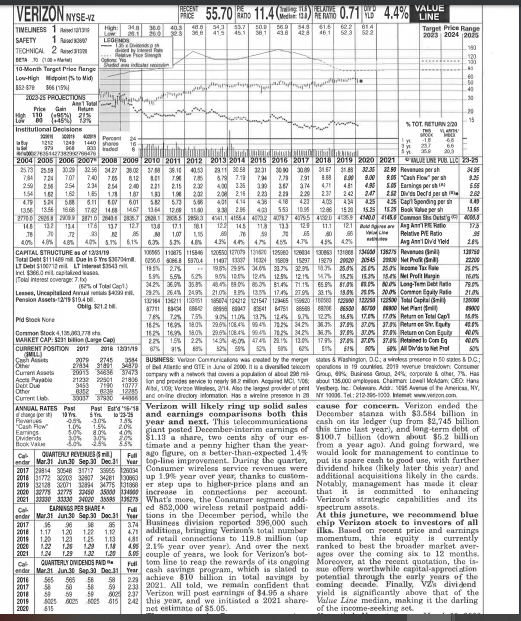

Selected Yields Recent 34201 TAXABLE 3 Months Ago 2 2019 Year Age 369 Recent 3 Months Ago 12/2012/1996/19 TAXABLE Market Riss 22250 Faisal Funds Phimbo 20 CPAP 3- U.S. Treasury Securities 3 mois Corporate Bands Financial D-yar) Trilusti 25/30-) U /30A Uity 5/30 ya S&P LED High Yield Corp Bond Index Foreign Bon 10-Year 154 Gany OB 10 yasination rected 135 United Kingdom Martpage-Backed Securities GNMUSS HMCS Gold NVA 55 Preferred Stock Utility FRA BOB Financial 3rd Carren Stock Stocks Media Industrial 12-2 314 54 m TAX EXEMPT Treasury Security Yield Curve Bond Bayer indexes 2D Bandidos ICO) 26 Dance General Ohligation Bonds (GOs) 1. AAA 8.00% 5A 4.00% 100 1D your 231-AA 25/30 year Revenue Bands (Revs) (15 Years Education Elects AA 1.00% 277 0.00% Tol Road AA Federal Reserve Data BANK RESERVES Two Week Panlod: In Millions, Nor Seasonally Ad'usted Recent levels Average level over the last 2/26/20 Change 12 Ws 26 Wis 17154 150 -22131 1490120 14100 PredsVES NA FIRMA 1497 1902 -72110 140419 416840 1423394 MONEY SUPPLY One Week Parlos in Glans Seasonally Adjusted 717/20 Recent Levels 1020 4719 Annual Growth Rales Over the last Mas GMOs 12 Mos RES B3% Mananciera dess ve Ma l in e 15529.5 213 VERIZON NYSE42 55.70 11.463) 0.71 4.4% VANTEE TINUNESS 1 WETY 1 TRONIC 2 16. urteange LOW POLECTIONS 12 9 3 TOTEUN 221 2 22 6156 we Ad GEO000 Over ons 19 counts 2013 Turn 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 UNREL 2 550 303 325 327 30 31 7724077755 8.12 2 54 254 254 20 22 215 Eringsshi 1110112181 222 223 220 Decided No 111 0601 4 0423 01 2018 stapler 136 13 HH HH 17.0 150 200 43 55 30 1 4511 457 Ch Outut RA13130 1982 1981 11 181 13 15 13 13 12 11 Bo o 10 000 PT Asti Ang Anti Did Yold CARTAL STRUCTURES 123119 W 1938751586260 1270091 0 TM 12 Per Tot 11140 Dus In Y S7 6 2566 3 58704 116 1 1590915297 18979 2020 2056 20 Not Pro 1955 2.70 W come Tax napred 196 . 9 5.4 5.5 5.25 124 125 126 Progn VIRT I NDO Llen De Ucapillow . 22% 26.48 249 21.02. 2013 17.1% 279 3815 19.0% 0 100 Corren t e 2106 Pension Assets 1219 8104 190210 190951 1 94212 121542 Captain ON 711 6854 85 84 83541 BT512668908200 500 60 N Paul Ndo 7% 72% 75% 110 120 121 120 tane Teulap 16 160 0% 29.6% 106.4% 99,4% 70% 82% 30.5 37.09 27.0437.0 Petano Sv. 400 Carnak 41 16211020110490420M M 70 euron Con Epub 100 WAKET CAP: 5211 on Lange Cap 2215 225 141414521101 272 le com CURRENT POSITION 2017 2016 10919 80 % n o N ON MIDWdsto Polo BUSINESS: Veron Construction was cd by the mergersion C D Cure ion and provides comery M in i MCI 135.000 mp Cramer Low do CEO Hans Nol : Vores , 14. Also the longest rider all Vesten O v er the Are NY and online direct i on as a wrine press N Tel: 212-35-1000 www.veron Verizon will likely ring up solid sales cause for concern. Verizon ended the and earning comparisons both this December stan with $ 584 billion in year and next. This telecommunications cash on its ledger (up from $2.765 billion giant posted December interim earnings of this time last year, and long-term debt of $1.13 a share, two cents shy of our es S100,7 Billion down bost $62 billion timate and a penny higher than the year from year . And going forward, we ago figure, on a better than expected 1.4 would look for management to continue to top-line improvement. During the quarter, put its spare cash te ooduse, with further 31712 3965 54 Consumer wireless service revenues were dividend hikee (likely later this year and up 1.9 year over year, thanks to custom-additional acquisitions likely in the cards er step up to higher price plans and an Notably, management has made it clear 2000 IN 3278 increase in connections per account that is committed to enhancing 2001 2000 W 155251925 What's more, the Consumer segment add Verizon's strategie capabilities and its LANGS HER SHARE led 852,000 wireless retail postpaid addi spectrum assets Wer 3 30 Sep 30 Dec t ions in the December period, while the At this juneture, we recommend blue 1 Husiness division reported 395.000 such chip Verizon stock to investors of all addition, bringing Ver 's total number ilks. Based on recent price and earning of retail sections to 119.8 milline up momentum, this equity is currently 2.15 year over year. Ander the next ranked to beat the broader market couple of years, we look for Veron's bo o s over the coming site 12 months mline the ndetit MonCOVCE at the recent quotation, the ap 3 Dec 31 cash savings program, which is slated to offers worthwhile capital appreciation achieve 810 Lithon in total savings by potential through the early years of the 2021 All told we remain content that coming decade Finally dividend Verion will post earnings of $4.95 a share yield s o nntly above that of the 805 2 this year, and we initiated a 2021 share Value Line median, making it the darling met estimate of $5.05. of the income-seeking se Delta BISTRARE SI RRENTERIER Selected Yields Recent 34201 TAXABLE 3 Months Ago 2 2019 Year Age 369 Recent 3 Months Ago 12/2012/1996/19 TAXABLE Market Riss 22250 Faisal Funds Phimbo 20 CPAP 3- U.S. Treasury Securities 3 mois Corporate Bands Financial D-yar) Trilusti 25/30-) U /30A Uity 5/30 ya S&P LED High Yield Corp Bond Index Foreign Bon 10-Year 154 Gany OB 10 yasination rected 135 United Kingdom Martpage-Backed Securities GNMUSS HMCS Gold NVA 55 Preferred Stock Utility FRA BOB Financial 3rd Carren Stock Stocks Media Industrial 12-2 314 54 m TAX EXEMPT Treasury Security Yield Curve Bond Bayer indexes 2D Bandidos ICO) 26 Dance General Ohligation Bonds (GOs) 1. AAA 8.00% 5A 4.00% 100 1D your 231-AA 25/30 year Revenue Bands (Revs) (15 Years Education Elects AA 1.00% 277 0.00% Tol Road AA Federal Reserve Data BANK RESERVES Two Week Panlod: In Millions, Nor Seasonally Ad'usted Recent levels Average level over the last 2/26/20 Change 12 Ws 26 Wis 17154 150 -22131 1490120 14100 PredsVES NA FIRMA 1497 1902 -72110 140419 416840 1423394 MONEY SUPPLY One Week Parlos in Glans Seasonally Adjusted 717/20 Recent Levels 1020 4719 Annual Growth Rales Over the last Mas GMOs 12 Mos RES B3% Mananciera dess ve Ma l in e 15529.5 213 VERIZON NYSE42 55.70 11.463) 0.71 4.4% VANTEE TINUNESS 1 WETY 1 TRONIC 2 16. urteange LOW POLECTIONS 12 9 3 TOTEUN 221 2 22 6156 we Ad GEO000 Over ons 19 counts 2013 Turn 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 UNREL 2 550 303 325 327 30 31 7724077755 8.12 2 54 254 254 20 22 215 Eringsshi 1110112181 222 223 220 Decided No 111 0601 4 0423 01 2018 stapler 136 13 HH HH 17.0 150 200 43 55 30 1 4511 457 Ch Outut RA13130 1982 1981 11 181 13 15 13 13 12 11 Bo o 10 000 PT Asti Ang Anti Did Yold CARTAL STRUCTURES 123119 W 1938751586260 1270091 0 TM 12 Per Tot 11140 Dus In Y S7 6 2566 3 58704 116 1 1590915297 18979 2020 2056 20 Not Pro 1955 2.70 W come Tax napred 196 . 9 5.4 5.5 5.25 124 125 126 Progn VIRT I NDO Llen De Ucapillow . 22% 26.48 249 21.02. 2013 17.1% 279 3815 19.0% 0 100 Corren t e 2106 Pension Assets 1219 8104 190210 190951 1 94212 121542 Captain ON 711 6854 85 84 83541 BT512668908200 500 60 N Paul Ndo 7% 72% 75% 110 120 121 120 tane Teulap 16 160 0% 29.6% 106.4% 99,4% 70% 82% 30.5 37.09 27.0437.0 Petano Sv. 400 Carnak 41 16211020110490420M M 70 euron Con Epub 100 WAKET CAP: 5211 on Lange Cap 2215 225 141414521101 272 le com CURRENT POSITION 2017 2016 10919 80 % n o N ON MIDWdsto Polo BUSINESS: Veron Construction was cd by the mergersion C D Cure ion and provides comery M in i MCI 135.000 mp Cramer Low do CEO Hans Nol : Vores , 14. Also the longest rider all Vesten O v er the Are NY and online direct i on as a wrine press N Tel: 212-35-1000 www.veron Verizon will likely ring up solid sales cause for concern. Verizon ended the and earning comparisons both this December stan with $ 584 billion in year and next. This telecommunications cash on its ledger (up from $2.765 billion giant posted December interim earnings of this time last year, and long-term debt of $1.13 a share, two cents shy of our es S100,7 Billion down bost $62 billion timate and a penny higher than the year from year . And going forward, we ago figure, on a better than expected 1.4 would look for management to continue to top-line improvement. During the quarter, put its spare cash te ooduse, with further 31712 3965 54 Consumer wireless service revenues were dividend hikee (likely later this year and up 1.9 year over year, thanks to custom-additional acquisitions likely in the cards er step up to higher price plans and an Notably, management has made it clear 2000 IN 3278 increase in connections per account that is committed to enhancing 2001 2000 W 155251925 What's more, the Consumer segment add Verizon's strategie capabilities and its LANGS HER SHARE led 852,000 wireless retail postpaid addi spectrum assets Wer 3 30 Sep 30 Dec t ions in the December period, while the At this juneture, we recommend blue 1 Husiness division reported 395.000 such chip Verizon stock to investors of all addition, bringing Ver 's total number ilks. Based on recent price and earning of retail sections to 119.8 milline up momentum, this equity is currently 2.15 year over year. Ander the next ranked to beat the broader market couple of years, we look for Veron's bo o s over the coming site 12 months mline the ndetit MonCOVCE at the recent quotation, the ap 3 Dec 31 cash savings program, which is slated to offers worthwhile capital appreciation achieve 810 Lithon in total savings by potential through the early years of the 2021 All told we remain content that coming decade Finally dividend Verion will post earnings of $4.95 a share yield s o nntly above that of the 805 2 this year, and we initiated a 2021 share Value Line median, making it the darling met estimate of $5.05. of the income-seeking se Delta BISTRARE SI RRENTERIER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts