Question: Calculate the return on equity ratio using the attached. Please show work. THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In millions except per

Calculate the return on equity ratio using the attached. Please show work.

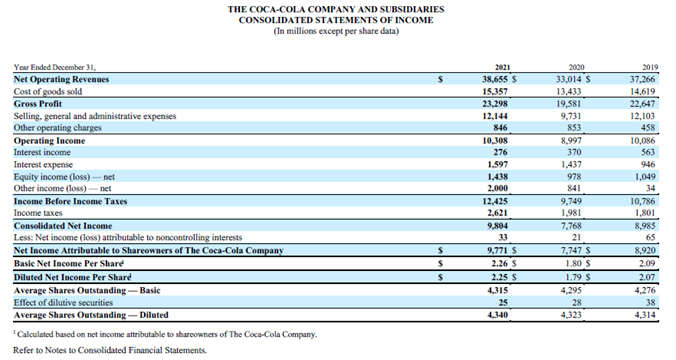

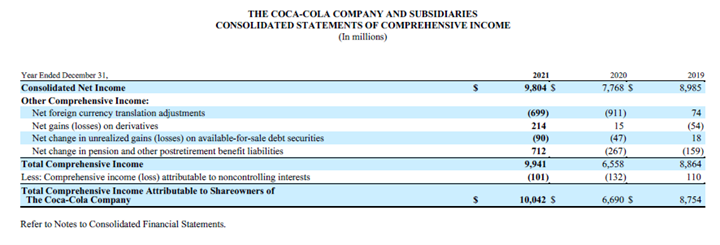

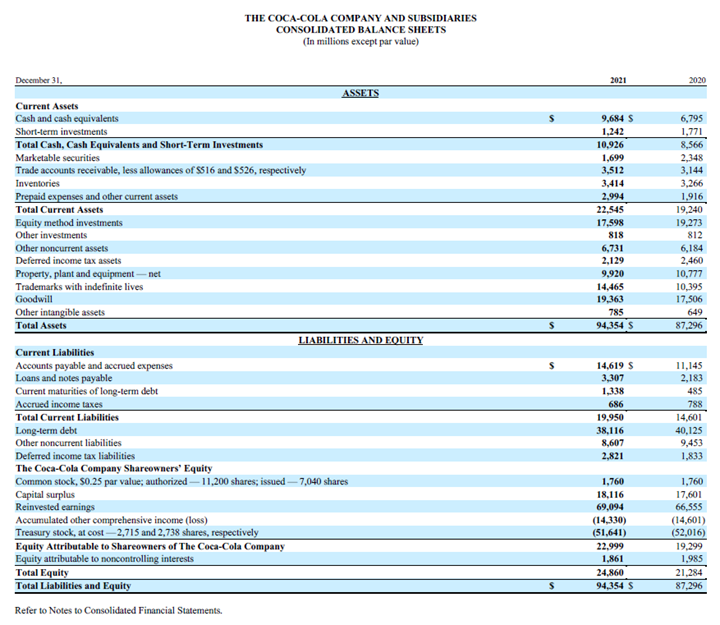

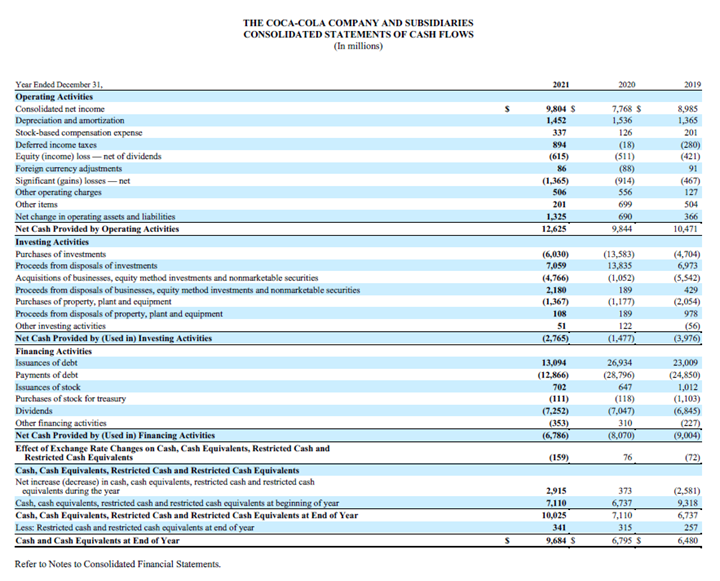

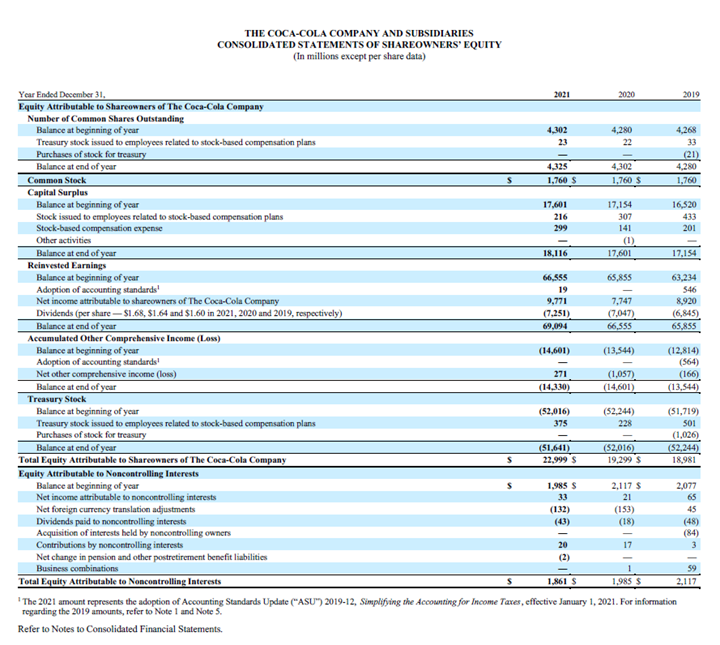

THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In millions except per share data) S Year Ended December 31, Net Operating Revenues Cost of goods sold Gross Profit Selling, general and administrative expenses Other operating charges Operating Income Interest income Interest expense Equity income (loss)-net Other income (loss)-net Income Before Income Taxes Income taxes Consolidated Net Income Less: Net income (loss) attributable to noncontrolling interests Net Income Attributable to Shareowners of The Coca-Cola Company Basic Net Income Per Share Diluted Net Income Per Share Average Shares Outstanding - Basic Effect of dilutive securities Average Shares Outstanding-Diluted 'Calculated based on net income attributable to shareowners of The Coca-Cola Company. Refer to Notes to Consolidated Financial Statements. S S $ 2021 38,655 S 15,357 23,298 12,144 846 10,308 276 1,597 1,438 2,000 12,425 2,621 9,804 33 9,771 S 2.26 S 2.25 S 4,315 25 4,340 2020 33,014 S 13,433 19,581 9,731 853 8,997 370 1,437 978 841 9,749 1,981 7,768 21 7,747 S 1.80 S 1.79 $ 4,295 28 4,323 2019 37,266 14,619 22,647 12,103 458 10,086 563 946 1,049 34 10,786 1,801 8,985 65 8,920 2.09 2.07 4,276 38 4,314 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Year Ended December 31, Consolidated Net Income Other Comprehensive Income: Net foreign currency translation adjustments Net gains (losses) on derivatives Net change in unrealized gains (losses) on available-for-sale debt securities Net change in pension and other postretirement benefit liabilities Total Comprehensive Income Less: Comprehensive income (loss) attributable to noncontrolling interests Total Comprehensive Income Attributable to Shareowners of The Coca-Cola Company Refer to Notes to Consolidated Financial Statements. 2021 9,804 S (699) 214 (90) 712 9,941 (101) 10,042 S 2020 7,768 S (911) 15 (47) (267) 6,558 (132) 6,690 S 2019 8,985 74 (54) 18 (159) 8,864 110 8,754 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In millions except par value) ASSETS December 31, Current Assets Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable, less allowances of $516 and $526, respectively Inventories Prepaid expenses and other current assets Total Current Assets Equity method investments Other investments Other noncurrent assets Deferred income tax assets Property, plant and equipment net Trademarks with indefinite lives Goodwill Other intangible assets Total Assets Current Liabilities Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other noncurrent liabilities Deferred income tax liabilities The Coca-Cola Company Shareowners' Equity Common stock, $0.25 par value; authorized 11,200 shares; issued -7,040 shares Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost-2,715 and 2,738 shares, respectively Equity Attributable to Shareowners of The Coca-Cola Company Equity attributable to noncontrolling interests Total Equity Total Liabilities and Equity Refer to Notes to Consolidated Financial Statements. LIABILITIES AND EQUITY S S 2021 9,684 S 1,242 10,926 1,699 3,512 2,994 22,545 17,598 818 6,731 2,129 9,920 14,465 19,363 785 94,354 S 14,619 S 3,307 1,338 686 19,950 38,116 8,607 2,821 1,760 18,116 69,094 (14,330) (51,641) 22,999 1,861 24,860 94,354 S 2020 6,795 1,771 8,566 2,348 3,144 3,266 1,916 19,240 19,273 812 6,184 2,460 10,777 10,395 17,506 649 87,296 11,145 2,183 485 788 14,601 40,125 9,453 1,833 1,760 17,601 66,555 (14,601) (52,016) 19,299 1,985 21,284 87,296 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Year Ended December 31, Operating Activities Consolidated net income Depreciation and amortization Stock-based compensation expense Deferred income taxes Equity (income) loss-net of dividends Foreign currency adjustments Significant (gains) losses-net Other operating charges Other items Net change in operating assets and liabilities Net Cash Provided by Operating Activities Investing Activities Purchases of investments Proceeds from disposals of investments Acquisitions of businesses, equity method investments and nonmarketable securities Proceeds from disposals of businesses, equity method investments and nonmarketable securities Purchases of property, plant and equipment Proceeds from disposals of property, plant and equipment Other investing activities Net Cash Provided by (Used in) Investing Activities Financing Activities Issuances of debt Payments of debt Issuances of stock Purchases of stock for treasury Dividends Other financing activities Net Cash Provided by (Used in) Financing Activities Effect of Exchange Rate Changes on Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents Net increase (decrease) in cash, cash equivalents, restricted cash and restricted cash equivalents during the year Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of year Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents at End of Year Less: Restricted cash and restricted cash equivalents at end of year Cash and Cash Equivalents at End of Year Refer to Notes to Consolidated Financial Statements. 2021 9,804 S 1,452 337 894 (615) 86 (1,365) 506 201 1,325 12,625 (6,030) 7,059 (4,766) 2,180 (1,367) 108 51 (2,765) 13,094 (12,866) 702 (111) (7,252) (353) (6,786) (159) 2,915 7,110 10,025 341 9,684 S 2020 7,768 $ 1,536 126 (18) (511) (8:8) (914) 556 699 690 9,844 (13,583) 13,835 (1,052) 189 (1,177) 189 122 (1,477) 26,934 (28,796) 647 (118) (7,047) 310 (8,070) 76 373 6,737 7,110 315 6,795 $ 2019 8,985 1,365 201 (280) (421) 91 (467) 127 504 366 10,471 (4,704) 6,973 (5,542) 429 (2,054) 978 (56) (3,976) 23,009 (24,850) 1,012 (1,103) (6,845) (227) (9,004) (72) (2,581) 9,318 6,737 257 6,480 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREOWNERS' EQUITY (In millions except per share data) Year Ended December 31, Equity Attributable to Shareowners of The Coca-Cola Company Number of Common Shares Outstanding Balance at beginning of year 4,268 Treasury stock issued to employees related to stock-based compensation plans 33 Purchases of stock for treasury (21) Balance at end of year 4,280 Common Stock 1,760 Capital Surplus Balance at beginning of year 17,601 16,520 Stock issued to employees related to stock-based compensation plans 216 433 Stock-based compensation expense 299 201 Other activities 18,116 17,601 17,154 Balance at end of year Reinvested Earnings Balance at beginning of year 66,555 65,855 63,234 Adoption of accounting standards 19 546 Net income attributable to shareowners of The Coca-Cola Company 9,771 7,747 8,920 (7,251) (7,047) (6,845) Dividends (per share-- $1.68, $1.64 and $1.60 in 2021, 2020 and 2019, respectively) Balance at end of year 69,094 66,555 65,855 Accumulated Other Comprehensive Income (Loss) Balance at beginning of year (14,601) (13,544) (12,814) Adoption of accounting standards (564) Net other comprehensive income (loss) 271 (1,057) (166) Balance at end of year (14,330) (14,601) (13,544) Treasury Stock Balance at beginning of year (52,244) (51,719) (52,016) 375 228 Treasury stock issued to employees related to stock-based compensation plans Purchases of stock for treasury 501 (1,026) Balance at end of year (52,244) (51,641) 22,999 S (52,016) 19,299 $ Total Equity Attributable to Shareowners of The Coca-Cola Company 18,981 Equity Attributable to Noncontrolling Interests Balance at beginning of year 2,117 $ 2,077 1,985 S 33 Net income attributable to noncontrolling interests 21 65 Net foreign currency translation adjustments (132) (153) 45 Dividends paid to noncontrolling interests (43) (18) (48) Acquisition of interests held by noncontrolling owners (84) Contributions by noncontrolling interests 17 Net change in pension and other postretirement benefit liabilities Business combinations Total Equity Attributable to Noncontrolling Interests 1,861 S 1,985 $ 2,117 The 2021 amount represents the adoption of Accounting Standards Update ("ASU") 2019-12, Simplifying the Accounting for Income Taxes, effective January 1, 2021. For information regarding the 2019 amounts, refer to Note 1 and Note 5. Refer to Notes to Consolidated Financial Statements. S S S 2021 4,302 23 4,325 1,760 S 2020 4,280 22 4,302 1,760 $ 17,154 307 141 (1) 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts