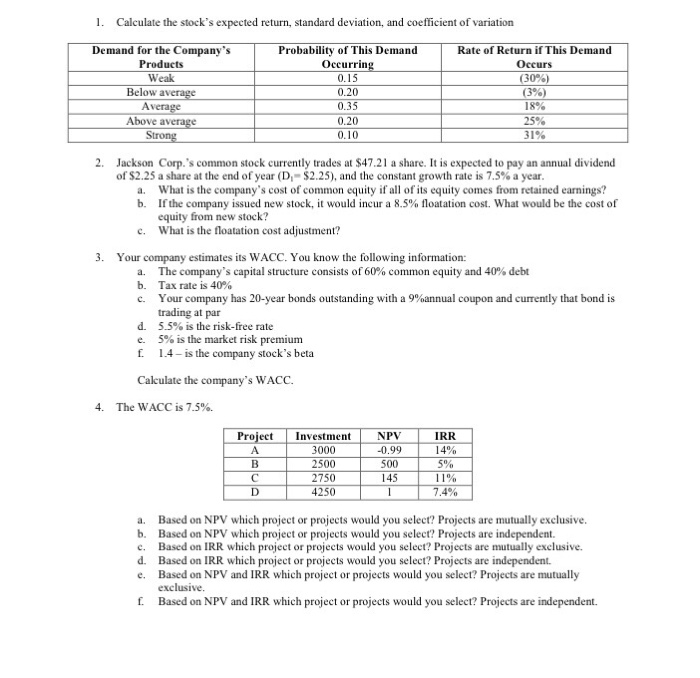

Question: Calculate the stock's expected return, standard deviation, and coefficient of variation Jackson Corp.'s common stock currently trades at $47.21 a share. It is expended to

Calculate the stock's expected return, standard deviation, and coefficient of variation Jackson Corp.'s common stock currently trades at $47.21 a share. It is expended to pay an j:hhi.iI dividend of $2.25 a share at the end of year (I), - S2.25). and the constant growth rate in 7.5 % a year. What is the company's cost of common equity if all of its equity comes from retained earnings? If the company issued new stock, it would incur a K.5 % floatation cost. What would be the cost of equity from new stock? c. Whjt is the floatation cost adjustment? Your company estimates its WACC. You know the following information: a. The company's capital structure consists of 60 % common equity and 40 % debt Tax rate is 40 % Your company has 20-year bonds outstanding with a 9 % annual coupon and currently that bond is trading at par 5.5 % is the risk-free rate 5 % is the market risk premium 1.4 - is the company stock's beta car -Plate the company's WACC. Based on NPV which project or projects would you select? Projects are mutually exclusive. Based on NPV which project or projects would you select? Projects are independent Based on IRR which project or projects would you select? Projects are mutually exclusive. Based on IRR which project or projects would you select? Projects are independent. Based on NPV and IRR which project or projects would you select? Projects are mutually exclusive. Based on NPV and IRR which project or projects would you select? Projects are independent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts