Question: Calculate the total variable costs per active wear unit. (Hint - Exhibit 9 provides Direct and Indirect variable costs. See page 7 of the case

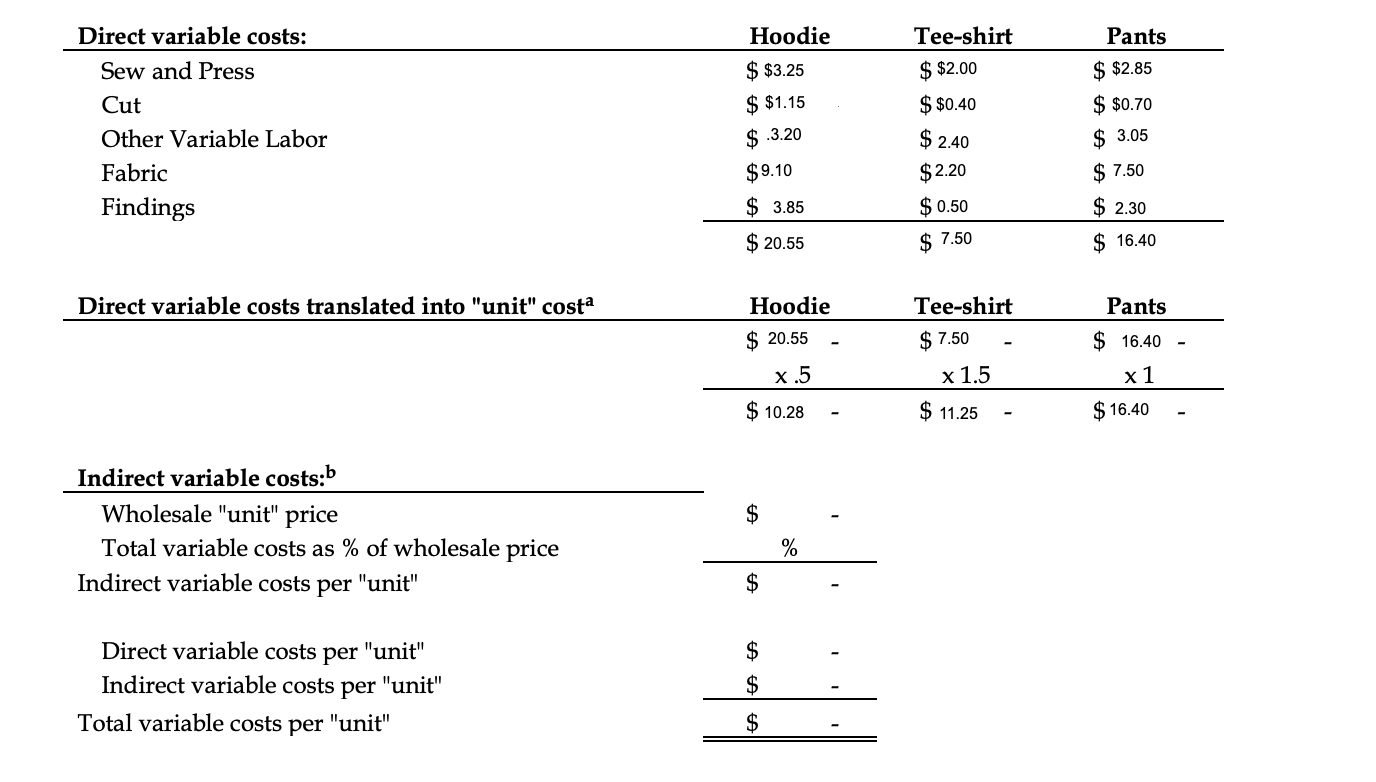

Calculate the total variable costs per active wear unit. (Hint - Exhibit 9 provides Direct and Indirect variable costs. See page 7 of the case for the indirect variable costs. These have to be added per Exhibit 9). The wholesale unit price is $95.

A facility to manufacture the pants could be rented for $500,000 annually with equipment costing about $2 million and plant start-up costs estimated at $1.2 million. Yearly overhead, excluding rent, was projected to be $3 million. Hoodies and tee-shirts could be produced at a plant that could be rented for the same annual amount as the pants plant. Equipment would cost $2.5 million, start-up costs would be another $2.5 million, and yearly overhead, excluding rent, would be $3.5 million. Launch costs, which included a national advertising and public relations campaign, were estimated at $2 million. New fixtures for company-owned stores carrying the active-wear line would run $50,000 per store. All launch, fixture, plant start-up, and equipment costs would be depreciated over a five-year period. Allen had also run some numbers on variable costs. Direct labor of sewing, pressing, and cutting had to be considered. Raw material costs were broken out into fabric and findings (e.g., buttons, zippers, and thread). Allen's estimates are summarized in Exhibit 8. Allen projected working capital requirements at 3% of wholesale prices and sales commissions at 4%. She expected carrying costs for inventory to be 1% of wholesale prices. Other expenses that Allen estimated were bad debt at .7% of wholesale prices, transportation at .24% and order processing/miscellaneous at .15%. Vigor would be able to leverage Harrington's existing corporate support functions (e.g., IT, HR, Legal, Finance, etc.) to run the new business, but Vigor would have to hire a general manager, merchant, planning manager, and two design staff members who were dedicated to the new product line. These management salaries and support allocations were estimated at $1 million per year. \begin{tabular}{l} Direct varia \\ \hline Sew and P \\ Cut \\ Other Var \\ Fabric \\ Findings \end{tabular} \begin{tabular}{lrrr} Direct variable costs translated into "unit" cost & Hoodie & Tee-shirt & Pants \\ \hline & $20.55 & $7.50 & $16.40 \\ 1 \\ \cline { 2 - 4 } & a.5 \\ \hline$10.28 & $11.25 & $16.40 \end{tabular} Indirect variable costs: b Wholesale "unit" price Total variable costs as \% of wholesale price Indirect variable costs per "unit" \begin{tabular}{ccc} $ & & \\ \hline% & \\ \hline$ & \end{tabular} Direct variable costs per "unit" Indirect variable costs per "unit" Total variable costs per "unit" \begin{tabular}{ll} $ & \\ $ & \\ \hline \hline$ & \\ \hline \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts