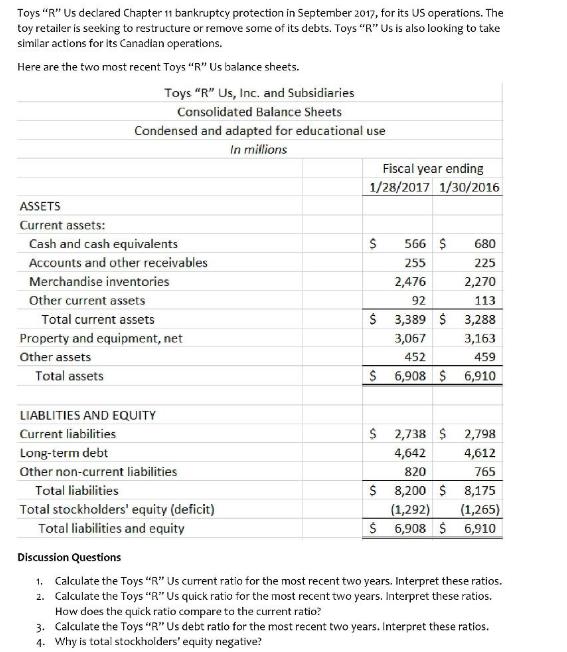

Toys R Us declared Chapter 11 bankruptcy protection in September 2017, for its US operations. The...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

Toys "R" Us declared Chapter 11 bankruptcy protection in September 2017, for its US operations. The toy retailer is seeking to restructure or remove some of its debts. Toys "R" Us is also looking to take similar actions for its Canadlan operations. Here are the two most recent Toys "R" Us balance sheets. Toys "R" Us, Inc. and Subsidiaries Consolidated Balance Sheets Condensed and adapted for educational use In millions Fiscal year ending 1/28/2017 1/30/2016 ASSETS Current assets: Cash and cash equivalents 566 $ 680 Accounts and other receivables 255 225 Merchandise inventories 2,476 2,270 Other current assets 92 113 Total current assets $ 3,389 $ 3,288 Property and equipment, net 3,067 3,163 Other assets 452 459 Total assets $ 6,908 $ 6,910 LIABLITIES AND EQUITY $ 2,738 $ 2,798 4,612 Current liabilities Long-term debt 4,642 Other non-current liabilities 820 765 $ 8,200 $ 8,175 (1,292) (1,265) $ 6,908 $ 6,910 Total liabilities Total stockholders' equity (deficit) Total liabilities and equity Discussion Questions 1, Calculate the Toys “R" Us current ratio for the most recent two years. Interpret these ratios. 2. Calculate the Toys "R" Us quick ratio for the most recent two years. Interpret these ratios. How does the quick ratio compare to the current ratio? 3. Calculate the Toys "R" Us debt ratio for the most recent two years. Interpret these ratios. 4. Why is total stockholders' equity negative? Toys "R" Us declared Chapter 11 bankruptcy protection in September 2017, for its US operations. The toy retailer is seeking to restructure or remove some of its debts. Toys "R" Us is also looking to take similar actions for its Canadlan operations. Here are the two most recent Toys "R" Us balance sheets. Toys "R" Us, Inc. and Subsidiaries Consolidated Balance Sheets Condensed and adapted for educational use In millions Fiscal year ending 1/28/2017 1/30/2016 ASSETS Current assets: Cash and cash equivalents 566 $ 680 Accounts and other receivables 255 225 Merchandise inventories 2,476 2,270 Other current assets 92 113 Total current assets $ 3,389 $ 3,288 Property and equipment, net 3,067 3,163 Other assets 452 459 Total assets $ 6,908 $ 6,910 LIABLITIES AND EQUITY $ 2,738 $ 2,798 4,612 Current liabilities Long-term debt 4,642 Other non-current liabilities 820 765 $ 8,200 $ 8,175 (1,292) (1,265) $ 6,908 $ 6,910 Total liabilities Total stockholders' equity (deficit) Total liabilities and equity Discussion Questions 1, Calculate the Toys “R" Us current ratio for the most recent two years. Interpret these ratios. 2. Calculate the Toys "R" Us quick ratio for the most recent two years. Interpret these ratios. How does the quick ratio compare to the current ratio? 3. Calculate the Toys "R" Us debt ratio for the most recent two years. Interpret these ratios. 4. Why is total stockholders' equity negative?

Expert Answer:

Answer rating: 100% (QA)

1 Calculation of current ratio for the most recent two years and interpretation Current ratio Current assets Current liabilities Year ended 1282017 Ye... View the full answer

Related Book For

Statistics for Managers Using Microsoft Excel

ISBN: 978-0133130805

7th edition

Authors: David M. Levine, David F. Stephan, Kathryn A. Szabat

Posted Date:

Students also viewed these finance questions

-

What is total stockholders equity for Sportplace, Inc.? a. $709,900 b. $704,200 c. $638,000 d. $715,600 e. None of the above These account balances at December 31 relate to Sportplace, Inc.: $ 51,700...

-

The data in Toys R Us are quarterly revenues (in $millions) for Toys R Us from 1996-Q1 through 2012-Q2. (Data extracted from Standard & Poor's Stock Reports, November 1995, November 1998, and April...

-

How does a companys current ratio differ from its quick ratio?

-

When are objects on the periphery of your vision most noticeable?

-

Explain why research is important in accounting. Discuss the research process.

-

A CPA firm has numerous partners, all of whom work out of the firm's sole office in New York City. Jeannie is the lead attest partner on the audit of Bell Bank, a small financial institution located...

-

What is the difference between Rayleigh's method and the Rayleigh-Ritz method?

-

Zanellas Smart Shawls, Inc., is a small business that Zanella developed while in college. She began hand-knitting shawls for her dorm friends to wear while studying. As demand grew, she hired some...

-

Graph one period of the function y = 3 tan (4x). Please, use the graph paper provided to do this. In order to receive credit, you must show work for: a) finding the period. b) finding the asymptotes...

-

John Pinot is the marketing manager who is heading up the magazine promotion for the TZ Advantage tennis racquets. John already worked with a graphic artist and copy editor to produce the full-page...

-

Consider the images of a jumping flea. What-0.4 -1.2 First movement of hind legs -0.2 -1.0 Oms Take-off form(s) of mechanical energy does the flea have during each of the pictured time points (at t =...

-

Anna's preferences can be represented by the utility function with marginal rate of substitution MRS(x,y) = 3x+4 2y For each of the given parameter values below, determine whether the listed bundle...

-

A proton enters a region of uniform electric field of magnitude 7 9 . 1 N / C with an initial velocity of 2 0 . 1 km / s directed perpendicularly to the electric field. What is the speed of the...

-

A partner of a business receiving the income described below files federal income taxes as a single taxpayer, perform the following: a . Calculate the tax liability, after - tax earnings, marginal...

-

Suppose that $3200 is borrowed for five years at an interest rate of 8.5% per year, compounded continuously . Find the amount owed, assuming no payments are made until the end. Do not round any...

-

A report published in the Centers for Disease Control andPreventions Morbidity and Mortality Weekly Report(MMWR46:11891191, 1997) illustrated many important features ofstaphylococcal food poisoning....

-

k. Jingle Bells' bonds are being sold for $980.80, and their coupon rate is 6%, with annual payments. If the maturity of those bonds is in exactly 48 semesters from now, and the face value of each...

-

The purpose of this case is to come up with a contingency plan[s] in order to sustain the program Move With Me, a program that serves thousands of community members throughout Lower Manhattan. The...

-

The quality control director for a clothing manufacturer wants to study the effect of operators and machines on the breaking strength (in pounds) of wool serge material. A batch of the material is...

-

You predicted the value of a baseball franchise, based on current revenue. The data are stored in BBRevenue2012. a. Construct a 95% confidence interval estimate of the mean value of all baseball...

-

The population mean waiting time to check out of a supermarket has been 10.73 minutes. Recently, in an effort to reduce the waiting time, the supermarket has experimented with a system in which there...

-

Find a single equivalent damping constant for the following cases: a. When three dampers are parallel. b. When three dampers are in series. c. When three dampers are connected to a rigid bar (Fig....

-

Develop an expression for the damping constant of the rotational damper shown in Fig. 1.105 in terms of \(D, d, l, h, \omega\), and \(\mu\), where \(\omega\) denotes the constant angular velocity of...

-

Consider a system of two dampers, with damping constants \(c_{1}\) and \(c_{2}\), arranged in parallel as shown in Fig. 1.104. The rigid bar to which the two dampers are connected remains horizontal...

Study smarter with the SolutionInn App