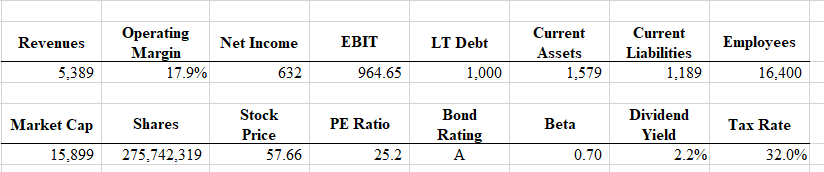

Question: Calculate the WACC for 2007 using the below assumptions. Please show all work/formulas on how you got to the WACC. Revenues Net Income EBIT LT

Calculate the WACC for 2007 using the below assumptions. Please show all work/formulas on how you got to the WACC.

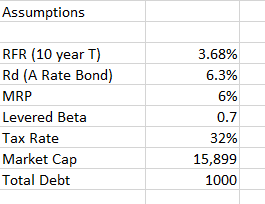

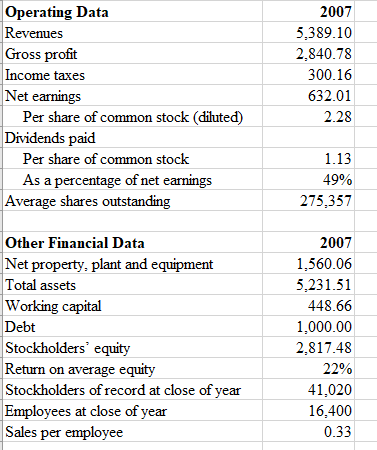

Revenues Net Income EBIT LT Debt Employees Operating Margin 17.9% Current Assets 1,579 Current Liabilities 1,189 5,389 632 964.65 1,000 16,400 Shares PE Ratio Beta Tax Rate Market Cap 15,899 Stock Price 57.66 Bond Rating A Dividend Yield 2.2% 275,742,319 25.2 0.70 32.0% Assumptions 3.68% 6.3% 6% RFR (10 year) Rd (A Rate Bond) MRP Levered Beta Tax Rate Market Cap Total Debt 0.7 32% 15,899 1000 Operating Data Revenues Gross profit Income taxes Net earnings Per share of common stock (diluted) Dividends paid Per share of common stock As a percentage of net earnings Average shares outstanding 2007 5,389.10 2.840.78 300.16 632.01 2.28 1.13 49% 275,357 Other Financial Data Net property, plant and equipment Total assets Working capital Debt Stockholders' equity Return on average equity Stockholders of record at close of year Employees at close of year Sales per employee 2007 1,560.06 5,231.51 448.66 1,000.00 2.817.48 22% 41,020 16,400 0.33 Revenues Net Income EBIT LT Debt Employees Operating Margin 17.9% Current Assets 1,579 Current Liabilities 1,189 5,389 632 964.65 1,000 16,400 Shares PE Ratio Beta Tax Rate Market Cap 15,899 Stock Price 57.66 Bond Rating A Dividend Yield 2.2% 275,742,319 25.2 0.70 32.0% Assumptions 3.68% 6.3% 6% RFR (10 year) Rd (A Rate Bond) MRP Levered Beta Tax Rate Market Cap Total Debt 0.7 32% 15,899 1000 Operating Data Revenues Gross profit Income taxes Net earnings Per share of common stock (diluted) Dividends paid Per share of common stock As a percentage of net earnings Average shares outstanding 2007 5,389.10 2.840.78 300.16 632.01 2.28 1.13 49% 275,357 Other Financial Data Net property, plant and equipment Total assets Working capital Debt Stockholders' equity Return on average equity Stockholders of record at close of year Employees at close of year Sales per employee 2007 1,560.06 5,231.51 448.66 1,000.00 2.817.48 22% 41,020 16,400 0.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts