Question: Calculate using formula (Not Excel): Your board has a relatively basic understanding of diversification and are looking to invest a portion of the company's profits

Calculate using formula (Not Excel):

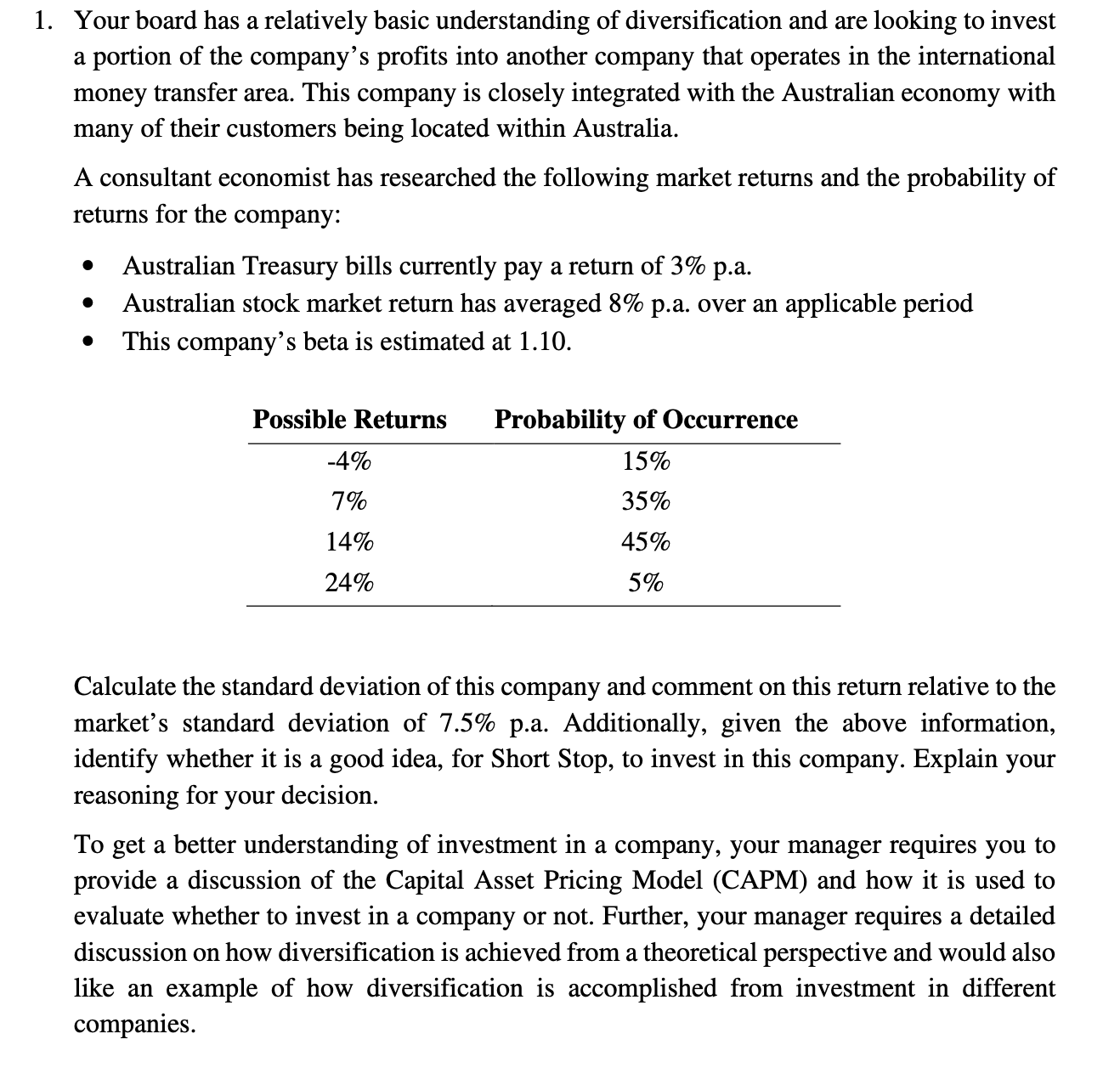

Your board has a relatively basic understanding of diversification and are looking to invest a portion of the company's profits into another company that operates in the international money transfer area. This company is closely integrated with the Australian economy with many of their customers being located within Australia. A consultant economist has researched the following market returns and the probability of returns for the company: - Australian Treasury bills currently pay a return of 3% p.a. - Australian stock market return has averaged 8% p.a. over an applicable period - This company's beta is estimated at 1.10 . Calculate the standard deviation of this company and comment on this return relative to the market's standard deviation of 7.5% p.a. Additionally, given the above information, identify whether it is a good idea, for Short Stop, to invest in this company. Explain your reasoning for your decision. To get a better understanding of investment in a company, your manager requires you to provide a discussion of the Capital Asset Pricing Model (CAPM) and how it is used to evaluate whether to invest in a company or not. Further, your manager requires a detailed discussion on how diversification is achieved from a theoretical perspective and would also like an example of how diversification is accomplished from investment in different companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts