Question: Calculated Constructions Ltd has the following information available in relation to mutually exclusive projects A and B. Year 0 1 Cashflows Project A Project B

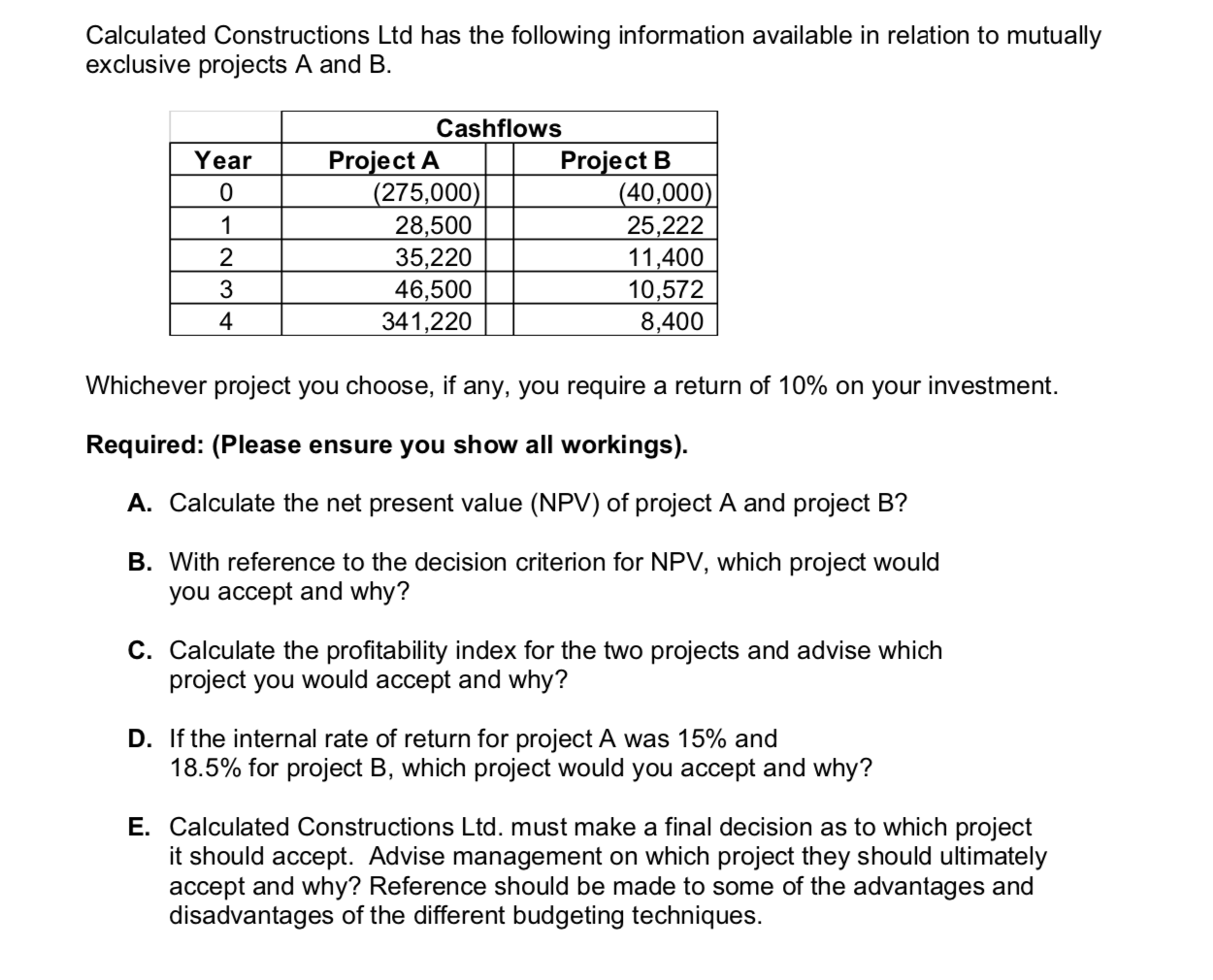

Calculated Constructions Ltd has the following information available in relation to mutually exclusive projects A and B. Year 0 1 Cashflows Project A Project B (275,000) (40,000) 28,500 25,222 35,220 11,400 46,500 10,572 341,220 8,400 2 3 4 Whichever project you choose, if any, you require a return of 10% on your investment. Required: (Please ensure you show all workings). A. Calculate the net present value (NPV) of project A and project B? B. With reference to the decision criterion for NPV, which project would you accept and why? C. Calculate the profitability index for the two projects and advise which project you would accept and why? D. If the internal rate of return for project A was 15% and 18.5% for project B, which project would you accept and why? E. Calculated Constructions Ltd. must make a final decision as to which project it should accept. Advise management on which project they should ultimately accept and why? Reference should be made to some of the advantages and disadvantages of the different budgeting techniques

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts