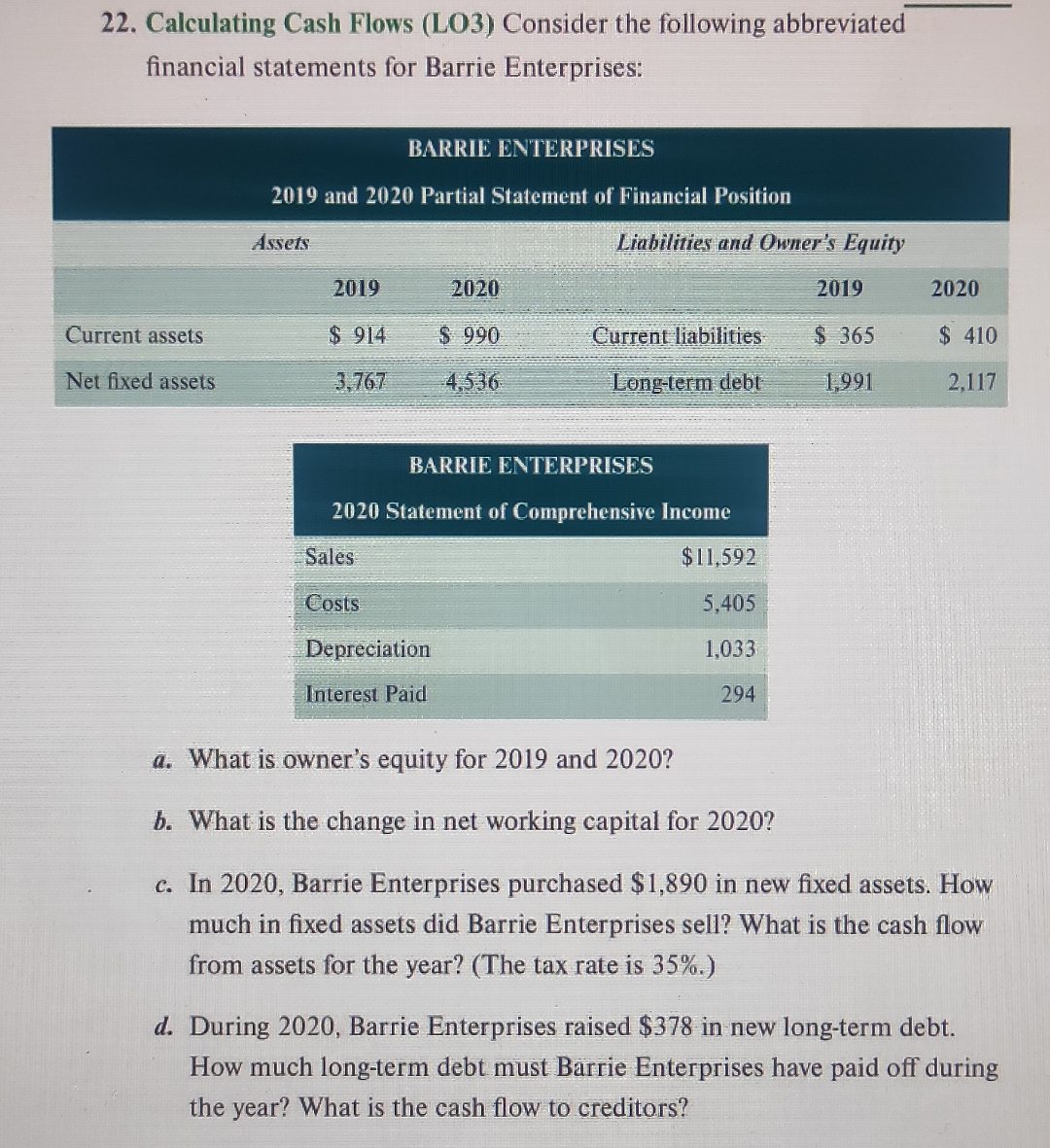

Question: Calculating Cash Flows ( LO 3 ) Consider the following abbreviated financial statements for Barrie Enterprises: BARRIE ENTERPRISES 2 0 1 9 and 2 0

Calculating Cash Flows LO Consider the following abbreviated

financial statements for Barrie Enterprises:

BARRIE ENTERPRISES

and Partial Statement of Financial Position

a What is owner's equity for and

b What is the change in net working capital for

c In Barrie Enterprises purchased $ in new fixed assets. How

much in fixed assets did Barrie Enterprises sell? What is the cash flow

from assets for the year? The tax rate is

d During Barrie Enterprises raised $ in new longterm debt.

How much longterm debt must Barrie Enterprises have paid off during

the year? What is the cash flow to creditors?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock