Question: Calculating CLV for Recurring Relationship 1. Shields Communications, a wireless communications provider based in Michigan, wants to determine CLV of their subscribers. A summary of

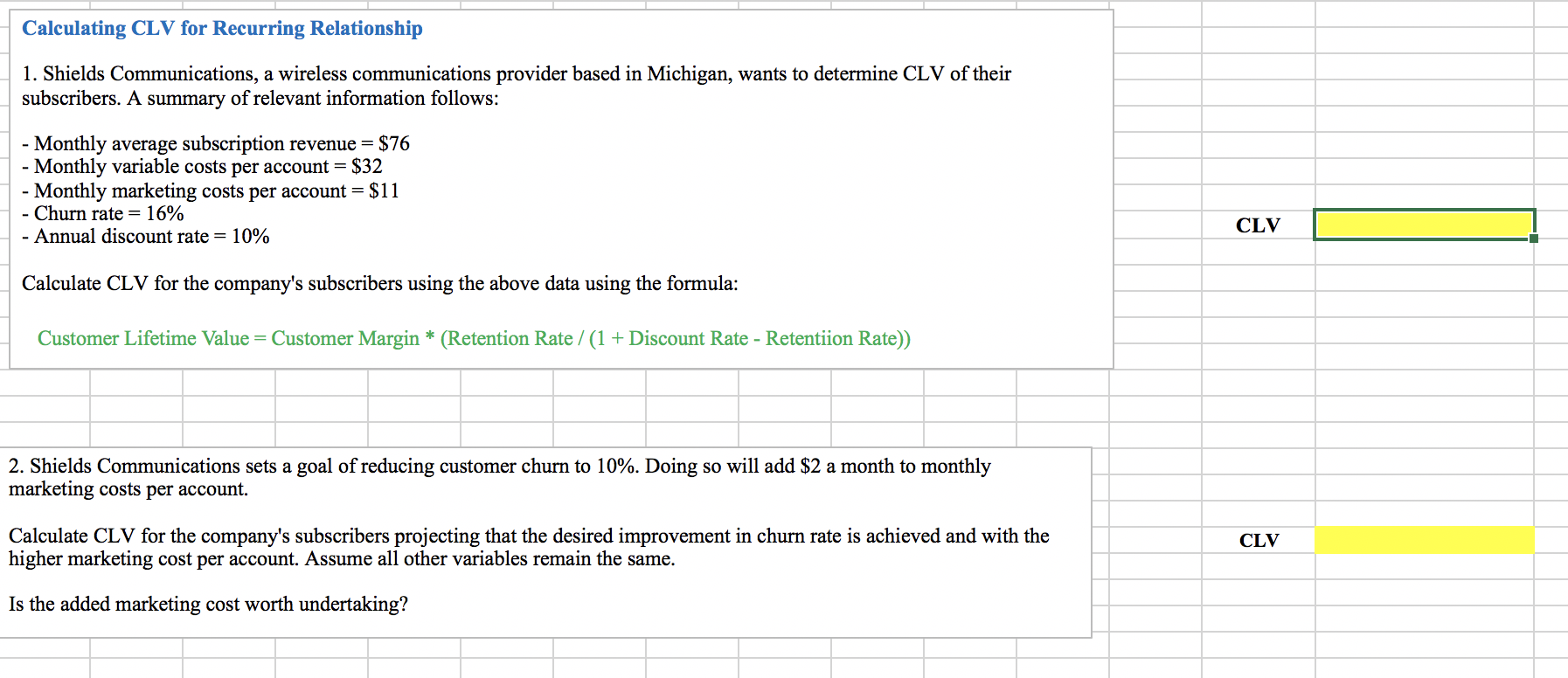

Calculating CLV for Recurring Relationship 1. Shields Communications, a wireless communications provider based in Michigan, wants to determine CLV of their subscribers. A summary of relevant information follows: - Monthly average subscription revenue = $76 - Monthly variable costs per account = $32 - Monthly marketing costs per account = $11 - Churn rate = 16% - Annual discount rate = 10% CLV Calculate CLV for the company's subscribers using the above data using the formula: Customer Lifetime Value = Customer Margin * (Retention Rate /(1+ Discount Rate - Retentiion Rate)) 2. Shields Communications sets a goal of reducing customer churn to 10%. Doing so will add $2 a month to monthly marketing costs per account. CLV Calculate CLV for the company's subscribers projecting that the desired improvement in churn rate is achieved and with the higher marketing cost per account. Assume all other variables remain the same. Is the added marketing cost worth undertaking? Calculating CLV for Recurring Relationship 1. Shields Communications, a wireless communications provider based in Michigan, wants to determine CLV of their subscribers. A summary of relevant information follows: - Monthly average subscription revenue = $76 - Monthly variable costs per account = $32 - Monthly marketing costs per account = $11 - Churn rate = 16% - Annual discount rate = 10% CLV Calculate CLV for the company's subscribers using the above data using the formula: Customer Lifetime Value = Customer Margin * (Retention Rate /(1+ Discount Rate - Retentiion Rate)) 2. Shields Communications sets a goal of reducing customer churn to 10%. Doing so will add $2 a month to monthly marketing costs per account. CLV Calculate CLV for the company's subscribers projecting that the desired improvement in churn rate is achieved and with the higher marketing cost per account. Assume all other variables remain the same. Is the added marketing cost worth undertaking

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts