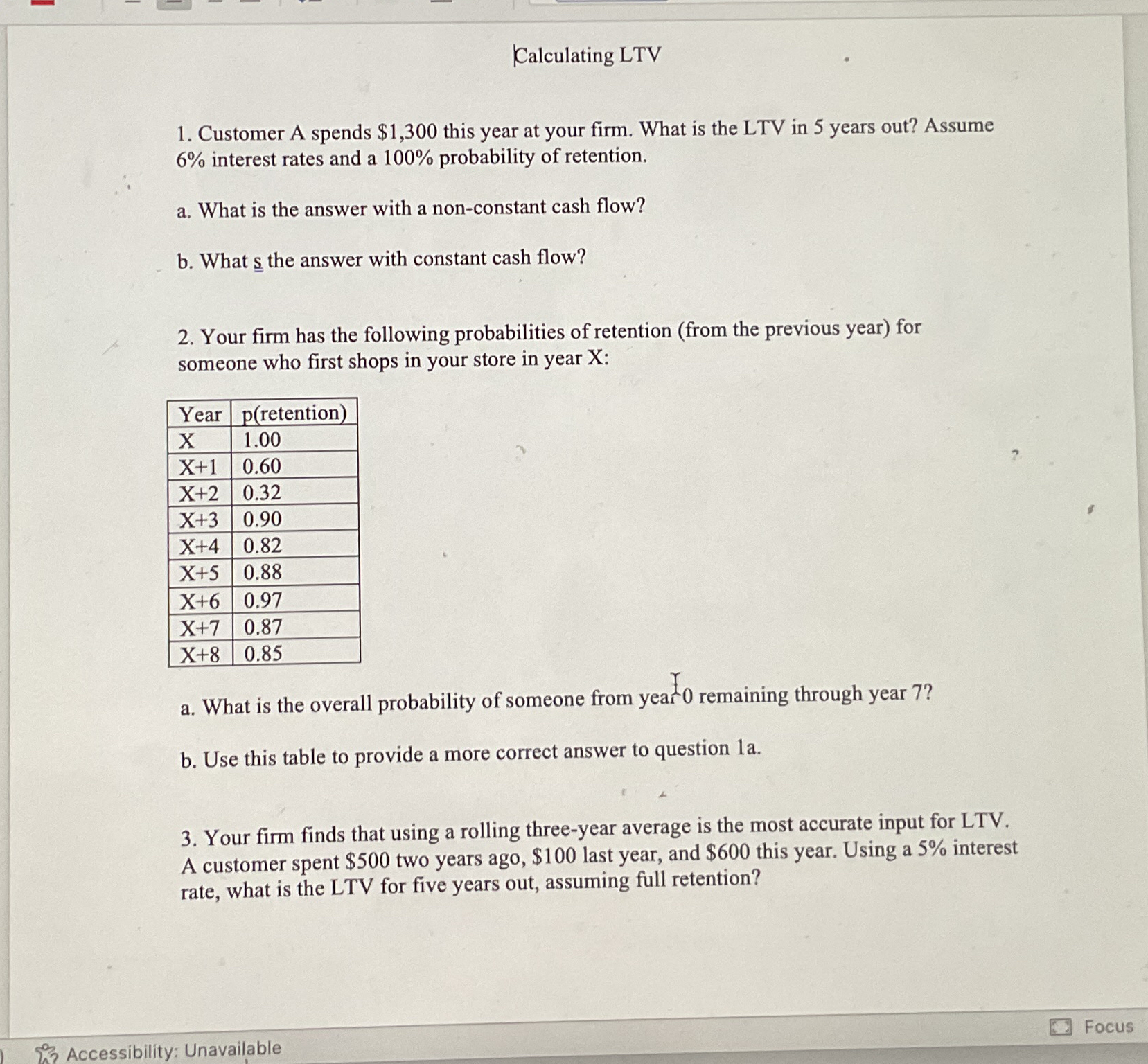

Question: Calculating LTV Customer A spends $ 1 , 3 0 0 this year at your firm. What is the LTV in 5 years out? Assume

Calculating LTV

Customer A spends $ this year at your firm. What is the LTV in years out? Assume

interest rates and a probability of retention.

a What is the answer with a nonconstant cash flow?

b What the answer with constant cash flow?

Your firm has the following probabilities of retention from the previous year for

someone who first shops in your store in year X :

a What is the overall probability of someone from year remaining through year

b Use this table to provide a more correct answer to question a

Your firm finds that using a rolling threeyear average is the most accurate input for LTV

A customer spent $ two years ago, $ last year, and $ this year. Using a interest

rate, what is the LTV for five years out, assuming full retention?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock