Question: Calculating NPV - Excel HOME E INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign Calibri 11 A . % M BIU-EB Cells Alignment Number Conditional

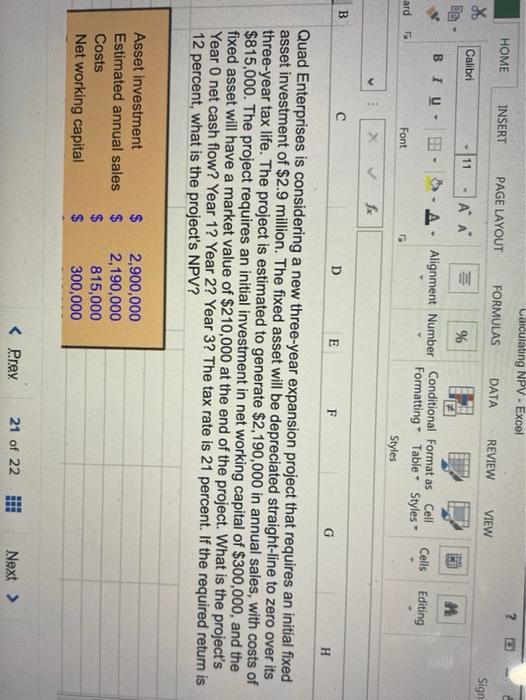

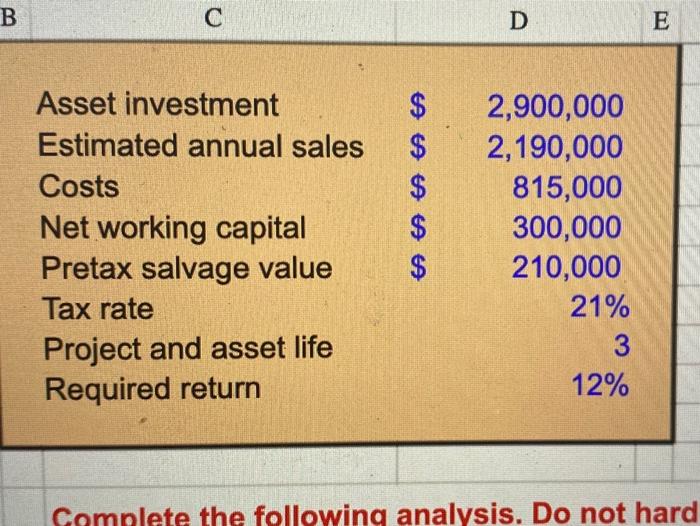

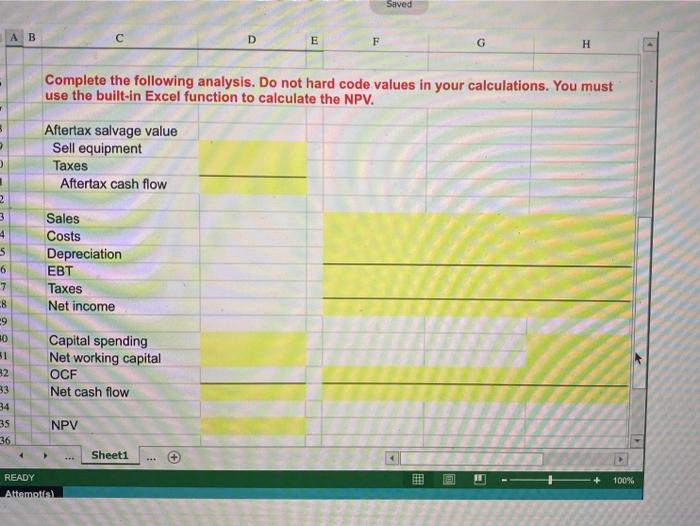

Calculating NPV - Excel HOME E INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign Calibri 11 A . % M BIU-EB Cells Alignment Number Conditional Format as Cell Formatting" Table Styles Styles Editing ard Font X fx B D E F G Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life. The project is estimated to generate $2,190,000 in annual sales, with costs of $815,000. The project requires an initial investment in net working capital of $300,000, and the fixed asset will have a market value of $210,000 at the end of the project. What is the project's Year 0 net cash flow? Year 1? Year 2? Year 3? The tax rate is 21 percent. If the required return is 12 percent, what is the project's NPV? Asset investment Estimated annual sales Costs Net working capital $ $ $ 2,900,000 2,190,000 815,000 300,000 $ B D E Asset investment Estimated annual sales Costs Net working capital Pretax salvage value Tax rate Project and asset life Required return A A A A A 2,900,000 2,190,000 815,000 300,000 210,000 21% 3 12% Complete the following analysis. Do not hard Saved A B D E F G H Complete the following analysis. Do not hard code values in your calculations. You must use the built-in Excel function to calculate the NPV. Aftertax salvage value Sell equipment Taxes Aftertax cash flow 2 3 4 5 6 7 -8 9 80 51 Sales Costs Depreciation EBT Taxes Net income Capital spending Net working capital OCF Net cash flow 82 33 34 35 36 NPV Sheet1 100% READY Attempt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts