Question: Calculating operating cash flow - Excel FILE INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In A A Arial - 12 Paste BIU- A- Alignment

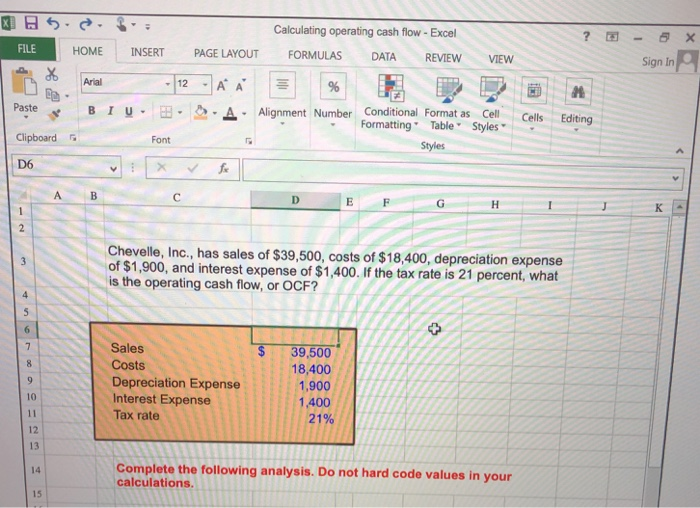

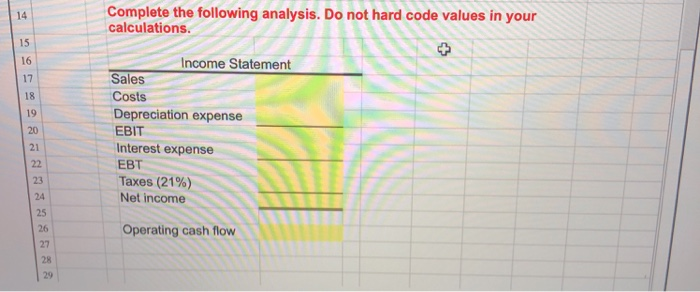

Calculating operating cash flow - Excel FILE INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In A A Arial - 12 Paste BIU- A- Alignment Number Conditional Format as Cell Formatting Table Styles Cells Editing Clipboard . Font Styles D6 fe D H. Chevelle, Inc., has sales of $39,500, costs of $18,400, depreciation expense of $1,900, and interest expense of $1,400. If the tax rate is 21 percent, what is the operating cash flow, or OCF? 6. Sales 2$ 39,500 Costs Depreciation Expense Interest Expense Tax rate 18,400 1,900 10 1,400 11 21% 12 13 Complete the following analysis. Do not hard code values in your calculations. 14 15 Complete the following analysis. Do not hard code values in your calculations. 14 15 Income Statement 16 Sales 17 Costs 18 Depreciation expense EBIT Interest expense 19 20 21 22 EBT Taxes (21%) 23 Net income 24 25 Operating cash flow 26 27 28 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts