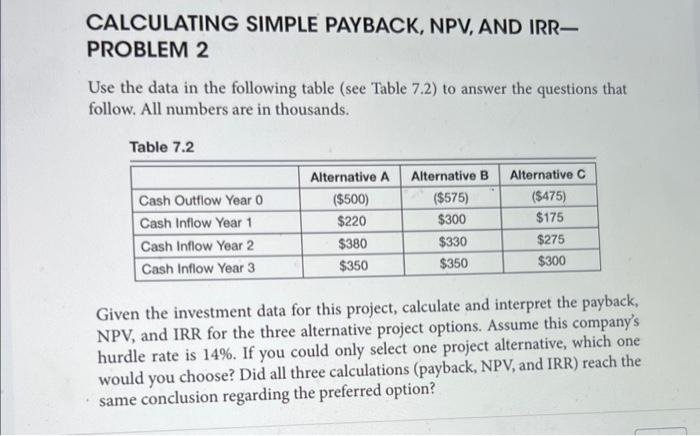

Question: CALCULATING SIMPLE PAYBACK, NPV, AND IRRPROBLEM 2 Use the data in the following table (see Table 7.2) to answer the questions that follow. All numbers

CALCULATING SIMPLE PAYBACK, NPV, AND IRRPROBLEM 2 Use the data in the following table (see Table 7.2) to answer the questions that follow. All numbers are in thousands. Given the investment data for this project, calculate and interpret the payback, NPV, and IRR for the three alternative project options. Assume this company's hurdle rate is 14%. If you could only select one project alternative, which one would you choose? Did all three calculations (payback, NPV, and IRR) reach the same conclusion regarding the preferred option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts