Question: Calculating the Average Total Assets and the Return on Assets The income statement, statement of retained earnings, and balance sheet for Somerville Company are as

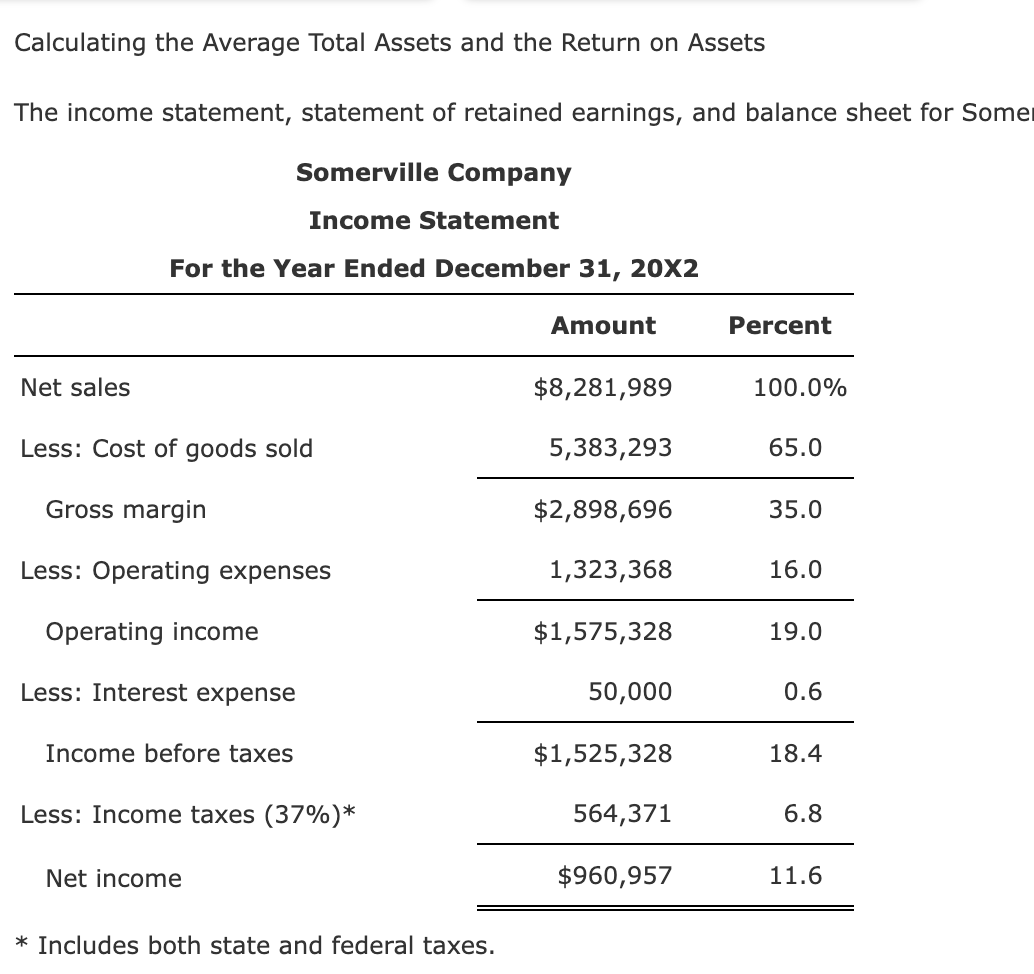

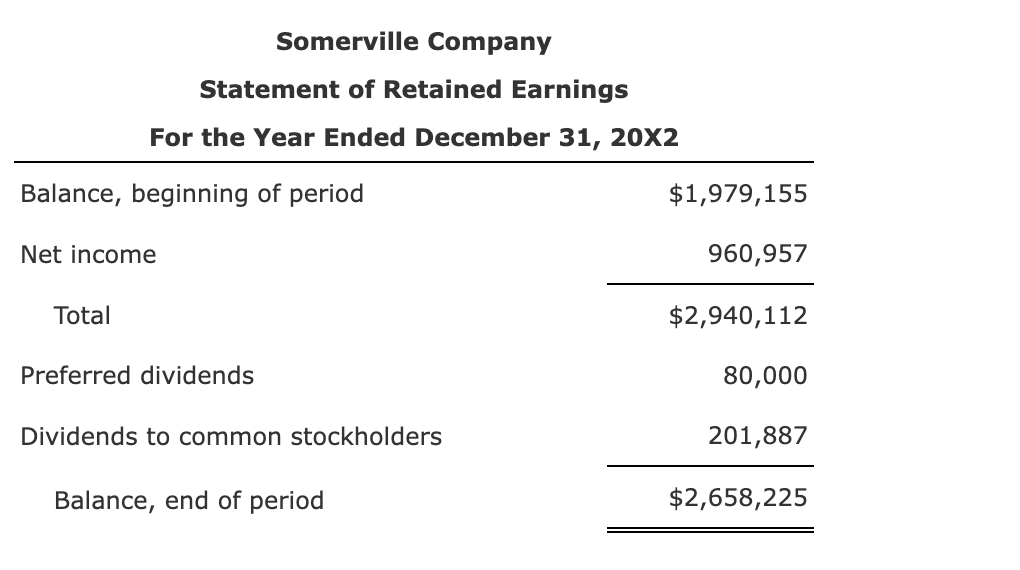

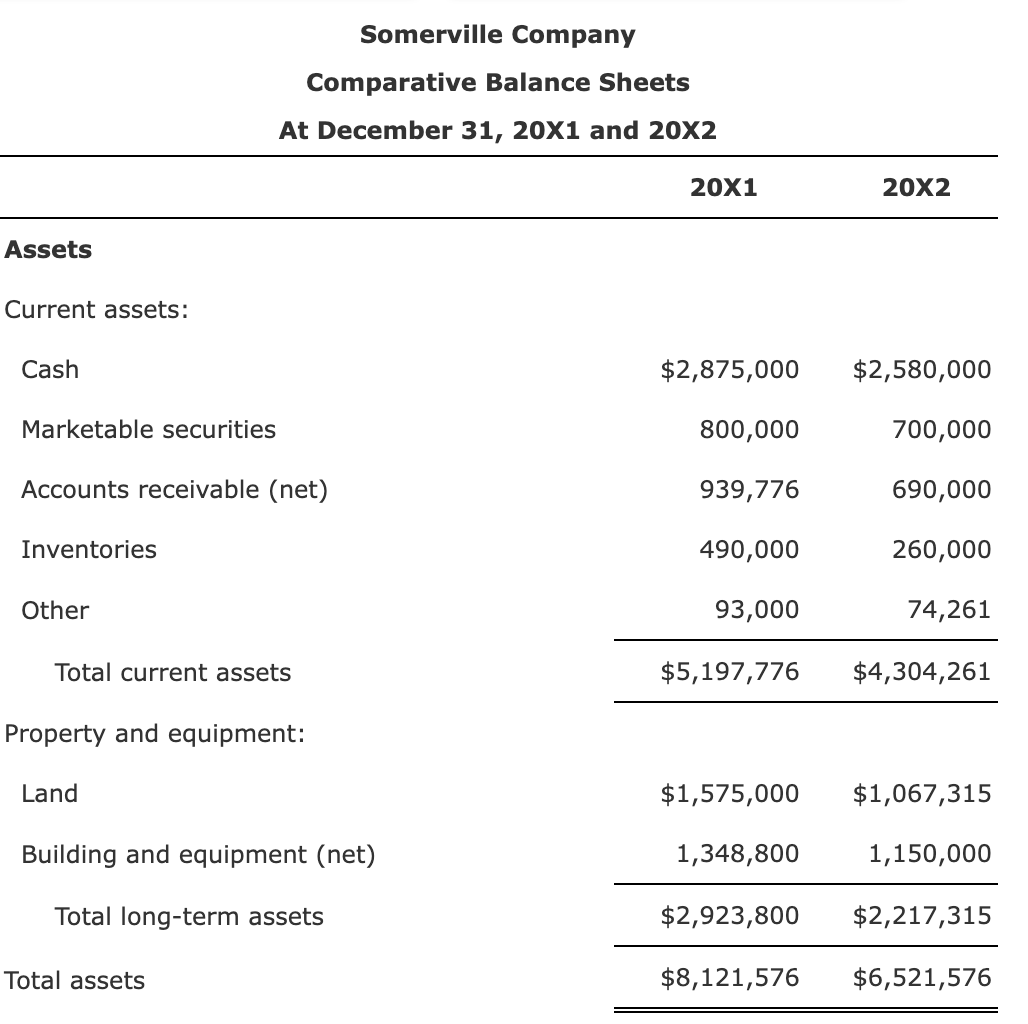

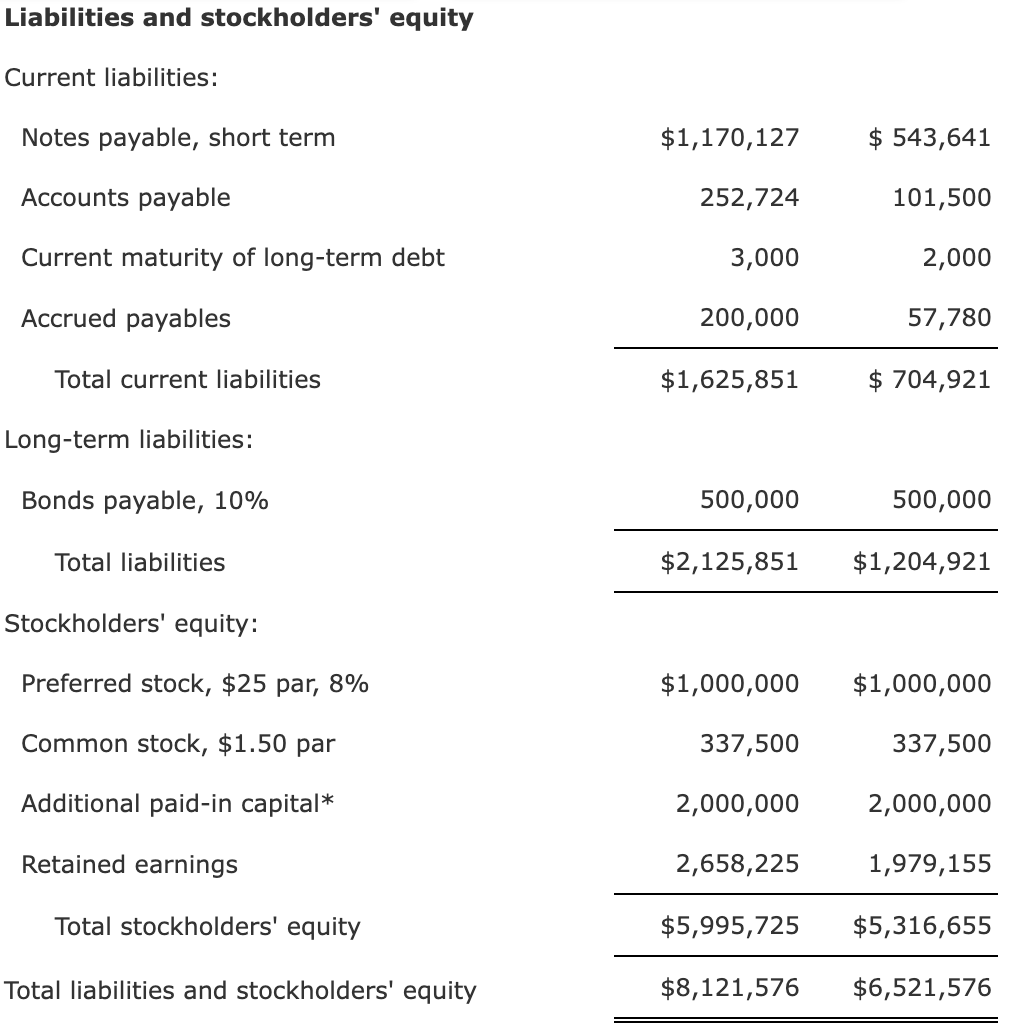

Calculating the Average Total Assets and the Return on Assets The income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows. Also, assume a tax rate of 37%.

Somerville Company Comparative Balance Sheets At December 31, 20X1 and 20X2 Note: Round the return on total assets to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on total assets. \ Liabilities and stockholders' equity Current liabilities: \\( \\begin{array}{lrr}\\text { Notes payable, short term } & \\$ 1,170,127 & \\$ 543,641 \\\\ \\text { Accounts payable } & 252,724 & 101,500 \\\\ \\text { Current maturity of long-term debt } & 3,000 & 2,000 \\\\ \\text { Accrued payables } & 200,000 & 57,780 \\\\ \\text { Total current liabilities } & \\$ 1,625,851 & \\$ 704,921\\end{array} \\) Long-term liabilities: \\begin{tabular}{crr} Bonds payable, \10 & 500,000 & 500,000 \\\\ \\cline { 2 - 3 } Total liabilities & \\( \\$ 2,125,851 \\) & \\( \\$ 1,204,921 \\) \\\\ \\hline \\end{tabular} Stockholders' equity: \\begin{tabular}{lrr} Preferred stock, \\( \\$ 25 \\) par, 8\\% & \\( \\$ 1,000,000 \\) & \\( \\$ 1,000,000 \\) \\\\ Common stock, \\$1.50 par & 337,500 & 337,500 \\\\ Additional paid-in capital* & \\( 2,000,000 \\) & \\( 2,000,000 \\) \\\\ Retained earnings & \\( 2,658,225 \\) & \\( 1,979,155 \\) \\\\ \\multicolumn{1}{c}{ Total stockholders' equity } & \\( \\$ 5,995,725 \\) & \\( \\$ 5,316,655 \\) \\\\ \\hline Total liabilities and stockholders' equity & \\( \\$ 8,121,576 \\) & \\( \\$ 6,521,576 \\) \\\\ \\hline \\hline \\end{tabular} Calculating the Average Total Assets and the Return on Assets The income statement, statement of retained earnings, and balance sheet for Some Somerville Company Income Statement \\( \\uparrow \\) incluaes dorn stace ana reaeral caxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts