Question: Calculating the Variable Overhead Spending and Efficiency Variances Standish Company manufactures consumer products and provided the following information for the month of February: Units produced

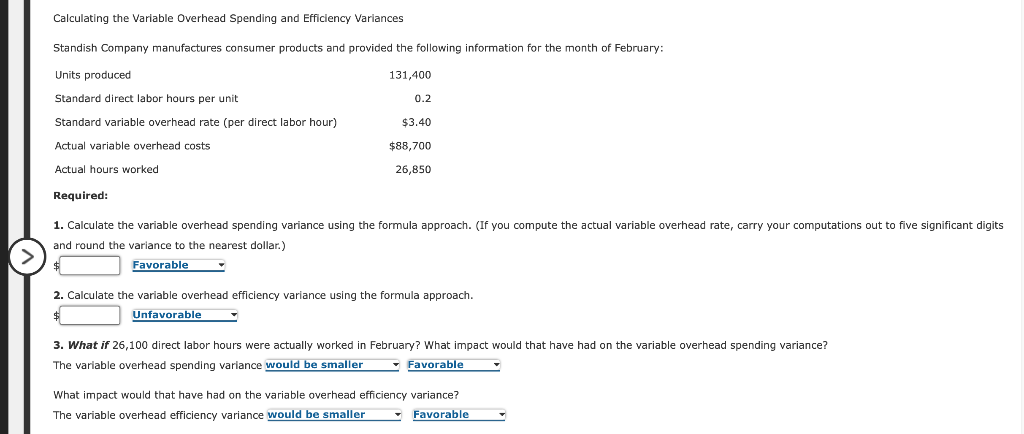

Calculating the Variable Overhead Spending and Efficiency Variances Standish Company manufactures consumer products and provided the following information for the month of February: Units produced 131,400 Standard direct labor hours per unit 0.2 Standard variable overhead rate (per direct labor hour) $3.40 Actual variable overhead costs $88,700 26,850 Actual hours worked Required: 1. Calculate the variable overhead spending variance using the formula approach. (If you compute the actual variable overhead rate, carry your computations out to five significant digits and round the variance to the nearest dollar.) Favorable 2. Calculate the variable overhead efficiency variance using the formula approach. Unfavorable 3. What if 26,100 direct labor hours were actually worked in February? What impact would that have had on the variable overhead spending variance? The variable overhead spending variance would be smaller Favorable What impact would that have had on the variable overhead efficiency variance? The variable overhead efficiency variance would be smaller Favorable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts