Question: Calculation: 01. 0. Jim estimated that he would need $62,000 to buy Audi Q5 in 8 years times. Right now you have only $12,000. If

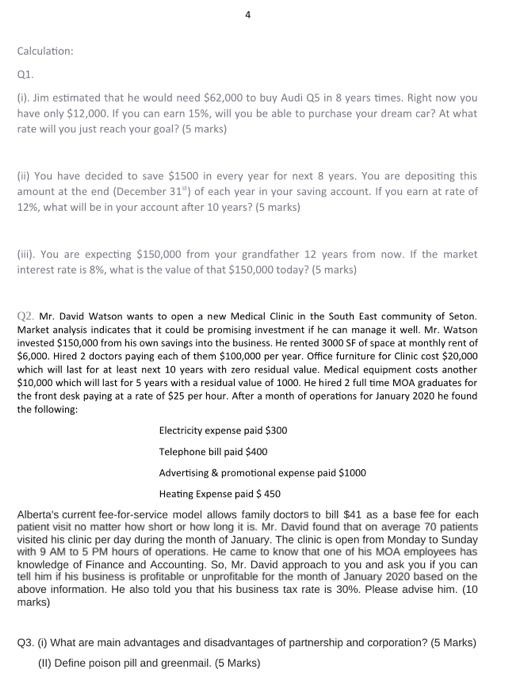

Calculation: 01. 0. Jim estimated that he would need $62,000 to buy Audi Q5 in 8 years times. Right now you have only $12,000. If you can earn 15%, will you be able to purchase your dream car? At what rate will you just reach your goal? (5 marks) (in) You have decided to save $1500 in every year for next 8 years. You are depositing this amount at the end (December 31") of each year in your saving account. If you earn at rate of 12%, what will be in your account after 10 years? (5 marks) (i). You are expecting $150,000 from your grandfather 12 years from now. If the market interest rate is 8%, what is the value of that $150,000 today? (5 marks) Q2. Mr. David Watson wants to open a new Medical Clinic in the South East community of Seton. Market analysis indicates that it could be promising investment if he can manage it well. Mr. Watson invested $150,000 from his own savings into the business. He rented 3000 SF of space at monthly rent of $6,000. Hired 2 doctors paying each of them $100,000 per year. Office furniture for Clinic cost $20,000 which will last for at least next 10 years with zero residual value. Medical equipment costs another $10,000 which will last for 5 years with a residual value of 1000. He hired 2 full time MOA graduates for the front desk paying at a rate of $25 per hour. After a month of operations for January 2020 he found the following: Electricity expense paid $300 Telephone bill paid $400 Advertising & promotional expense paid $1000 Heating Expense paid $ 450 Alberta's current fee-for-service model allows family doctors to bill $41 as a base fee for each patient visit no matter how short or how long it is. Mr. David found that on average 70 patients visited his clinic per day during the month of January. The clinic is open from Monday to Sunday with 9 AM to 5 PM hours of operations. He came to know that one of his MOA employees has knowledge of Finance and Accounting. So, Mr. David approach to you and ask you if you can tell him if his business is profitable or unprofitable for the month of January 2020 based on the above information. He also told you that his business tax rate is 30%. Please advise him. (10 marks) 23. What are main advantages and disadvantages of partnership and corporation? (5 Marks) (II) Define poison pill and greenmail

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts