Question: Calculation for 10/1/17 Journal entry : BOP BV 4/1/17 x effective interest rate =3920 x 5.1627%= 202.38 interest expense accrued(as shown in journal entry) The

Calculation for 10/1/17 Journal entry : BOP BV 4/1/17 x effective interest rate =3920 x 5.1627%= 202.38 interest expense accrued(as shown in journal entry)

The calculation for 12/31/17 Journal entry: EOP BV 10/1/17 x effective interest rate = 3925 x 5.1627% x 3/6(cause 3 months from oct 1 to dec 31)= 101.31 interest expense (as shown on journal entry

As you can see from the above calculations, that was how the numbers from interest expense were calculated to put on journal entry. So my question is WHY are we using BOP for 10/1/17 for interest expense calculation and EOP for the 12/31/17 expense calculation? why are we not using BOP for both and vice versa? it doesn't seem consistent.

here BOP, BV stands for the beginning of year book value of bond and EOP BV stands for the end of the period book value of bonds.

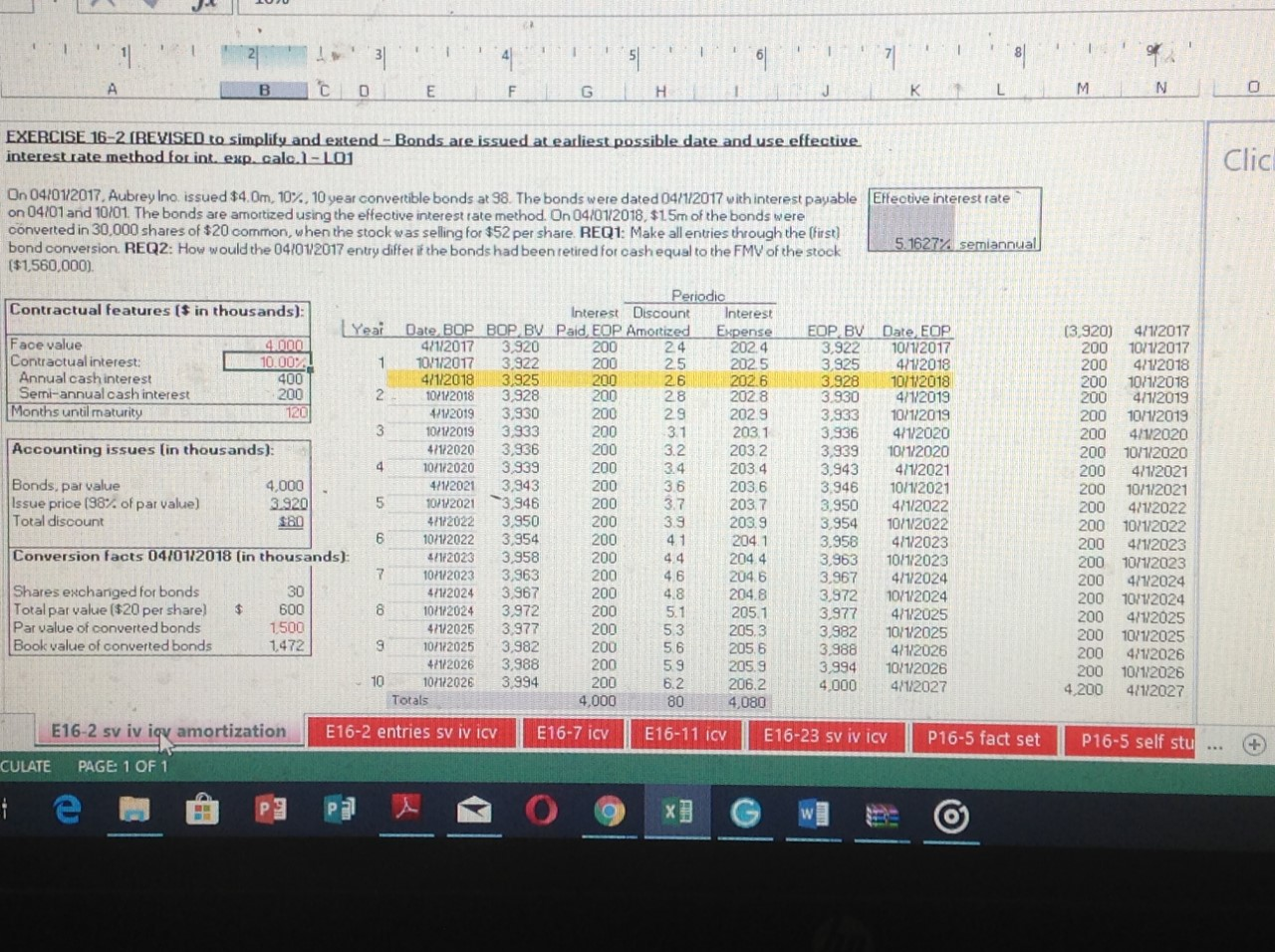

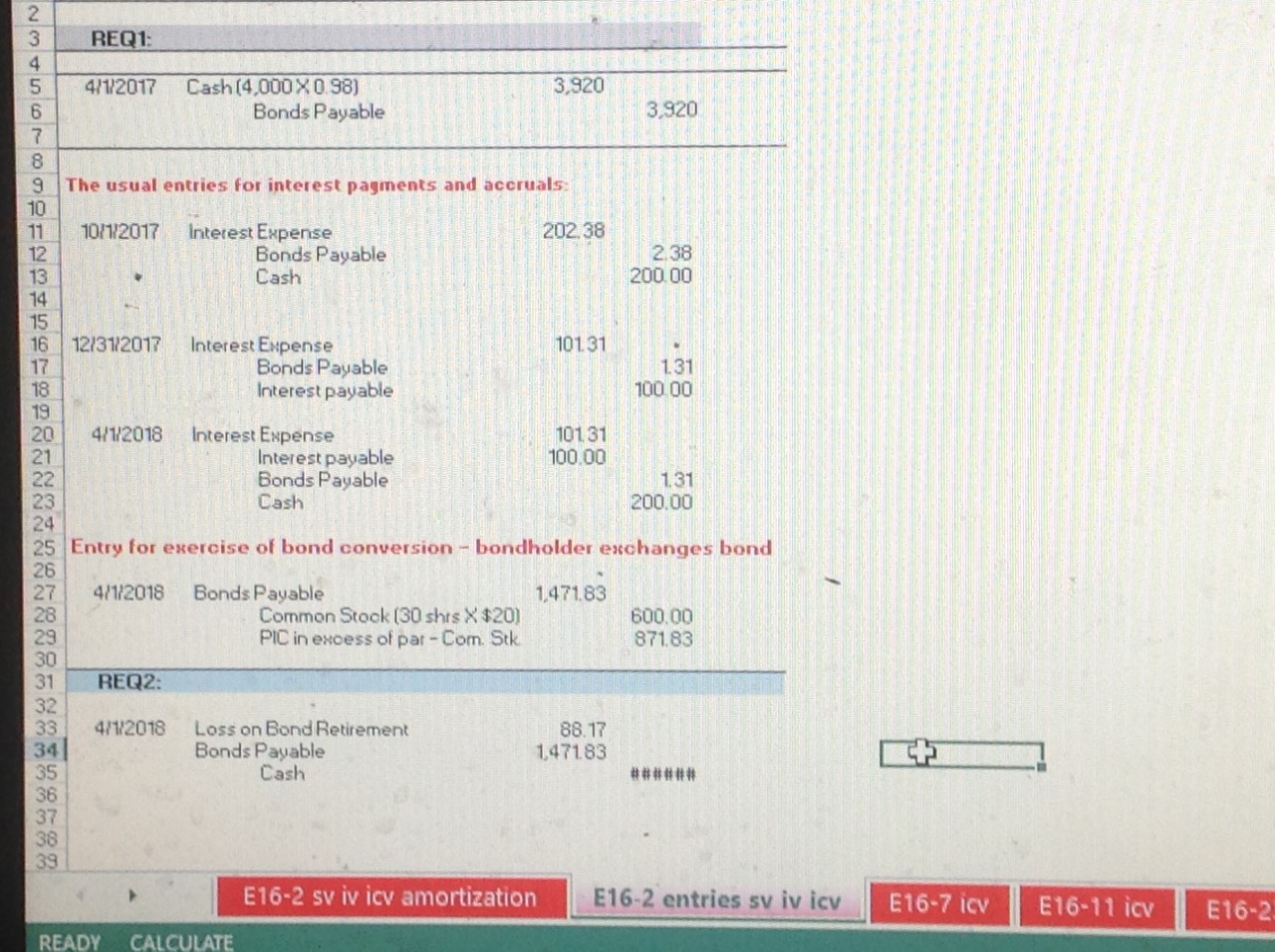

B C D E F G H J K L EXERCISE 16-2 IREVISED to simplify and extend - Bonds are issued at earliest possible date and use effective interest rate method for int. exp. calo.-LOI Clic 13,920) 200 200 200 200 200 On 04/01/2017, Aubrey Ino, issued $4.0m, 10%, 10 year convertible bonds at 98. The bonds were dated 04/1/2017 with interest payable Effective interest rate on 04/01 and 10/01. The bonds are amortized using the effective interest rate method. On 04/01/2018, $15m of the bonds were converted in 30,000 shares of $20 common, when the stock was selling for $52 per share. REQ1: Make all entries through the first) bond conversion REQ2: How would the 04/01 2017 entry differ if the bonds had been retired for cash equal to the FMV of the stock 5.1627% semiannual ($1,560,000) Periodic Contractual features ($ in thousands): Interest Discount Interest Year Date BOP BOP BV Paid EOP Amortized Expense EOP BV Date EOP Face value 4.00 4/1/2017 3.920 200 2.4 202.4 3,922 10/1/2017 Contractual interest: 10.00 ! 10/11/2017 3,922 200 25 2025 3.925 4/1/2018 Annual cash interest 400 4/1/2018 3.925 202.6 3,928 10/1/2018 Semi-annual cash interest 200 10/1/2018 3,928 202.8 3.930 4/1/2019 Months until maturity 120 192019 3.930 202.9 3,933 10/1/2019 10/12019 3,933 200 2031 3,936 4/1/2020 Accounting issues lin thousands): 4/1/2020 3.936 200 203 2 3,939 10/1/2020 10/12020 3.939 2034 3,943 4/1/2021 Bonds, par value 4,000 4112021 3,943 203.6 3.946 10/1/2021 Issue price (98% of par value) 10/120213.946 200 203.7 3,950 4/1/2022 Total discount $80 4/1/2022 3.950 203.9 3,954 10/1/2022 10/1/2022 3,954 204.1 3.958 4/1/2023 Conversion facts 04/01/2018 (in thousands): 4712023 3.958 204.4 3,963 10/1/2023 10/1/2023 3,963 204.6 3,967 4/1/2024 Shares exchanged for bonds 30 4/1/2024 3,967 200 204.8 3,972 10/1/2024 Total par value ($20 per share) 600 10/12024 3.972 205.1 3,977 4/12025 Par value of converted bonds 1500 471/2025 3,977 205.3 3.982 10/12025 Book value of converted bonds 1.472 10712025 3.982 205.6 3.988 4/1/2026 4/1/2026 3,988 200 205.9 3,994 10/12026 10712026 3,994 206.2 4,000 4/1/2027 Totals 4,000 4,080 E16-2 sv iv igu amortization E16-2 entries sv iv icy E16-7 ICV E16-11 icy E16-23 sv iv Icy P16-5 fact set CULATE PAGE 1 OF 1 3.920 200 200 Connon AAAAS WNNN NOWO AO ANO 4/1/2017 10/1/2017 4/12018 10/1/2018 4/1/2019 10/1/2019 4/1/2020 10/1/2020 4/1/2021 10/112021 4/1/2022 10/12022 4/1/2023 10712023 4/1/2024 10/12024 4/12025 10/1/2025 4/12026 10/1/2026 47112027 200 200 200 200 200 200 200 200 200 200 200 200 200 200 200 200 200 4,200 200 200 200 9 200 200 P16-5 self stu ... + e P9 REQ1: MATERIE 4/1/2017 3,920 Cash (4,000 X 0.98) Bonds Payable 3,920 The usual entries for interest payments and accruals 110/1/2017 202.38 ONSOONE COVOAN Interest Expense Bonds Payable Cash 2.38 200.00 12/31/2017 10131 131 Interest Expense Bonds Payable Interest payable 100 00 4/1/2018 Interest Expense 10131 Interest payable 100.00 Bonds Payable 131 23 Cash 200.00 24 25 Entry for exercise of bond conversion - bondholder exchanges bond 4/1/2018 Bonds Payable 1.471.83 Common Stock (30 shrs X $20) 600.00 PIC in excess of par - Com. Stk. 871.83 REQ2: 4/12018 Loss on Bond Retirement Bonds Payable Cash 88.17 1.47183 35 ###### E16-2 sy iv icv amortization E16-2 entries sv iv icy E16-7 ICV E16-11 icy E16-2 READY CALCULATE B C D E F G H J K L EXERCISE 16-2 IREVISED to simplify and extend - Bonds are issued at earliest possible date and use effective interest rate method for int. exp. calo.-LOI Clic 13,920) 200 200 200 200 200 On 04/01/2017, Aubrey Ino, issued $4.0m, 10%, 10 year convertible bonds at 98. The bonds were dated 04/1/2017 with interest payable Effective interest rate on 04/01 and 10/01. The bonds are amortized using the effective interest rate method. On 04/01/2018, $15m of the bonds were converted in 30,000 shares of $20 common, when the stock was selling for $52 per share. REQ1: Make all entries through the first) bond conversion REQ2: How would the 04/01 2017 entry differ if the bonds had been retired for cash equal to the FMV of the stock 5.1627% semiannual ($1,560,000) Periodic Contractual features ($ in thousands): Interest Discount Interest Year Date BOP BOP BV Paid EOP Amortized Expense EOP BV Date EOP Face value 4.00 4/1/2017 3.920 200 2.4 202.4 3,922 10/1/2017 Contractual interest: 10.00 ! 10/11/2017 3,922 200 25 2025 3.925 4/1/2018 Annual cash interest 400 4/1/2018 3.925 202.6 3,928 10/1/2018 Semi-annual cash interest 200 10/1/2018 3,928 202.8 3.930 4/1/2019 Months until maturity 120 192019 3.930 202.9 3,933 10/1/2019 10/12019 3,933 200 2031 3,936 4/1/2020 Accounting issues lin thousands): 4/1/2020 3.936 200 203 2 3,939 10/1/2020 10/12020 3.939 2034 3,943 4/1/2021 Bonds, par value 4,000 4112021 3,943 203.6 3.946 10/1/2021 Issue price (98% of par value) 10/120213.946 200 203.7 3,950 4/1/2022 Total discount $80 4/1/2022 3.950 203.9 3,954 10/1/2022 10/1/2022 3,954 204.1 3.958 4/1/2023 Conversion facts 04/01/2018 (in thousands): 4712023 3.958 204.4 3,963 10/1/2023 10/1/2023 3,963 204.6 3,967 4/1/2024 Shares exchanged for bonds 30 4/1/2024 3,967 200 204.8 3,972 10/1/2024 Total par value ($20 per share) 600 10/12024 3.972 205.1 3,977 4/12025 Par value of converted bonds 1500 471/2025 3,977 205.3 3.982 10/12025 Book value of converted bonds 1.472 10712025 3.982 205.6 3.988 4/1/2026 4/1/2026 3,988 200 205.9 3,994 10/12026 10712026 3,994 206.2 4,000 4/1/2027 Totals 4,000 4,080 E16-2 sv iv igu amortization E16-2 entries sv iv icy E16-7 ICV E16-11 icy E16-23 sv iv Icy P16-5 fact set CULATE PAGE 1 OF 1 3.920 200 200 Connon AAAAS WNNN NOWO AO ANO 4/1/2017 10/1/2017 4/12018 10/1/2018 4/1/2019 10/1/2019 4/1/2020 10/1/2020 4/1/2021 10/112021 4/1/2022 10/12022 4/1/2023 10712023 4/1/2024 10/12024 4/12025 10/1/2025 4/12026 10/1/2026 47112027 200 200 200 200 200 200 200 200 200 200 200 200 200 200 200 200 200 4,200 200 200 200 9 200 200 P16-5 self stu ... + e P9 REQ1: MATERIE 4/1/2017 3,920 Cash (4,000 X 0.98) Bonds Payable 3,920 The usual entries for interest payments and accruals 110/1/2017 202.38 ONSOONE COVOAN Interest Expense Bonds Payable Cash 2.38 200.00 12/31/2017 10131 131 Interest Expense Bonds Payable Interest payable 100 00 4/1/2018 Interest Expense 10131 Interest payable 100.00 Bonds Payable 131 23 Cash 200.00 24 25 Entry for exercise of bond conversion - bondholder exchanges bond 4/1/2018 Bonds Payable 1.471.83 Common Stock (30 shrs X $20) 600.00 PIC in excess of par - Com. Stk. 871.83 REQ2: 4/12018 Loss on Bond Retirement Bonds Payable Cash 88.17 1.47183 35 ###### E16-2 sy iv icv amortization E16-2 entries sv iv icy E16-7 ICV E16-11 icy E16-2 READY CALCULATE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts