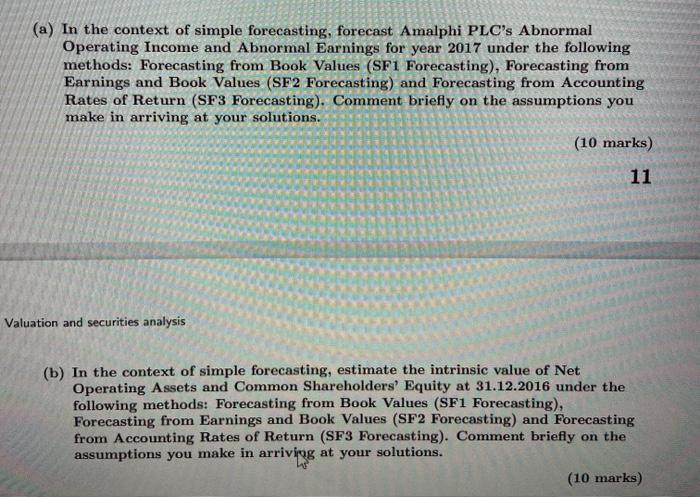

Question: Calculation Part to Question 4(a) & (b): Question 4 Consider the following information for Amalphi PLC: Statement of financial position as at Current operating assets

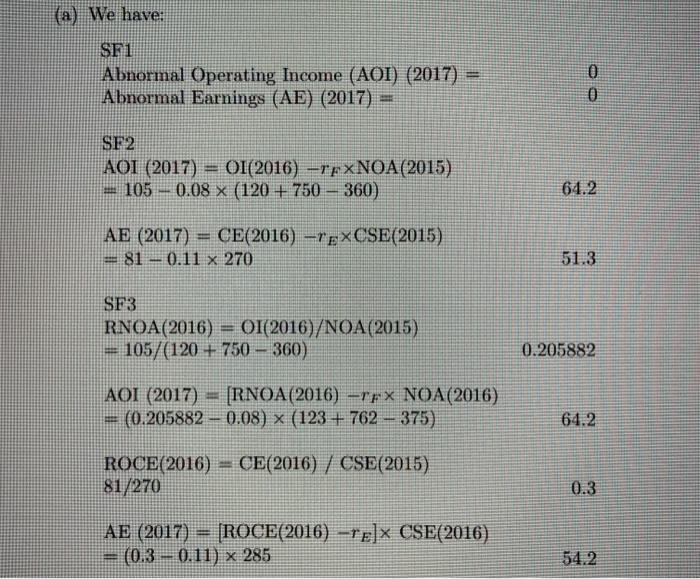

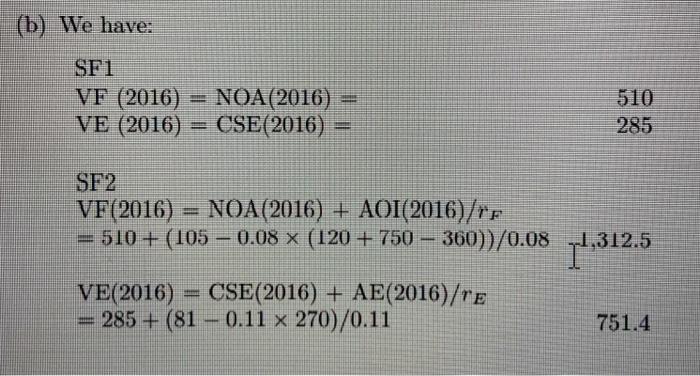

Calculation Part to Question 4(a) & (b):

![SF3 VF(2016) = NOA(2016)x (RNOA (2016) –9/(rp - g)] = 510 x [(0, 205882 – 0.01)/(0.08 – 0.01)] 1.427.1 VE(2016) = CSE(2016)×[](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/05/609b4d421815f_1620790592040.jpg)

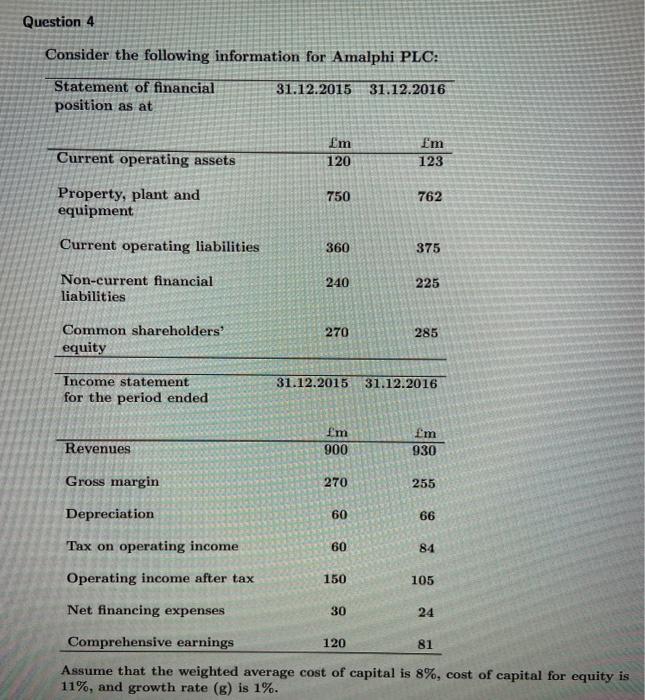

Question 4 Consider the following information for Amalphi PLC: Statement of financial position as at Current operating assets Property, plant and equipment Current operating liabilities Non-current financial liabilities Common shareholders' equity Income statement for the period ended Revenues Gross margin Depreciation Tax on operating income. Operating income after tax 31.12.2015 31.12.2016 Em 120 750 360 240 270 m 900 270 60 60 31.12.2015 31.12.2016 150 I'm 123 30 762 120 375 225 285 m 930 255 66 84 Net financing expenses Comprehensive rnings 81 Assume that the weighted average cost of capital is 8%, cost of capital for equity is 11%, and growth rate (g) is 1%. 105 24

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

A Assuming that the weighted average cost of capital is 8 cost of capita... View full answer

Get step-by-step solutions from verified subject matter experts