Question: Calculation Questions (4 points each) Note: you never need to put a negative (-) sign in front of any answer! When we ask for a

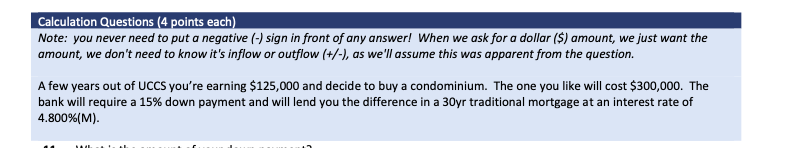

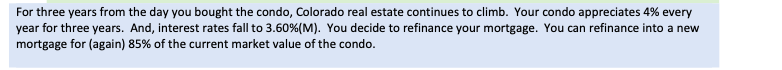

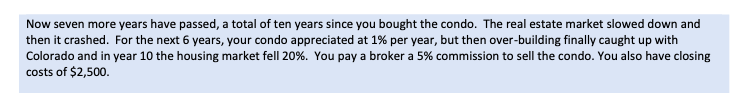

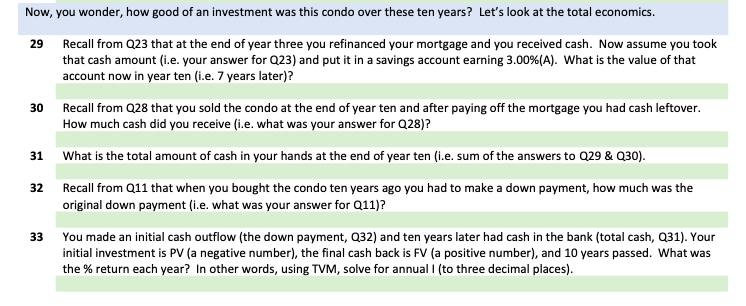

Calculation Questions (4 points each) Note: you never need to put a negative (-) sign in front of any answer! When we ask for a dollar ($) amount, we just want the amount, we don't need to know it's inflow or outflow (+/-), as we'll assume this was apparent from the question. A few years out of UCCS you're earning $125,000 and decide to buy a condominium. The one you like will cost $300,000. The bank will require a 15% down payment and will lend you the difference in a 30yr traditional mortgage at an interest rate of 4.800%(M). For three years from the day you bought the condo, Colorado real estate continues to climb. Your condo appreciates 4% every year for three years. And, interest rates fall to 3.60%(M). You decide to refinance your mortgage. You can refinance into a new mortgage for (again) 85% of the current market value of the condo. Now seven more years have passed, a total of ten years since you bought the condo. The real estate market slowed down and then it crashed. For the next 6 years, your condo appreciated at 1% per year, but then over-building finally caught up with Colorado and in year 10 the housing market fell 20%. You pay a broker a 5% commission to sell the condo. You also have closing costs of $2,500. Now, you wonder, how good of an investment was this condo over these ten years? Let's look at the total economics. 29 Recall from Q23 that at the end of year three you refinanced your mortgage and you received cash. Now assume you took that cash amount (i.e. your answer for Q23) and put it in a savings account earning 3.00%(A). What is the value of that account now in year ten (i.e. 7 years later)? 30 31 Recall from Q28 that you sold the condo at the end of year ten and after paying off the mortgage you had cash leftover. How much cash did you receive (i.e. what was your answer for Q28)? What is the total amount of cash in your hands at the end of year ten (i.e. sum of the answers to 229 & 030). 32 Recall from Q11 that when you bought the condo ten years ago you had to make a down payment, how much was the original down payment (i.e. what was your answer for Q11)? 33 You made an initial cash outflow (the down payment, Q32) and ten years later had cash in the bank (total cash, Q31). Your initial investment is PV (a negative number), the final cash back is FV (a positive number), and 10 years passed. What was the % return each year? In other words, using TVM, solve for annual 1 (to three decimal places). Calculation Questions (4 points each) Note: you never need to put a negative (-) sign in front of any answer! When we ask for a dollar ($) amount, we just want the amount, we don't need to know it's inflow or outflow (+/-), as we'll assume this was apparent from the question. A few years out of UCCS you're earning $125,000 and decide to buy a condominium. The one you like will cost $300,000. The bank will require a 15% down payment and will lend you the difference in a 30yr traditional mortgage at an interest rate of 4.800%(M). For three years from the day you bought the condo, Colorado real estate continues to climb. Your condo appreciates 4% every year for three years. And, interest rates fall to 3.60%(M). You decide to refinance your mortgage. You can refinance into a new mortgage for (again) 85% of the current market value of the condo. Now seven more years have passed, a total of ten years since you bought the condo. The real estate market slowed down and then it crashed. For the next 6 years, your condo appreciated at 1% per year, but then over-building finally caught up with Colorado and in year 10 the housing market fell 20%. You pay a broker a 5% commission to sell the condo. You also have closing costs of $2,500. Now, you wonder, how good of an investment was this condo over these ten years? Let's look at the total economics. 29 Recall from Q23 that at the end of year three you refinanced your mortgage and you received cash. Now assume you took that cash amount (i.e. your answer for Q23) and put it in a savings account earning 3.00%(A). What is the value of that account now in year ten (i.e. 7 years later)? 30 31 Recall from Q28 that you sold the condo at the end of year ten and after paying off the mortgage you had cash leftover. How much cash did you receive (i.e. what was your answer for Q28)? What is the total amount of cash in your hands at the end of year ten (i.e. sum of the answers to 229 & 030). 32 Recall from Q11 that when you bought the condo ten years ago you had to make a down payment, how much was the original down payment (i.e. what was your answer for Q11)? 33 You made an initial cash outflow (the down payment, Q32) and ten years later had cash in the bank (total cash, Q31). Your initial investment is PV (a negative number), the final cash back is FV (a positive number), and 10 years passed. What was the % return each year? In other words, using TVM, solve for annual 1 (to three decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts