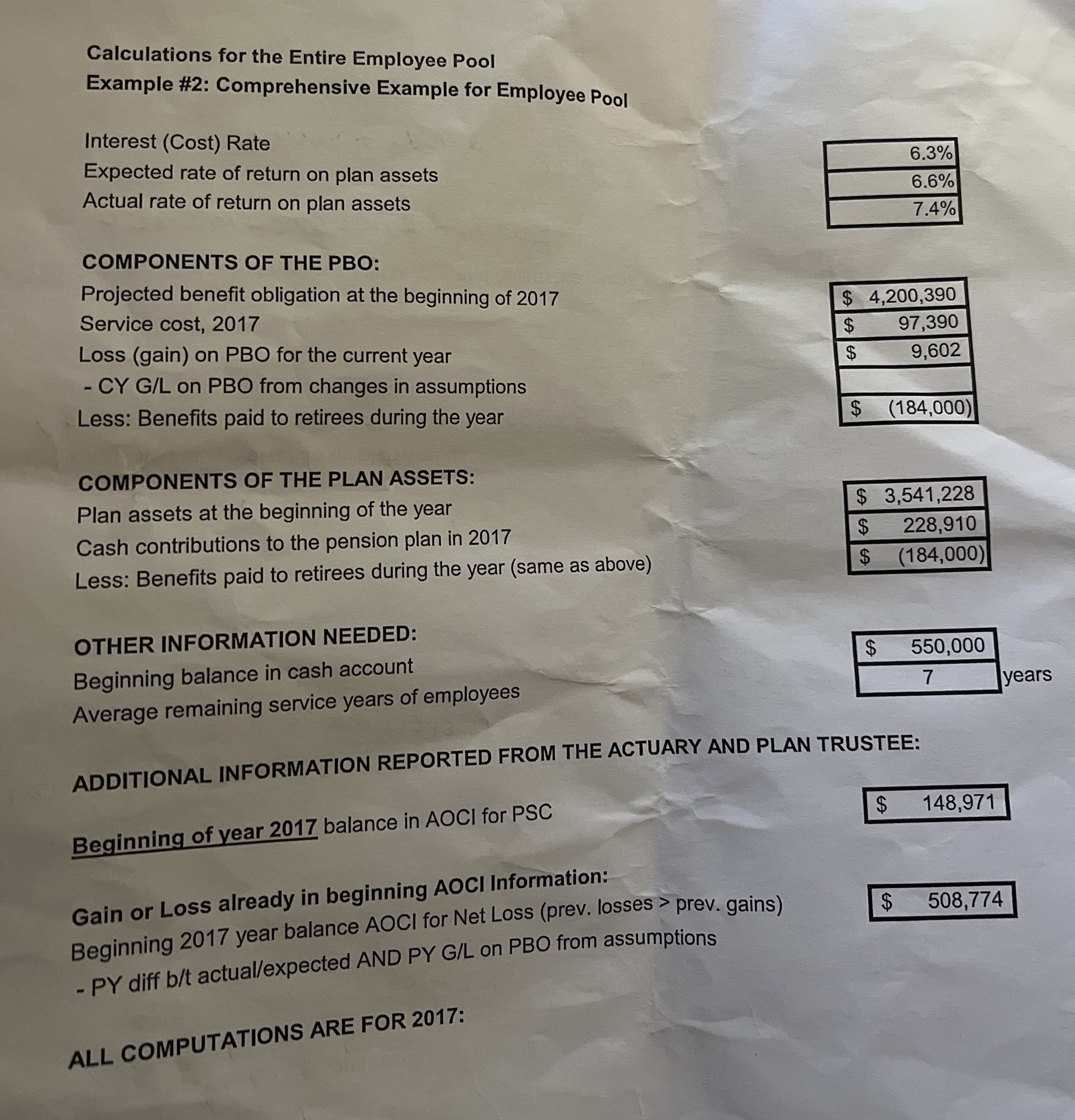

Question: Calculations for the Entire Employee Pool Example # 2 : Comprehensive Example for Employee Pool Interest ( Cost ) Rate Expected rate of return on

Calculations for the Entire Employee Pool

Example #: Comprehensive Example for Employee Pool

Interest Cost Rate

Expected rate of return on plan assets

Actual rate of return on plan assets

COMPONENTS OF THE PBO:

Projected benefit obligation at the beginning of

Service cost,

Loss gain on PBO for the current year

CY GL on PBO from changes in assumptions

Less: Benefits paid to retirees during the year

COMPONENTS OF THE PLAN ASSETS:

Plan assets at the beginning of the year

Cash contributions to the pension plan in

Less: Benefits paid to retirees during the year same as above

OTHER INFORMATION NEEDED:

Beginning balance in cash account

Average remaining service years of employees

ADDITIONAL INFORMATION REPORTED FROM THE ACTUARY AND PLAN TRUSTEE:

Beginning of year balance in AOCI for PSC

Gain or Loss already in beginning AOCI Information:

Beginning year balance AOCI for Net Loss prev losses prev. gains

PY diff bt actualexpected AND PY GL on PBO from assumptions

ALL COMPUTATIONS ARE FOR :

Calculate the interest cost and record the journal entry.

Calculate the expected return on plan assets and record the journal entry.

Calculate the actual return on plan assets:

Calculate the adjustments for gain or loss mad record the journal entry.

Calculate the amortization of PSC

Calculate the amortization of the net gain or loss if required and record the journal entry:

A loss of assumption changes has what impact on regular net income? Increase, decrease, or no impact.

Record the journal entry for payments to retirees:

Record the journal entry for contributions to the plan:

What amount should be debited to pension expense?

Rather than recording each entry separately we could use the pension worksheet to record the amounts as follows:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock